Form W-4 Guide: How to Change Your Tax Outcome

File your taxes with confidence.

Your max tax refund is guaranteed.

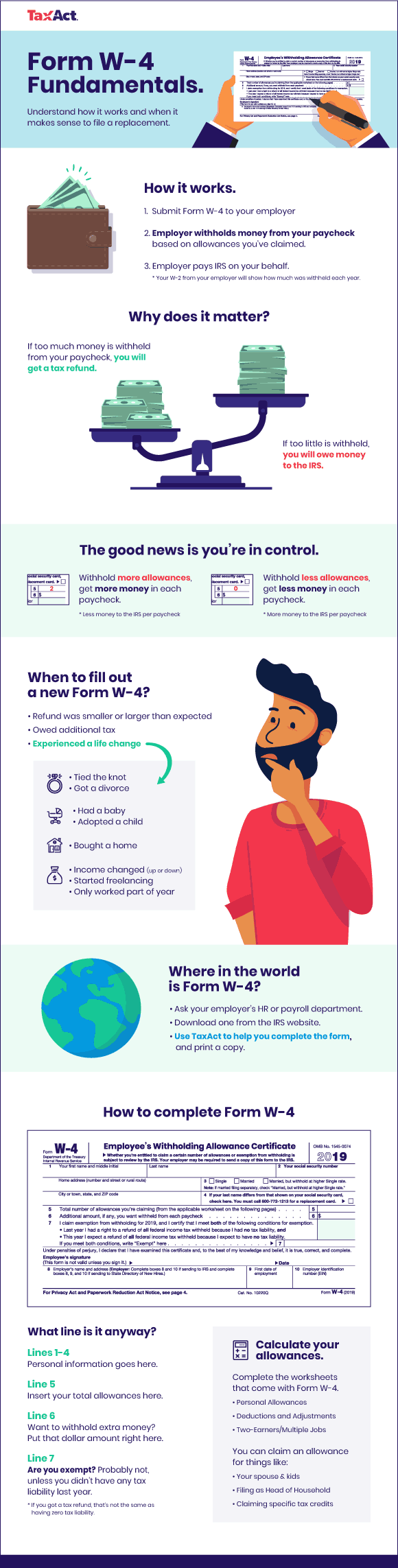

If you’re traditionally employed, you’re likely familiar with Form W-4. It’s the tax form used to select how much money you want to be withheld from your paychecks to pay your tax liability. If you don’t keep up with your tax payments throughout the year, you’ll not only receive a large tax bill when you file your return, but you’ll also have to pay extra penalties and fees.

The 2018 tax year was the first year filers experienced the impact of the new tax laws implemented under the Tax Cuts and Jobs Act passed at the end of 2017. If your tax outcome this past tax season wasn’t quite what you expected, you now have the chance to change it before the next tax season rolls around. Here’s a quick guide to controlling your tax outcome with Form W-4.

Control your tax outcome

Change is on the horizon

The Treasury Department and the IRS recently announced they plan to change Form W-4 for 2020. A new version of Form W-4 was released at the end of May 2019.

The IRS says this new form will better incorporate the changes ushered in by the new tax law so that the amount withheld for taxes from each paycheck is more accurate.

In the meantime, however, you can – and should – adjust your withholdings using the current Form W-4. Doing so will help ensure your tax outcome doesn’t surprise you when you file your 2020 tax return in 2021. TaxAct can help you determine how many allowances you should claim and complete a new form to submit to your payroll department all for free. Simply create an account to get started.

Not sure if you want to make adjustments? Use our W-4 Withholding Calculator to quickly determine what’s best for your tax situation.