Understanding Form W-4 is key to managing how much federal income tax is withheld from your paycheck. Whether you’re looking to boost your take-home pay or plan for a bigger tax refund, filling out your W-4 tax form correctly can help you hit that sweet spot.

At a glance:

- Form W-4 tells your employer how much federal income tax to withhold from your paycheck.

- You can adjust your W-4 form anytime, but it’s especially important to do so after major life changes.

- Decreasing your tax withholding may result in a bigger monthly paycheck; withholding more money each month may result in a bigger tax refund.

- As of 2020, Form W-4 no longer uses withholding allowances.

What is Form W-4?

Form W-4, also known as the Employee’s Withholding Certificate, is used by employers to determine how much federal income tax to withhold from your payroll. Based on the details you provide, it helps your employer calculate your tax obligation for each pay period. The goal is to match your tax withholding with your actual tax liability, so you don’t end up owing a large tax bill or getting a large tax refund when you file your return.

Form W-4 updates

In 2020, the Internal Revenue Service (IRS) made significant changes to Form W-4 to simplify the process and provide more accurate federal income tax withholding for taxpayers. The new design removed the use of allowances, which were previously tied to personal exemptions that were eliminated by the Tax Cuts and Jobs Act (TCJA) in 2017.

Now, the W-4 form is more straightforward, focusing on factors like additional income, deductions, and dependents. This change was intended to make the form easier to understand and fill out, while also helping employees avoid over- or under-withholding. Accurate withholding can prevent surprises for tax return filers — whether that’s a big tax bill or a large refund.

Form W-4 example

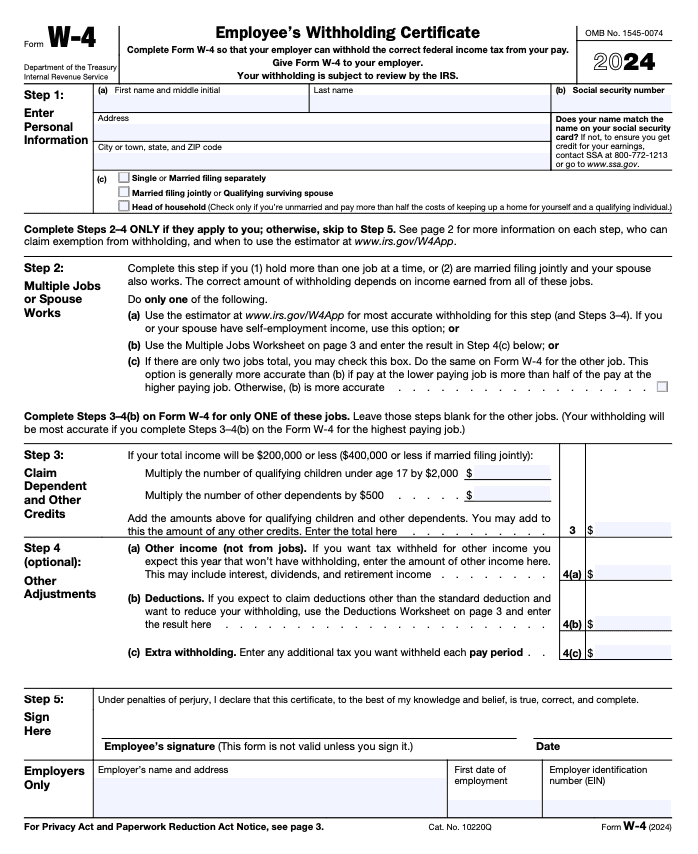

Form W-4 for the current year looks like this:

This tax form includes several important sections:

- Step 1 is for your basic information, such as name, address, and Social Security identification number.

- Step 2 applies if you hold multiple jobs or have a spouse who also works.

- Step 3 is where you account for your qualifying dependents and other tax credits.

- Step 4 is for additional adjustments, including any other income, deductions, or extra amounts of tax you want withheld.

Each section is designed to account for various factors affecting your tax liability, like the standard deduction and Child Tax Credit, which can affect your final tax bill or tax refund amount.

Form W-4 instructions

How do I fill out a W-4 form?

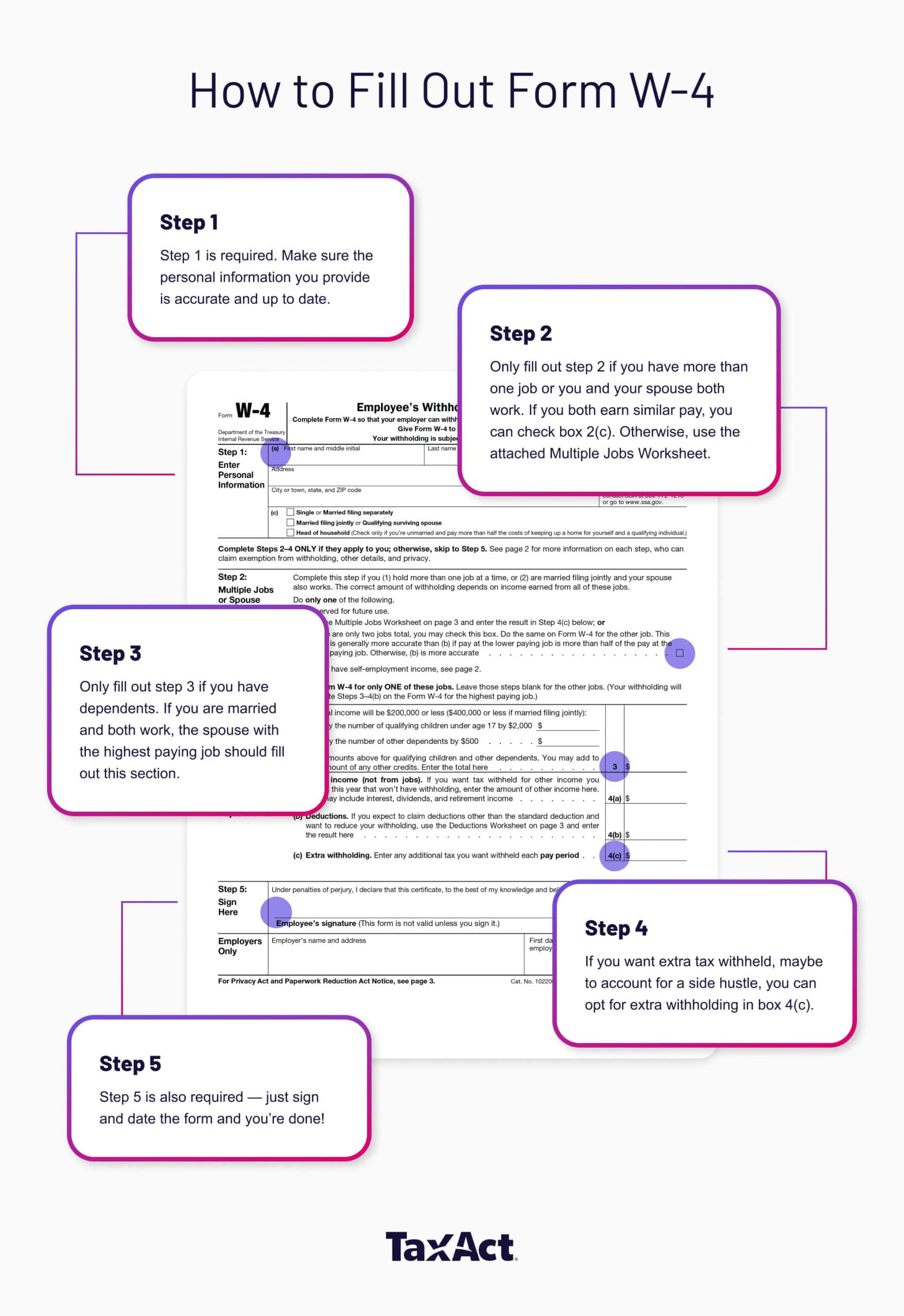

It’s easy to complete Form W-4. Here’s a step-by-step guide to help:

- Complete Step 1 with your personal details, like your name, Social Security number, and address. You’ll also select your filing status here, such as married filing jointly or head of household.

- Only fill out Step 2 if you have a second job or your spouse works. This step ensures the right amount of tax is withheld based on all income sources. If you and your spouse both work and earn similar pay, check box 2(c). Otherwise, use the Multiple Jobs Worksheet attached to Form W-4 to help you fill out this section.

- In Step 3, claim the appropriate number of dependents to adjust your withholding based on the Child Tax Credit or other credits. If you are married and both work, only the spouse with the highest paying job should fill out this section. The other spouse can leave Step 3 blank.

- Step 4 allows for adjustments, such as reporting additional income (like self-employment income), entering tax deductions beyond the standard deduction, or specifying an additional amount of tax you want withheld. If you want additional tax withheld for any reason, you can request extra withholding on line 4(c).

- Finally, sign and date the form in Step 5 before submitting it to your employer.

FAQs about Form W-4

When should I fill out a new W-4?

You can update your W-4 form anytime, but it’s especially good to do so after life events like a raise, marriage, new job, or the birth of a child. Submitting an updated W-4 form after significant changes in your financial situation or filing status ensures your tax withholding is as accurate as possible based on your anticipated overall tax liability for the year.

What happens if I claim too many allowances?

Allowances no longer exist on the current W-4 form, but claiming too many dependents in Step 3 or underreporting other income in Step 4 could result in too little being withheld, which could lead to a large tax bill at the end of the tax year.

Why does my employer withhold so much tax from my paycheck?

Your employer follows the IRS withholding tables, which are based on the information in your W-4 form and your earnings. Submitting a new W-4 can adjust the amount withheld if you want less tax taken out.

How do I adjust my tax withholding on a W-4?

You can adjust your withholding by filling out a new W-4 form and submitting it to your employer. If you want more money withheld, enter an additional amount in Step 4(c).

Can I use a tool to help fill out my W-4?

Yes, the IRS tax withholding estimator is a great tool to estimate your withholding. However, TaxAct’s Refund Booster tool (W-4 calculator)* goes one step further by filling out a new Form W-4 for you to give to your employer after the calculation process. More on this tool in the next section!

Is it better to withhold more tax to get a bigger refund?

Withholding more tax may feel like a safer option if you’re concerned about an unexpected tax bill, but it also means you’re giving the government an interest-free loan. For some, withholding less means more take-home pay now. For others, withholding more gives them peace of mind that they won’t owe a tax bill, and can count on getting a bigger tax refund later. You’re paying the same amount of income tax in either scenario, so it just depends on your personal preferences.

How to fill out a new Form W-4 with TaxAct

Speaking of adjusting your Form W-4 withholding — we can help with that too. TaxAct’s Refund Booster tool is a W-4 calculator designed to help you fine-tune your tax withholding based on your personal goals. Whether you prefer to get a smaller tax refund with more take-home pay in each paycheck or a larger refund at tax time, Refund Booster can guide you through filling out a new Form W-4 to match your preferences.

Here’s how it works: we’ll start by asking you a few questions about your tax situation, like whether you received a refund or owed tax payments during the prior year, and how much. Then, based on your answers, we’ll help you adjust your withholding to align with your goals.

To make sure your withholding is as accurate as possible, Refund Booster will also gather information about your filing status, how many jobs you (and your spouse, if applicable) have, and any 401(k), HSA, FSA, or other pre-tax contributions you plan to make. We’ll also ask about any dependents you have and factor that in for the Child Tax Credit, along with any additional income you might earn from capital gains or retirement funds.

After collecting this information, we’ll pre-fill your new Form W-4 for you. All you need to do is review, sign, and print it, then hand it off to your employer. Simple!

The bottom line

Form W-4 is essential for managing how much income tax is withheld from your paycheck. Filling out the form accurately can mean the difference between a larger paycheck now or a larger refund later. When in doubt, TaxAct is here to help you adjust your W-4 form easily as needed, ensuring that your tax situation is optimized for your individual financial goals.