If you’re spending time in the U.S. on a temporary visa, you may be surprised by how important certain tax-related forms can be, even when you’re only here as a student. One of these is the Statement for Exempt Individuals and Individuals With a Medical Condition, otherwise known as Form 8843. Here’s what you need to know about what it is and how to file.

What is Form 8843?

Certain nonresident individuals (including their spouses or dependents) use Form 8843 to notify the Internal Revenue Service that the days they were present in the U.S. should be excluded from the substantial presence test, therefore making them exempt. The form isn’t a tax return, but an informational statement. These nonresident individuals are legally required to complete and submit the form, regardless of whether they earned a U.S. income.

What does Form 8843 do?

If you’re one of these nonresident individuals, it’s important that you fill out a Form 8843 to uphold U.S. compliance requirements and to avoid future complications with your visa status. For example, if you fail to complete tax Form 8843, it can create a record of non-compliance, and you may experience difficulties when applying for visa renewal, adjustment, or a change of status.

Who needs to file Form 8843?

There are a few qualifications to meet as an exempt individual when filing Form 8843. These exempt individuals are typically categorized into four groups, including:

- Students. These international students should have an “F,” “J,” “M,” or “Q” visa.

- Teachers or trainees. These teachers or trainees should be individuals who are temporarily present in the U.S. under a “J” or “Q” visa.

- Professional athletes. These athletes must be temporarily present in the U.S. to compete in a charitable sports event.

- Individuals with a medical condition or medical problem. Nonresident individuals in this group qualify because they were unable to leave the U.S. due to a medical issue.

Example of Form 8843

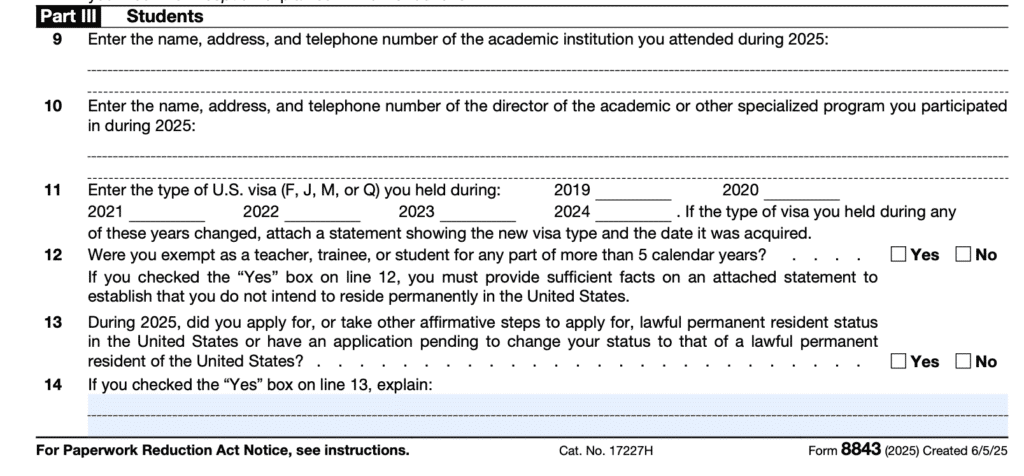

Here’s a preview of what Form 8843 looks like. If you’re a student, Part III is one of the sections you’ll be focusing on:

How to fill out Form 8843

Form 8843 is divided into five main parts, although it may not be necessary for you to complete every section.

Before filling out the individual parts, you’ll need to enter the following information: First name and initial, last name, your U.S. individual taxpayer identification number (TIN), address in the country of residence, and address in the U.S.

Part I: General Information

In this section, you’ll need to enter basic information about yourself. This information includes:

- Visa type

- Non-immigrant status

- Country of citizenship

- Passport information, such as the number and the country that issued the passport

- The number of days you want to exclude from the substantial presence test

Part II: Teachers and Trainees

This section is specifically for teachers and trainees. Teachers and trainees are expected to provide information regarding:

- The academic institution where they taught (teacher)

- The director of the academic or specialized program they participated in (trainee)

- The type of visa they held

- If and/or when they were exempt for any part of two of the preceding six calendar years

Part III: Students

This section is intended for students to complete. Students will be required to enter information regarding:

- The academic institution they attended

- The director of the academic or specialized program they participated in

- The type of visa they held in the applicable years

- Whether they were exempt as a teacher, trainee, or student for any part of more than five calendar years

- Whether they applied for lawful permanent resident status in the U.S.

Part IV: Professional Athletes

The professional athlete section is the shortest of the five parts. Although this section is titled “Professional Athletes,” it is specifically meant for athletes who are present in the U.S. to participate in a charitable sports event. Anyone who fills out this section will be expected to provide the following information:

- The charitable sports event(s) they participated in, including the name of the event, and the dates of the competition

- The name and employer ID number of the organization

Note: The athlete must also provide verification that proceeds were donated to the charitable organization.

Part V: Individuals With a Medical Condition or Medical Problem

Individuals who are required to fill out this section must provide the following information:

- An explanation of the medical issue that prevented them from leaving the U.S.

- The date they were supposed to leave the U.S.

- The date they actually left the U.S.

- A physician’s statement

Where to mail Form 8843

If you’re mailing your completed form, you can send it to the following address:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

USA

Can I file Form 8843 online?

You can easily file Form 8843 online with TaxActÒ when submitting it alongside Form 1040-NR. If you’re only filing Form 8843 without any other forms, you’ll need to mail it. TaxAct is the only primary tax software provider that allows users to e-file Form 8843 directly, making it a faster and more convenient alternative to mailing. Plus, when you use TaxAct, you get access to guided experience to walk you through each question.

Form 1040-NR is a U.S. Nonresident Alien Income Tax Return. This form would be filed by a nonresident individual who engaged in a trade or business in the U.S., represented a deceased person who would have had to file, or represented an estate or trust that had to file.

How to e-file Form 8843 with TaxAct

- Sign in or create your free TaxAct account.

- Choose Nonresident Alien (Form 1040-NR) in the setup.

- Follow the guided steps for visa and residency information.

- Complete Form 8843 directly within the TaxAct interface.

- Submit securely via IRS e-file.

FAQ

The bottom line

Nonresident individuals, such as students and other exempt individuals, must file Form 8843, regardless of whether they earned income during the tax year they were present in the U.S. While Form 8843 must be mailed when filing it on its own, it can be e-filed when attached to Form 1040-NR through TaxAct. Stay compliant and file confidently with a secure online tax solution for international students.

Start e-filing Form 8843 with TaxAct.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

TaxAct® Xpert Assist is available as an added service to users of TaxAct’s online consumer and SMB 1120-S and 1065 products. This service is available at an additional cost and is subject to limitations and restrictions. Some tax topics or situations may not be included as part of this service. Review of customer return if requested is broad and does not include source documents. View full TaxAct Xpert Assist Terms.