If you’re involved in a partnership or S corporation that owns rental real estate, you’ll likely come across Form 8825 during tax filing season. This Internal Revenue Service form reports rental income and expenses for these entities, determining how profits or losses are allocated to the owners’ tax returns. Keep reading to learn more about IRS Form 8825, including who is required to file it and why it matters.

What is Form 8825?

Form 8825, otherwise known as Rental Real Estate Income and Expenses of a Partnership or an S Corporation, is an IRS form used to report income and deductible expenses from rental real estate owned by pass-through entities.

Partnerships and S corporations use this form to summarize rental activity for each property they own, including rental income, operating expenses, and depreciation. The information reported on Form 8825 flows through to the entity’s tax return, and then to the partners’ or shareholders’ individual returns.

Who needs to file Form 8825 (and who doesn’t)

Form 8825 is meant to be filed by partnerships and S corporations that have rental real estate properties. During tax season, partnerships file Form 1065, U.S. Return of Partnership Income, and S corporations file Form 1120-S, U.S. Income Tax Return for an S Corporation. If these entities own rental real estate property, they’ll also need to fill out Form 8825 and attach it to tax Form 1065 or 1120-S, whichever is applicable.

You generally won’t need to use Form 8825 if you own rental real estate property personally or through a single-member LLC. In these cases, you’d typically report your rental income and expenses on Schedule E (Form 1040) or Schedule C.

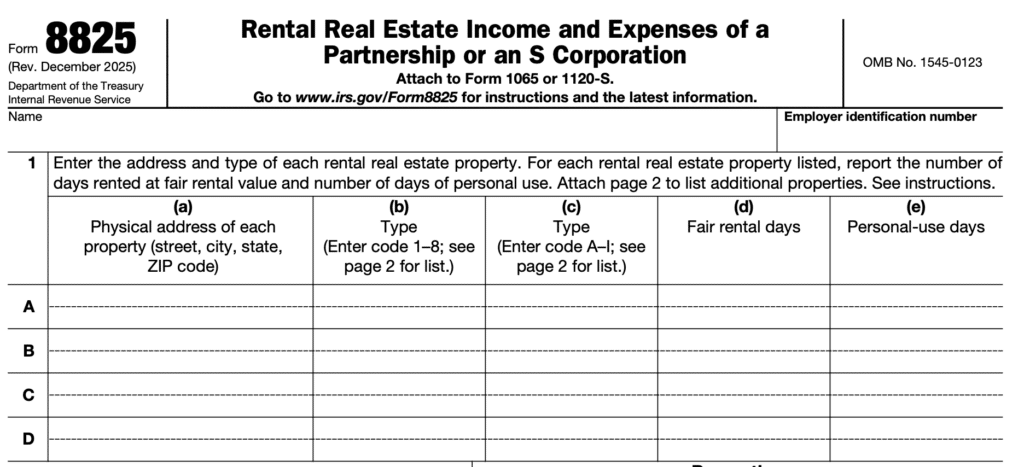

What does Form 8825 look like?

Here’s a brief preview of the first portion of rental income tax Form 8825. In this portion, you’ll include basic information about the entity’s properties.

Form 8825 Instructions: How to fill out Form 8825

Form 8825 may look overwhelming at first glance, but it’s relatively simple to navigate when broken down into steps.

After you fill out the partnership or S corporation’s name and Employer Identification Number (EIN), you’ll need to enter a variety of information related to your rental real estate income and expenses. To simplify the process, we’ll break up the form into sections:

Section I: Your rental properties Rows (A-D) Columns (a-e)

To prepare for this section, you’ll want to build a property list and track fair rental days and personal-use days. You’ll need to provide the following information for each of your properties:

- The physical address of each property

- Type of property and code: 1 – Single-family residence, 2 – Multi-family residence, 3 – Vacation or short-term rental, 4 – Commercial, 5 – Land, 6 – Royalties, 7 – Self-rental, 8 – Other

- Other information with code: A – Nontaxable contribution, B – Other exchange, C – Taxable acquisition, D – New construction/renovation or other basic addition/subtraction, E – Reserved for future use, F – Nontaxable distribution, G – Taxable disposition, H – Abandonment, I – Other/supplement

- Number of fair rental days

- Number of personal-use days

Section II: Rental real estate income (lines 2a-c)

Beginning in this section, you’ll enter amounts for each property using the same property columns you completed in Section I.

- Enter your gross rents (2a)

- Enter other income related to rental real estate activity (2b)

- Add lines 2a and 2b to enter the total rental real estate income for each property (2c)

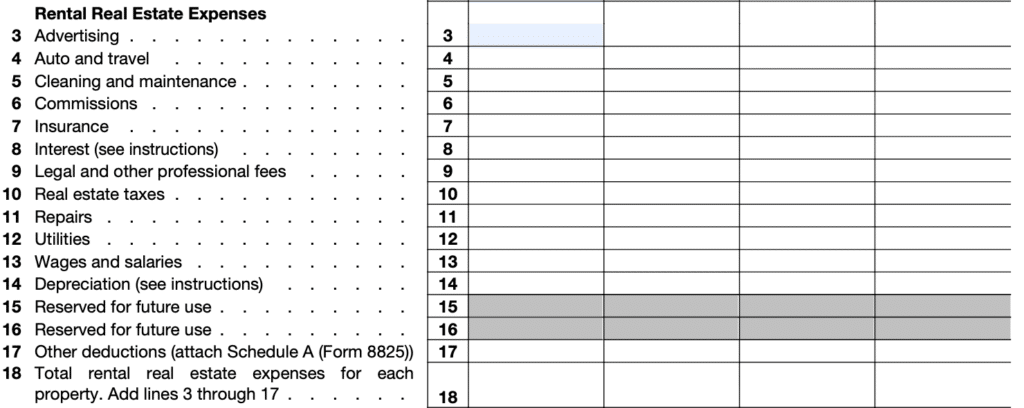

Section III: Rental real estate expenses (lines 3-18)

Here, we’ll focus on numbers 3 through 18. These lines are where you’ll report your categorized deductible expenses. It’s essential to keep receipts and statements so you can accurately record this information.

- Enter the amount for each expense type listed (3-17)

- Add lines 3-17 for the total rental real estate expenses for each property (18)

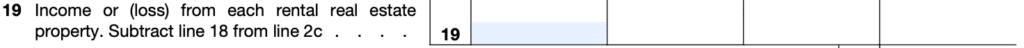

Section IV: Property net income or loss (line 19)

This section focuses specifically on line 19. You’ll need to provide the net income or loss for each property. To get this information, you must subtract your total rental real estate expenses (18) from your total rental real estate income (2c).

Section V: Totals (lines 20a-22b)

Now that you’ve filled out the information above, you can include the summary totals. Enter the following information:

- Total rental real estate income (20a)

- Total rental real estate expenses (20b)

- Net gain or loss from sale of property (21), which would be included in Part II, line 17 of Form 4797

- Net income or loss from rental real estate activities from partnerships, estates, and trusts, in which this partnership or S corporation is a partner or beneficiary on Schedule K-1 (22a)

- The names and employer identification numbers (EIN) of the partnerships, estates, or trusts from line 22a (22b)

Section VI: Report on main return (23)

Finally, you’ll combine the totals from lines 20a through 22a and enter the result on line 23 of Form 8825. The same amount is then reported on Schedule K, line 2 of Form 1065 or 1120-S.

How Form 8825 flows to Schedule K and Schedule K-1

Form 8825 connects to Schedule K, and then Schedule K-1, through the total on line 23. Depending on whether the entity is a partnership (Form 1065) or an S corporation (Form 1120-S), you’ll take the total from line 23 of Form 8825 and enter it on Schedule K, line 2 of Form 1065 or 1120-S.

Each partner or shareholder would then receive a Schedule K-1 tax form to use for their own personal tax return. The K-1 would include the individual’s share of net rental real estate income or loss, which they would report on Schedule E of Form 1040.

Schedule M-3 and Schedule A

For tax years beginning in 2025, the IRS introduced Schedule A (Form 8825) for certain partnerships and S corporations that are required to file Schedule M-3. If you’re in that group, you may need to use Schedule A to report “other deductions” and then carry the total back to Form 8825.

How TaxAct® can help you file Form 1065 and 1120-S

TaxAct Business makes it easy to e-file your partnership and/or S corporation tax returns. Just select Partnerships or S Corporations after clicking the link to file Form 1065 or the 1120-S tax form, respectively.

While you’re there, be sure to check out our resources, such as our Form 1065 preparation checklist and our Form 1120-S checklist.

FAQ

The bottom line

If a partnership or S corporation owns rental real estate, Form 8825 plays a key role in accurately reporting rental income and expenses, ensuring the correct amounts are reflected on owners’ tax returns. While the form can seem detailed, understanding how each section works makes compliance manageable and helps avoid errors that could affect Schedule K, K-1s, and individual returns.

Use TaxAct to easily file your tax return with confidence, accuracy, and step-by-step guidance from experts.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.