Filing taxes can be complex, especially for partnership business owners who need to file IRS Form 1065. If your business is a partnership or a multi-member LLC, you’re in the right place! This guide will walk you through what you need to know about Form 1065 — what it is, how to file it, and key schedules you’ll need to include. Whether you’re new to partnerships or just need a refresher, we’ve got you covered.

At a glance:

- Form 1065 is an informational business tax return used by partnerships. It reports the partnership’s total income, losses, expenses, etc., to the IRS.

- Partnerships do not pay income taxes but pass profits and losses through to their partners, reported on Schedule K-1 to each partner.

What is IRS Form 1065?

IRS Form 1065, officially known as the U.S. Return of Partnership Income, is the Internal Revenue Service (IRS) form used by partnerships to report their gross income, deductible expenses, capital gains, and other key financial information. Essentially, it’s the partnership tax return that the IRS uses to keep tabs on a partnership’s business activity throughout the tax year.

Do I need to file Form 1065?

According to the IRS, a business partnership is two or more people engaged in a trade or business who each contribute money, property, labor, or skill and expect to share in the profits and losses together.

You must file Form 1065 if your small business:

- Is a partnership, including general partnerships, limited partnerships, or limited liability partnerships (LLPs).

- Is a multi-member LLC that’s treated as a partnership for tax purposes.

- Is a nonprofit religious organization classified as 501(d).

- Has foreign partners or has conducted business in the U.S., even if it was organized outside of the U.S. (with some exceptions).

How partnerships are taxed

Unlike corporations, partnerships don’t pay income taxes directly. Instead, they operate as a pass-through entity, meaning the profits and losses are “passed through” to individual partners. While Form 1065 declares the partnership’s losses, deductions, and credits, the partnership must also submit Schedule K-1 to each partner, who will file it with their personal tax returns to report their portion of the partnership’s financials.

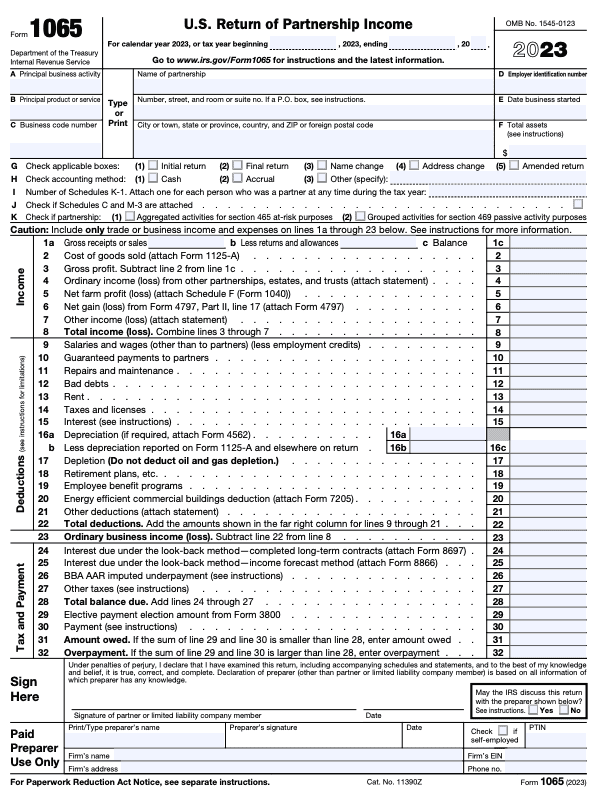

Form 1065 example

Here’s a look at what the first page of IRS Form 1065 looks like:

Don’t let the boxes intimidate you — it’s all just business information broken down into clear sections. Here’s the gist of what each section includes:

- General information: This is where the partnership’s basic details go, like the partnership’s name, address, and employer identification number (EIN). You’ll also include the type of partnership and the accounting method you’re using (cash or accrual).

- Income: This section includes the partnership’s gross receipts, cost of goods sold, and other business income.

- Deductions: Here, you report any deductible expenses, such as rent, wages, depreciation, or guaranteed payments to partners. This is an important section because it reduces the net income that gets passed on to partners.

- Tax and payment: While the partnership itself doesn’t pay income tax, certain situations — like interest and underpayments — might require taxes to be paid. If applicable, you’ll report those payments here.

- Schedule B: This part collects other information about the partnership, including whether the partnership owns any foreign partnerships and if it made any distributions to partners.

- Balance sheet (Schedule L): The balance sheets are financial statements for a partnership that show its assets, liabilities, and partners’ equity on the first and last days of the tax year. These should match up with the partnership’s books and records. If there are any differences, you’ll need to attach a statement explaining why.

Form 1065 might look complex, but each box ensures the IRS gets a complete picture of your partnership’s financials. The more complete and accurate your form, the less chance you’ll have the IRS knocking on your door.

Form 1065 instructions

Before you start filing, use a comprehensive checklist, such as TaxAct’s 1065 Partnership Return tax preparation checklist, to ensure you’ve got all the tax forms and additional documents you’ll need. Here’s a high-level breakdown of the steps you’ll need to take when filing Form 1065:

- Gather financial information: Collect specific financial details about your partnership, including income, expenses, and distributions.

- Partner information: Obtain information on each partner’s share of the partnership. You’ll need each partner’s name, address, and tax ID number (SSN or EIN). You’ll also need a list of each partner’s profit, loss, ownership percentages, and other relevant financial reports.

- Complete required schedules: Fill out various schedules, such as Schedule K-1 for each partner (more on each schedule below).

- File by the deadline: The due date for calendar-year partnerships is typically March 15 unless it falls on a weekend or holiday, in which case the deadline is moved to the next business day. For partnerships using a fiscal year bookkeeping method, the form is due by the 15th day of the third month following the end of the fiscal year.

- Request a tax extension if necessary: If you need more time to file, you can request a six-month extension by filing Form 7004, the Application for Automatic Extension of Time. This will give calendar-year partnerships until Sept. 15 to file. Just remember, an extension to file isn’t an extension to pay your tax liability, so if any taxes are owed (like certain self-employment taxes or foreign payments), those still need to be settled by the original due date to avoid penalties.

Important schedules for Form 1065

Several schedules accompany Form 1065, each providing crucial details about the partnership’s finances. Here are the most important ones:

- Schedule K: This summarizes the partnership’s total income, deductions, credits, and other essential tax items for the year.

- Schedule K-1: The partnership’s income, losses, and credits are divided among the partners. Each partner gets their own Schedule K-1 reporting their share of the partnership’s income to file with their personal tax return.

- Schedule L (balance sheet): This schedule reports the partnership’s balance sheet. It summarizes the partnership’s financial statements, listing its total assets, liabilities, and partners’ capital accounts.

- Schedule M-1: Here, you reconcile the net income reported on the partnership’s books with the income reported on Form 1065.

- Schedule M-2: This schedule tracks any changes in partners’ capital accounts throughout the year.

- Schedule M-3: This schedule is required for partnerships with over $10 million in assets. It provides additional details about the partnership’s financial information.

All partnerships must complete Schedule L, M-1, and M-2 unless all the following apply:

- The partnership’s total receipts for the tax year were less than $250,000.

- The partnership’s total assets at the end of the tax year were less than $1 million.

- Schedule K-1s are filed with the return and given to the partners on or before the due date (including extensions) for the partnership return.

- The partnership is not filing and is not required to file Schedule M-3.

The IRS takes accuracy seriously, so always ensure your numbers are right before submitting anything! But you don’t have to go it alone — TaxAct Business can help guide you through the Form 1065 filing process.

FAQs about Form 1065

How to file Form 1065 with TaxAct

Filing Form 1065 doesn’t have to be complicated. TaxAct Business makes it simple for you to e-file your partnership tax return yourself. Simply select our Partnerships product as shown below to get started:

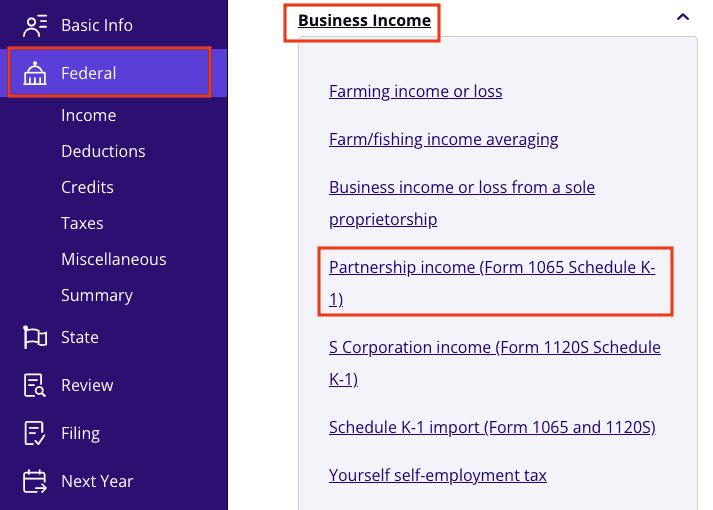

And if you’re a partner needing to file your Schedule K-1 with your personal tax return, TaxAct can help with that, too. Here’s how you can file your Schedule K-1 with TaxAct:

- From within your TaxAct return (Online or Desktop), click Federal (on smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Business Income dropdown, then click Partnership income (Form 1065 Schedule K-1) as shown below:

3. Click + Add Federal Partnership Schedule K-1 to create a new copy of the form, or click Edit to edit a form already created. (Desktop program: click Review instead of Edit).

4. Continue with the interview process to enter or review your information.

It’s that simple! Whether you’re filing for your partnership or just your partner’s share of the profits, TaxAct is here to help streamline the process.

The bottom line

Filing IRS Form 1065 can seem daunting for many taxpayers, but with the right tools and support, it doesn’t have to be. With TaxAct as your guide, you can confidently handle everything from partnership income to partner distributions. Whether you’re new to filing partnership taxes or just need some guidance, we’ll walk you through the tax filing process so you can focus more on the important stuff — like running your partnership.