If you’ve found yourself with one or more 1095 forms this tax season, you might wonder what they mean for your tax return. Whether it’s Form 1095-A, 1095-B, or 1095-C, these tax forms all relate to health insurance and are crucial for understanding your coverage, tax credits, and potential liabilities.

The table below provides a quick overview of the different 1095 forms and what they are for. Click on any link to jump to more detailed sections about each form.

| Form | What it is | Why you might receive it | Received by |

|---|---|---|---|

| 1095-A | Health Insurance Marketplace Statement: For those who purchased health insurance through the online Marketplace. | You were enrolled in a Marketplace health plan during the tax year. | Mid-February following the tax year. |

| 1095-B | Health Coverage: Provided by insurers to report that you had minimum essential coverage. | You were covered by health insurance outside the Marketplace, like through an employer or government program. | Mid-March, following the tax year. |

| 1095-C | Employer-Provided Health Insurance Offer and Coverage: For employees of companies with 50 or more full-time employees. | You worked for an employer considered an Applicable Large Employer (50+ employees) and were offered health insurance. | Late February or early March, following the tax year. |

At a glance:

- You’ll receive Form 1095-A if you purchase insurance through the Health Insurance Marketplace.

- Forms 1095-B and 1095-C are for informational purposes only and don’t need to be reported on personal income tax returns.

- If you have different types of health insurance coverage, you may receive multiple forms (A, B, and C) in a year.

What is a 1095-A form?

Form 1095-A, Health Insurance Marketplace Statement, is sent to individuals who bought health insurance through the Health Insurance Marketplace. It plays an important role in your tax return as it helps you complete Form 8962, Premium Tax Credit, which determines if you qualify for the premium tax credit (PTC).

How does Form 1095-A affect my taxes?

The premium tax credit explained

The PTC is a refundable tax credit that helps cover health insurance premiums purchased through the Health Insurance Marketplace. Basically, you can choose to take advance payments of the premium tax credit (APTC), meaning you receive the tax credit in advance to help lower your monthly premiums instead of waiting to claim the full credit at tax time. In this scenario, the Internal Revenue Service (IRS) sends the monthly advance payments directly to your health insurer.

Your household income determines eligibility for the APTC. The amount you receive is based on your expected income for the year. The final credit amount is determined by your actual income reported on your tax return for that year. Form 1095-A will help you reconcile your PTC with any tax credit payments received in advance. For example, if your income is higher than estimated, you may have to pay back some of your advance payments. But if your income was lower than estimated, you could receive additional payment as a tax refund.

You’ll typically receive Form 1095-A by mid-February. If you enrolled in Marketplace coverage, wait until you have this form before filing your income tax return to ensure the information you provide to the IRS is correct.

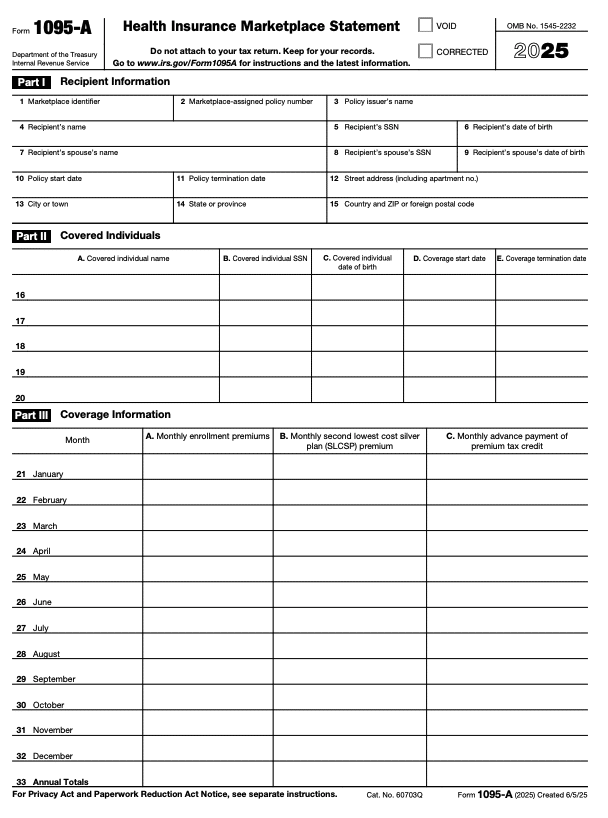

IRS Form 1095-A example

Here’s an example of what Form 1095-A looks like:

This form contains several sections, and each section provides important coverage information:

- Part I: Recipient Information – Provides details about the recipient of Marketplace coverage.

- Part II: Covered Individuals – Lists all covered individuals, including family members.

- Part III: Coverage Information – Shows the coverage details month by month, including premium payments and any advance payments of the premium tax credit.

What is a 1095-B form?

Form 1095-B provides proof that you had minimum essential coverage during the previous year, which is required by the Affordable Care Act (ACA). This form reports health coverage not covered by Form 1095-A or Form 1095-C. You might receive it directly from your insurer, the government (Medicaid, Medicare Part A, CHIP, VA, etc.), or your employer if you work for a self-insured small business with fewer than 50 full-time employees.

Insurance providers use Form 1095-B to report the type of coverage, the months of the year the coverage applied, and the names of individuals covered by the plan.

Why is this form important for taxpayers? In the past, an individual mandate provision in the ACA required individuals to have minimum essential healthcare coverage or face a tax penalty. While the federal individual mandate penalty is no longer in effect, some states have their own health insurance mandates and may enforce penalties for not having minimum essential coverage unless you qualify for an exemption.

California, Massachusetts, New Jersey, Rhode Island, and the District of Columbia impose various penalties for not having health coverage. Exemptions vary by state and can include a lack of affordability or hardship due to financial . If you think you might qualify for an exemption, contact your state’s tax authority.

The 1095-B form is informational, meaning you do not need to file it with your tax return. However, you should keep it with your other tax records.

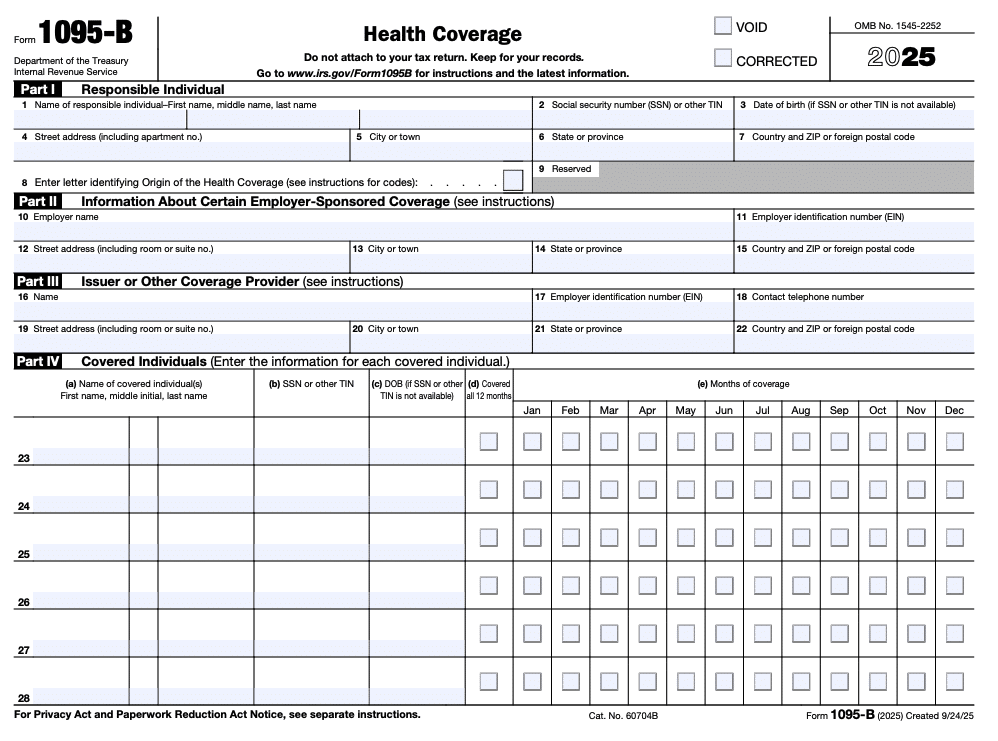

IRS Form 1095-B example

Here’s an example of what Form 1095-B looks like:

Like 1095-A, this form includes information about your insurance coverage:

- Part I: Responsible Individual – Information about the responsible individual, usually the primary policyholder.

- Part II: Information About Certain Employer-Sponsored Coverage – Lists your employer’s name and whether your employer sponsors your coverage.

- Part III: Issuer or Other Coverage Provider – Provides details on the company providing the coverage.

- Part IV: Covered Individuals – Lists all individuals covered under the plan, such as dependents. The checked boxes indicate whether each individual was covered for the entire year and, if not, which months they had coverage.

What is a 1095-C form?

Employers with 50 or more full-time employees or full-time equivalent employees, also called an applicable large employer (ALE), issue Form 1095-C. This form details the employer’s health insurance coverage and whether you (the employee) enrolled in coverage. It is used to verify if the employer met the requirements of the ACA.

If you worked for an ALE, you’ll receive Form 1095-C by early March. This form helps determine eligibility for the premium tax credit, but just like Form 1095-B, it does not need to be filed with your federal tax return.

IRS Form 1095-C example

Form 1095-C looks like this:

The form is divided into three sections:

- Part I: Employee – General information about you (name, Social Security number, address) and your employer.

- Part II: Employee Offer of Coverage – Details about the health care coverage plans offered, your age, the months when you were eligible to participate, and when the plan year began. The IRS has a complete list of codes for line 14 in the instructions for Form 1095-C to indicate the kind of plan offered.

- Part III: Covered Individuals (not pictured) – Information on all family members who also enrolled in coverage, plus their dates of birth and tax identification numbers.

FAQs about Forms 1095-A, 1095-B, and 1095-C

Where to get a 1095 form?

Your 1095 form will be sent to you by your health insurance , employer, or the Health Insurance Marketplace. In most cases, you should receive your 1095 form(s) in the mail by the following dates:

- Form 1095-A: mid-February

- Form 1095-B: mid-March

- Form 1095-C: early March

If you still haven’t received your 1095 form by the above deadlines, contact your insurance provider or employer. Also, remember to check your online accounts in case the form was sent electronically instead!

How do I get my 1095-A, B, or C forms online?

You may be able to access your 1095 forms online through your health insurance provider, employer, or the Marketplace website. Log in to your account to view or download the form. If you have any questions about how to log in, contact your provider or employer for assistance.

Why do I need Form 1095-B or Form 1095-C?

Forms 1095-B and 1095-C are information returns, meaning they are used primarily for informational purposes. They prove that you had health insurance coverage throughout the tax year and should be kept for your records, but you do not generally need these forms to file your income tax return.

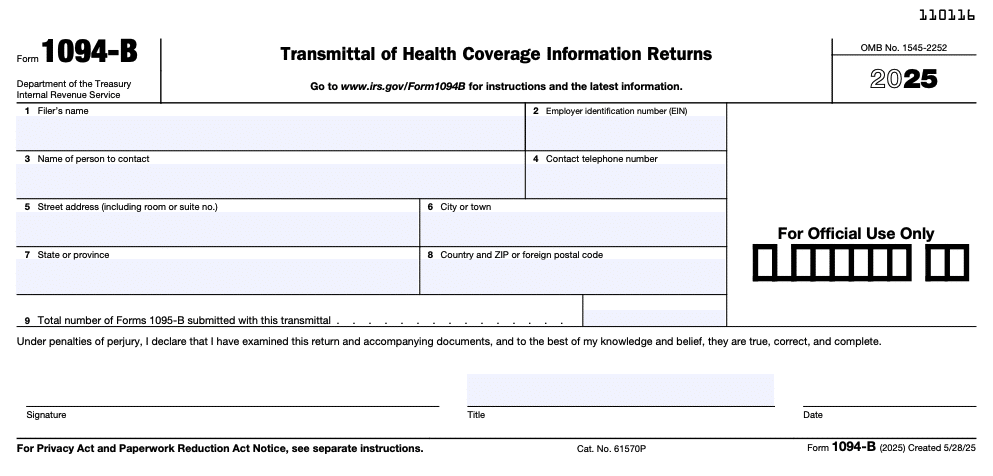

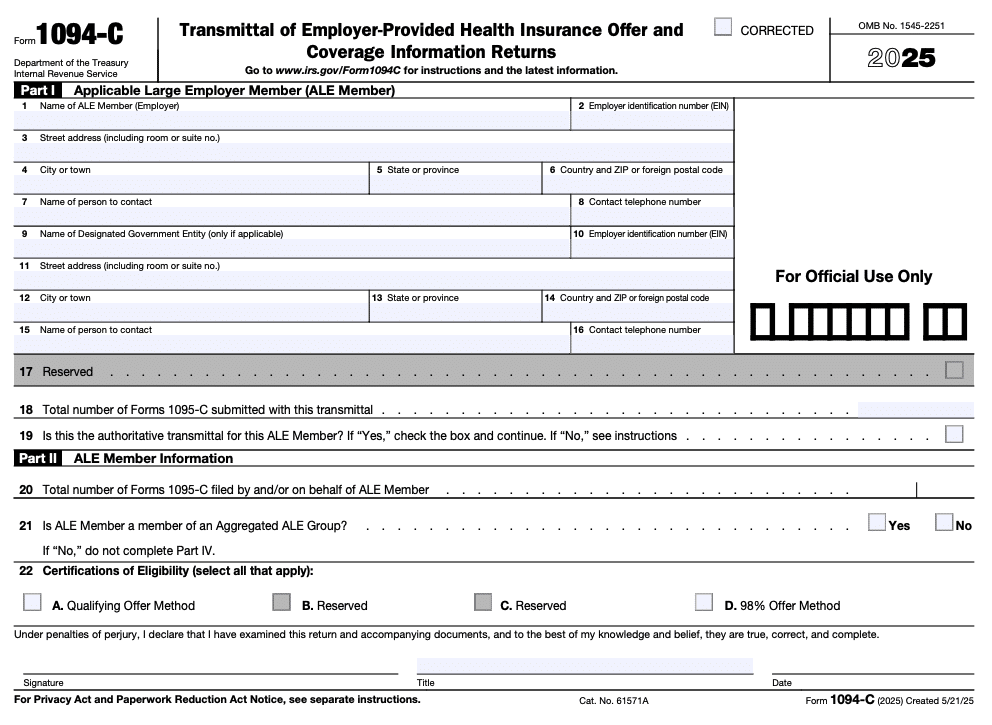

What are Form 1094-B and Form 1094-C?

Forms 1094-B and 1094-C are transmittal forms that accompany Forms 1095-B and 1095-C, respectively. These forms are only sent to the IRS, so you won’t receive them as a taxpayer. In short, 1095 forms are for individuals, while 1094 forms are for the IRS.

Coverage providers use Form 1094-B to report a summary of minimum essential coverage to the IRS. It looks like this:

Meanwhile, Form 1094-C is used by employers to report information about employer-provided health insurance. It looks like this:

Can I receive IRS Form 1095-A, 1095-B, and 1095-C all in one year?

Yes, you could receive multiple forms if your healthcare coverage changed throughout the year. For example, if you were enrolled in a Marketplace health plan for part of the year and later received employer-provided coverage, you might get both Form 1095-A and Form 1095-C.

As another example, if you work for a company with 50 or more employees and the coverage provided by that employer is purchased through an insurance company, you will receive 1095-B from the insurance company and 1095-C from your employer.

Where do I enter tax information from IRS Form 1095-A, 1095-B, or 1095-C on my tax return?

If you need to file Form 1095-A with TaxAct®, you can do so using our tax preparation software. We ask you simple Q&A interview questions and guide you through the steps to file. We can also help you add a new Form 1095-A or edit an existing one if necessary.

Forms 1095-B and 1095-C are not required to be filed with your tax return — just keep them with your records.

What if I have adult children on my health insurance plan, but they file their own tax returns?

Only one Form 1095 is sent to the primary policyholder. If your adult children are covered under your health plan but file their own tax returns, you’ll need to provide them with copies of the form.

Do I qualify for the premium tax credit?

To qualify for the PTC, you must meet the following criteria:

- You were enrolled in health insurance coverage through the Marketplace for at least one month of the calendar year.

- You did not qualify for an employer-sponsored plan that was considered affordable for your income level.

- You were not eligible to enroll in a government program such as Medicare, Medicaid, or CHIP.

- You fall within certain household income limits (more on that later).

- No one else can claim you as a dependent on their tax return.

- Your filing status is not married filing separately. However, there are exceptions for some victims of domestic abuse and spousal abandonment — the IRS addresses these scenarios on its PTC FAQ page.

How much can I make before I no longer qualify for a premium tax credit?

The PTC usually begins phasing out for those earning 100% to 400% of the federal poverty line (FPL), but Congress temporarily changed this rule for tax years 2021 through 2025. This means taxpayers with income above that threshold could qualify for the PTC if otherwise eligible. After 2025, your income will once again need to be below 400% of the FPL to claim the PTC.

Note that income limits are higher if you live in Hawaii or Alaska. You can reference the 2025 poverty guidelines page to find the income limits that apply to residents of the 48 contiguous states for tax year 2025, based on family size. Income limits are tied to inflation each year. Typically, the lower your income, the more help you receive through a premium tax credit. You don’t qualify for the premium tax credit if your income is above the upper limit.The poverty guidelines page also includes different figures for Hawaii and Alaska residents.

How do I calculate my household income for the premium tax credit?

To determine your household income for the PTC, start with your adjusted gross income (AGI). Your adjusted gross income includes all your taxable income, reduced by “adjustments,” including deductions and retirement plan contributions.

Add back the following items to calculate your household income:

- Non-taxable Social Security benefits

- Tax-exempt interest income

- Excluded foreign income

TaxAct can help here — our software calculates your household income and allowable credit for you making it easy to determine your income.

If my income disqualifies me from advance credit payments I’ve already received, how much could I have to pay back?

Let’s say your income was more than you expected during a year when you received advance credit payments, and your income is above 400% of the federal poverty level. In that case, your advance credit payments must be paid back (with a possible exception in tax years 2021 through 2025). However, if you made more than you expected but your income is still below 400% of the federal poverty level, there is a repayment limitation on the amount you must repay.

For example:

- If your income is less than 200% of the federal poverty level ($31,300 for an individual in 2025), you will not have to pay back more than $350 of advance credit payments as a single filer (and no more than $700 for other filing statuses).

- If your income is less than 300% of the federal poverty level, the maximum amount you will pay back as an individual is $900.

- If your income is less than 400% of the federal poverty level, you won’t have to pay back more than $1,500 as an individual.

How to report 1095 forms with TaxAct

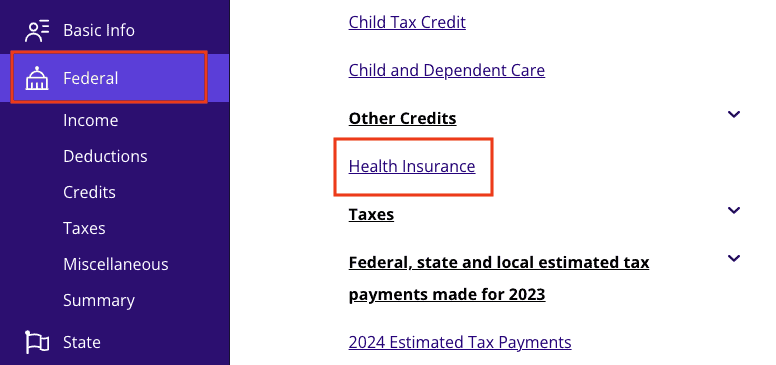

To enter or review Form 1095-A in the TaxAct program:

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click Health Insurance as shown below.

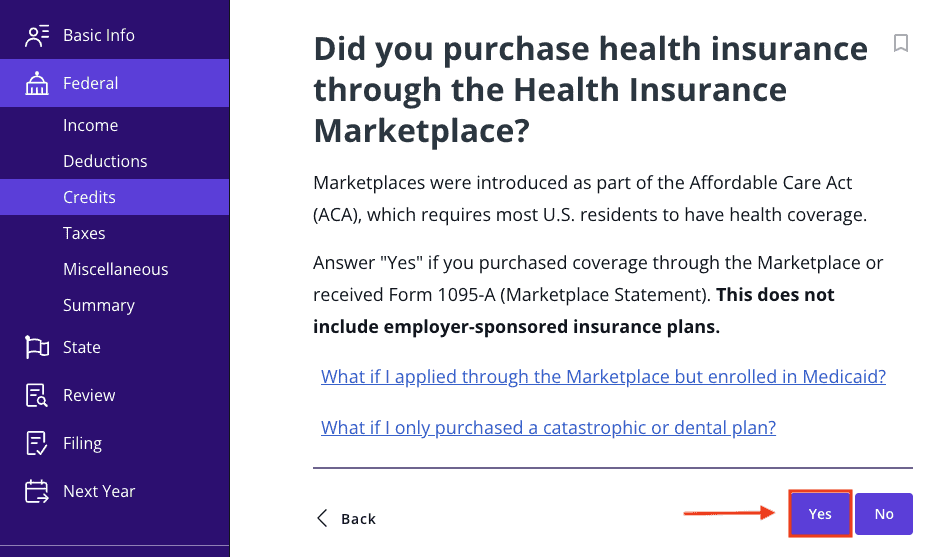

3. Click Yes, as shown below, and then click Continue.

4. Continue with the interview process to enter your information.

Remember, Forms 1095-B and 1095-C do not need to be filed with your tax return, but you should keep them with your other tax documents.

The bottom line

While Form 1095-A is crucial for those who purchased insurance through the Marketplace, Forms 1095-B and 1095-C are mainly informational. Keep these tax forms handy for your records and use TaxAct’s helpful tax preparation software to guide you through the filing process. We’re here to help make your tax filing experience as smooth as possible!

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.