Can tax preparation software help you find deductions, pay less tax, and stay out of trouble with the IRS as well as a live person sitting in front of you can?

For most taxpayers, today’s tax preparation software can do a great job on all of the above.

In fact, tax preparation software has a few advantages.

After all, it’s endlessly patient, it systematically guides you every step of the way, and it never suffers from tax season burnout.

It doesn’t even complain if you wait until the last week before the deadline to begin.

To get the most from your tax preparation software, however, you need to use it right.

If you take shortcuts, for example, you can miss the advantages of going through the federal and state Q&A sections.

Here’s how to use tax preparation software with confidence:

1. Get organized before you start

By January, you should have a file for all the year-end tax forms that start showing up in your mailbox.

When you’re ready to do your tax return, sort them by type of income or expense.

Put all your W-2 forms together, and all your dividend and interest statements, for example.

You’ll want to go through each section of the program only once, if possible.

If you keep track of your finances with personal finance software, update your file and print out relevant reports.

It’s important to keep track of how you came up with the numbers you enter into the tax preparation software.

Create a list or a worksheet with notes about how you estimated any amounts, how you valued charitable contributions, and anything else you may need to remember later.

You should also keep track of amortized mortgage points and anything else you’ll need to reference in later years.

If you’re downloading the program, make sure you have the latest updates before you start.

2. Go through the Q&A interviews in order

It’s possible to go directly to the tax forms and start filling them in.

Unless you are a tax pro, however, resist the urge to do so.

You’re defeating much of the purpose of tax preparation software by skipping the complete Q&A sections, or by hopping around too much from one section to another.

Entering information in the tax preparation software without going through the Q&As from start to finish would be like going to a tax professional and rattling off your tax numbers without letting the tax pro talk or ask you any questions.

Either tax preparation software or a tax professional is bound to ask you a few questions that don’t apply.

Don’t get discouraged and start skipping around.

TaxACT is designed to ask you as few questions as possible and still make sure your taxes are done correctly and to your best advantage.

3. Enter your information one section at a time

Try to deal with each tax-related piece of paper only once. After you enter an item, a check-mark or other mark lets you know you’re done with that item.

You can use your worksheet to take note of any questions you have as you go along.

It’s normal to discover you need just one more receipt, or the interest income from another account.

Don’t let the fact that you don’t have everything stall your work.

For substantial numbers, such as your property taxes, if you can’t find a number you might want to enter an estimate.

Most of us are anxious to see the grand total of income tax owed or being refunded, and entering estimated amounts can help you do that.

Right-click an entry box, and then click Mark as Estimate. TaxACT will remind you to recheck the number before you file.

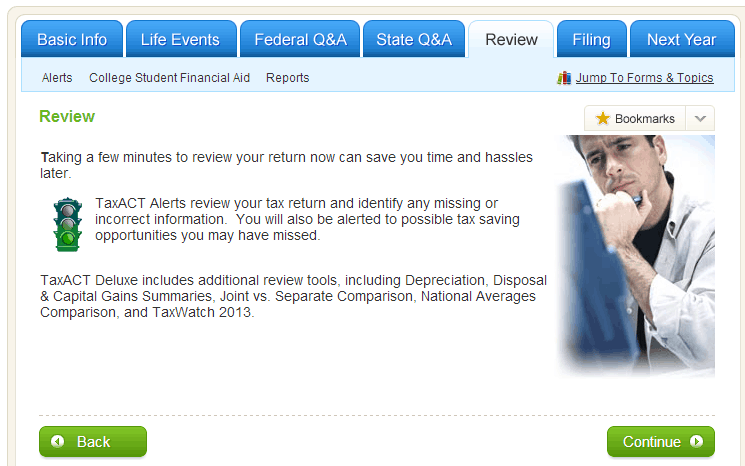

4. Review before you file

You’ve reached the end of the federal and state Q&A sections, but you’re not done.

Use the Review main tab to check for missing or incorrect information.

TaxACT will not let you file before you correct some errors and omissions.

Other items may not prevent you from filing, but you should check them to make sure you are getting all the breaks you are entitled to.

You should also read your tax return.

It’s easy to think that if you’ve entered all your numbers, your tax return should be 100% correct.

However, you are responsible for reading your return and making sure it’s right.

For example, if you enter car mileage for your small business, but you miss just one check box in the questions, the program may determine that you don’t qualify for the deduction.

By comparing the items you expect to see on your return to the income and deductions on the actual form, you can make sure everything was entered correctly.

How much time do you allow yourself to work on your tax return?

Photo credit: ebayink via photopin cc