Want to spruce up your home? You’re not alone. More than one-third of Americans are planning to remodel their homes within the next five years. If you’re like most Americans, your house is one of your biggest expenses, and it’s important to keep it up to date and in good condition. But not all home improvement projects add significant value to your home. Keep reading to find out which projects offer the most bang for your buck and which to avoid if you plan to sell soon. Then discover the projects that can help you save money on your taxes.

Selling soon?

You may be weighing whether it’s more advantageous to renovate your house or sell it as is. Most homebuyers want move-in-ready homes and will pay substantially less for fixer-uppers. Moreover, some lenders won’t loan money for houses in poor condition.

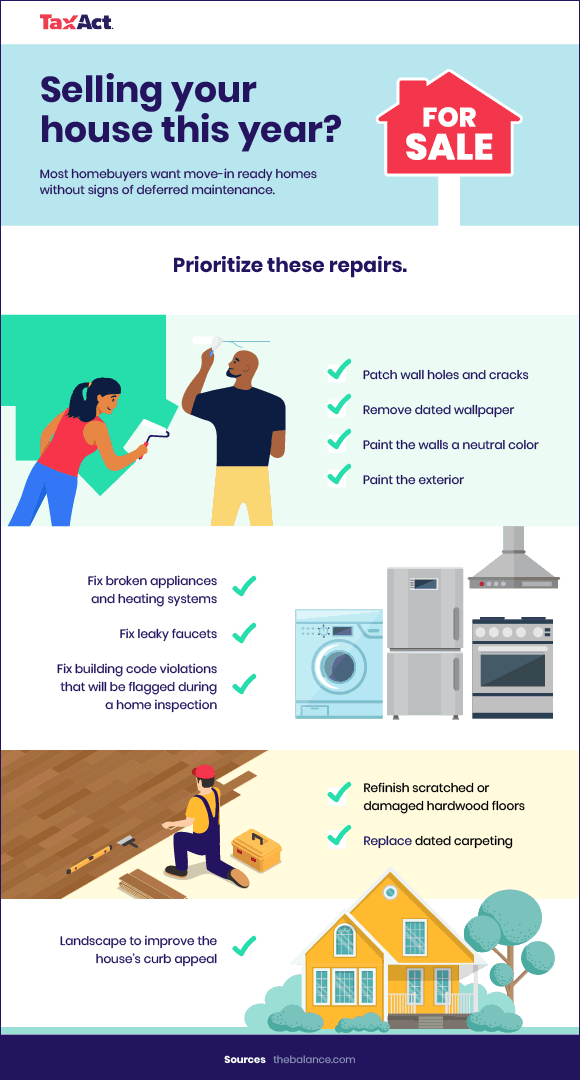

It’s usually a good idea to do non-cosmetic repairs, such as replacing a worn-out roof, patching holes and cracks, painting the interior and exterior, fixing broken appliances or heating systems, repairing broken faucets or pipes, and fixing building-code violations that will be flagged during an inspection. It may also be worthwhile to remove old wallpaper and paneling, replace dated carpeting, refinish damaged hardwood floors, and do basic landscaping to improve the house’s curb appeal.

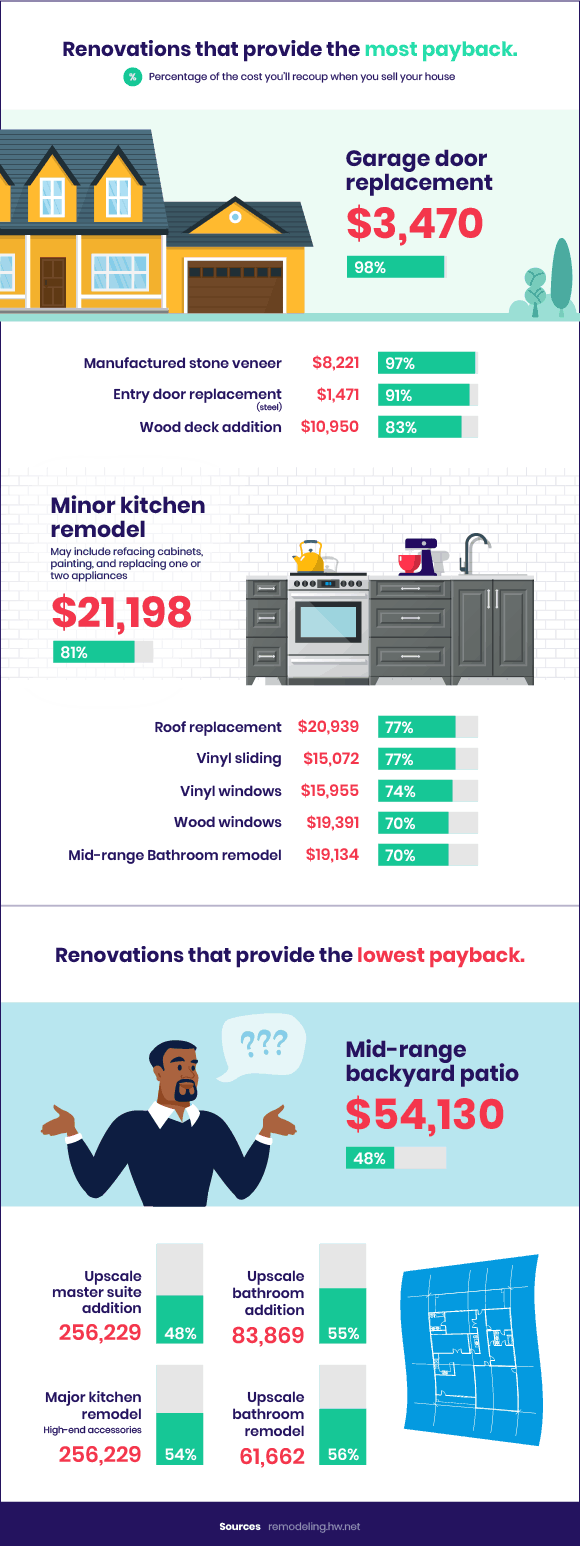

More extensive renovations probably won’t pay off if you’re selling soon. Homeowners rarely get a dollar-for-dollar increase in market value for major home improvements. For example, if you add a $123,000 master suite to your house, you’ll recoup only about $70,000 on the resale value of your home, according to Remodeling Magazine. For a mid-range kitchen remodel, you’ll recoup about 57 percent of the cost, and for a mid-range bath remodel, you’ll recoup about 70 percent of the cost.

Talk to a local realtor before you do any renovations. He or she can help you understand what homebuyers expect in your area. Also, tour similar houses for sale in your neighborhood and note the condition and amenities. If you determine your house needs improvements before you put it on the market, focus on renovations that provide the most payback. In general, expensive, high-end home improvements pay off the least.

Staying put for five years or longer?

It makes sense to stay in your house and renovate if you love your neighborhood or schools. While it’s a good idea to keep your home’s resale value in mind no matter when you plan to sell, you can put your family’s quality of life front and center if you plan to stay for a while.

What bothers you most about your house? Broken cabinets, old appliances, a dated bathroom, a funky layout? That’s what you should improve first. In 2021, home improvement spending was on the rise, with homeowners increasing their spending by 25 percent year over year. The most popular remodels were:

- Interior painting

- Bathroom remodels

- Landscaping

- Smart home device installation

- Flooring

If you’re over the age of 75 or live with an aging relative, it may be time to improve your house for ease of living. Forty-six percent of homeowners renovate their homes in anticipation of getting older.

Popular projects for older homeowners include:

- Adding pull-out shelves to kitchen cabinets

- Changing doorknobs to lever handles

- Installing smart thermostats

- Installing smart blinds and drapes

- Installing smart lighting

- Replacing lower kitchen cabinets with drawers

Save money on your taxes

Most home improvements aren’t tax-deductible because they’re considered personal expenses. But certain renovations or home improvements projects can help save money on taxes if they fall into the following categories.

1. Renovations of a home office

Are you self-employed and work at home? If so, you can deduct 100 percent of the cost of improvements you make to your home office. For example, if you replace the windows in your office, you can deduct the entire cost of supplies and labor as an office expense, provided you meet the home office deduction requirements.

You may also be able to deduct a percentage of whole-house repairs. To figure out how much you can deduct, divide the square footage of your house by the square footage of your office. For example, if your house is 1,000 square feet and your office is 100 square feet, you could deduct 10 percent of the cost of whole-house repairs. That means if you painted your entire home at a cost of $500, you could deduct $50 as an office expense.

As of 2022, only self-employed workers can deduct home-office expenses. If you work for an employer and have a home office, you’re no longer eligible to deduct out-of-pocket expenses for working from home.

2. Solar panels

If your roof faces south, east, or west and gets at least five hours of sunshine a day, it may be worth outfitting your house with solar electricity — especially because the federal government offers a generous tax incentive. For solar systems installed in 2020-2022, the IRS will give you a tax credit for 26 percent of the cost of the project. In 2023, the federal credit drops to 22 percent. Unless Congress renews it, this tax credit is set to expire for private residences in 2024.

Many states also offer their own tax incentives. For instance, Arizona offers a tax credit of up to $1,000.

A standard solar system costs an average of $20,498 and will be about $15,168 after factoring in the federal tax credit. Don’t forget, solar panels also help you save on electricity bills. How much you’ll save depends on how expensive electricity is where you live.

3. Renewable energy improvements

The federal government also provides tax credits for renewable energy installations including fuel cells, small wind turbines, and geothermal heat pumps. You can get a 26 percent tax credit for systems installed and placed in service in 2020-2022. This tax credit will drop to 22 percent for systems placed in service in 2023 and expire entirely in 2024.

4. Medically-necessary improvements

Do you need to install ramps, modify bathrooms, widen doors and hallways, add handrails, install lifts, or make any other improvements for medical purposes? These expenses are deductible as itemized medical expenses as long as the cost is reasonable and the improvement doesn’t increase the value of your property. You may also deduct the costs of operating and maintaining any medically-necessary improvements.

5. Improvements funded by a mortgage or Home Equity Line of Credit (HELOC)

If you roll the cost of improvements into the acquisition price of your home and take out a mortgage to pay for them, you can deduct the cost of the loan’s interest on your taxes. The FHA 203(k) mortgage and the Fanny Mae HomeStyle Renovation mortgage are designed to help homebuyers pay for renovations.

Some homeowners can also deduct the interest on a Home Equity Line of Credit (HELOC). As of 2018, HELOCs must be used to improve a home and need to meet certain other requirements for the interest to be deductible. For instance, homeowners can only deduct the interest on home loans (mortgages and HELOCs) totaling a maximum of $750,000. Cash-out refinancing is another option that may have tax benefits. Qualifying homeowners with significant equity in their homes can typically borrow up to 80 percent of the appraised value of their homes and walk away with cash for renovations. However, you may end up with a higher interest rate on your new loan.

Conclusion

If you plan to revamp your home soon, get savvy about which home improvements pay off and which projects can help you save money at tax time. By improving your house, you could sell it faster or transform it into your dream home.