As a homeowner, it’s important to understand how your taxes are impacted if you sell your home. Before you pack up and move, here’s how putting your house on the market makes a difference on your tax return.

1. Not all gains are taxable income.

If you make a profit when you sell your home, there’s a chance not all of that money is taxable. As long as you meet certain qualifications, you can exclude up to $250,000 of the profits (up to $500,000 if you’re married filing jointly). Those qualifications are:

- You owned the home as your primary residence during at least two of the last five years before the date of the sale.

- The home wasn’t acquired through a like-kind exchange during the past five years.

- You didn’t claim an exclusion for the sale of a home during the two years prior to the date of the sale of the home of the gain you’re now trying to exclude.

2. You may qualify for a reduced exclusion.

In the event that you don’t qualify to exclude the full amount of your profit, a portion may still be tax-free.

For example, let’s say you only lived in the home for one year before you sold it, and therefore, don’t pass the two-out-of-five-years residency test. A reduced exclusion is available if you sold the home because of a change of employment, change of health, or because of other unforeseen circumstances, like a divorce or the birth of multiple babies from one pregnancy. If you need to change houses because you don’t have enough room for your growing family, the IRS still allows you to exclude some profit – it’s just a little less than the full exclusion amount.

3. Not all home sales need to be reported on your tax return.

When you sell your home, you can sign an affidavit or statement stating you won’t have taxable gain from the sale. Once you sign that form, the closing agent typically won’t send Form 1099-S, Proceeds from Real Estate Transactions, to you or the IRS reporting the sale. In that case, you don’t have to report the sale on your tax return either.

However, if you do receive Form 1099-S, you must report the sale of your home on your tax return. And, yes, that’s true even if you don’t have to pay tax on the gain.

4. A loss on the sale of the home is not deductible.

If you sell your house at a loss, it is considered a personal loss. Unfortunately, you can’t take a tax deduction on that loss.

5. If you pay tax, you may have a long-term gain.

A gain only qualifies as a long-term capital gain if you owned the home for more than one year.

6. Long-term gains tax rates are lower than short-term.

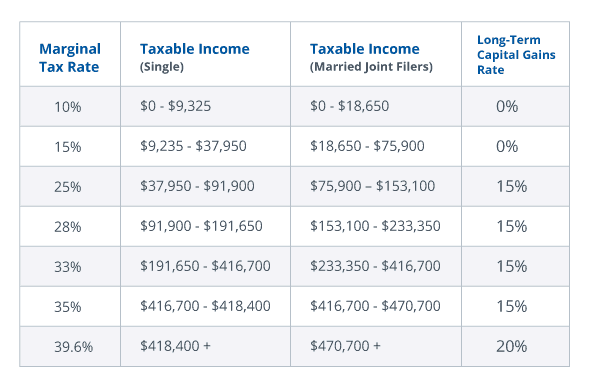

Long-term capital gains tax rates for 2017 are 0 percent, 15 percent or 20 percent. The rate applied to your capital gain depends on your income tax bracket. The breakdown looks like this:

High-income taxpayers must pay an additional 3.8 percent tax on certain investment income. That includes any gain from the sale of a residence that is not excluded from income. For this purpose, a high income taxpayer is a taxpayer with a modified adjusted gross income of more than $200,000 ($3250,000 if married filing jointly).

7. You may have to pay back your First-Time Homebuyer Credit.

If you purchased a home in 2008 and took advantage of the First-Time Homebuyer Credit, you may have to pay back a portion or all of that credit when you sell the home.

The same is true if you purchased the home in 2009 or 2010 and sold it or stopped living in it before the end of 36 months.

In either case, you must pay back the smaller of these two amounts:

- Your gain on the sale of the home

- The amount of your credit reduced by any repayments – if the credit was from 2008

or - The amount of credit you received – if the credit was from 2009

Under a couple different circumstances, you may qualify for an exception to paying back the credit. For instance, if you didn’t have a gain on the sale of the home, you don’t have to pay the credit back.

8. If you live in two homes, only one is eligible to exclude form your income.

You can only exclude the gain on the sale of your main home. That means the home you live in the most during the year.

It’s generally the place you receive your mail and the address you list on your identification or with billing companies. You can also consider where you bank or where you are a member of clubs or religious organizations.

9. If you didn’t live at the home, you may have to pay tax on your gain.

If your house value increased when you didn’t live in it, you may be liable for taxes on at least part the gain. For example, if the property was used as a rental house, you can’t exclude any gain from your taxable income starting at the time you rented it. To determine the amount of gain you can’t exclude, you should assume the property has gone up in value evenly during the time you owned it.

10. You can choose not to exclude the gain from a sale.

If you expect to sell another primary home within two years, you may want to consider claiming the gain on the sale of your current home instead of excluding it. You can only claim an exclusion on the sale of your main home once every two years.

Depending on your specific sale, it may be more beneficial to claim the current gain as income. You can then use the exclusion on the future sale of your main home.

11. To exclude the gain, you don’t have to buy a home of greater value.

You are no longer required to purchase another home after you sell in order to exclude the gain.

12. Update your address with the IRS.

Whenever you sell your home, update your address with the IRS by filing Form 8822, Change of Address. That is especially important if you expect correspondence from the IRS, such as a tax refund in the mail.