Raising kids or caring for a dependent isn’t cheap — especially when you’re juggling work or school on top of parenting. But if you pay for childcare so you can work or look for work, you might qualify for a tax credit. The Child and Dependent Care Tax Credit (CDCC) is a federal tax break designed to help ease the cost of care for eligible dependents.

This guide breaks down everything you need to know about the daycare tax credit, including eligibility criteria, qualifying expenses, how to calculate your credit amount, and how to claim the credit on your federal income tax return.

Note: The One Big Beautiful Bill (OBBB) is now also being referred to by lawmakers as the Working Families Tax Cut Act. You may see one or both names used here, but they refer to the same set of tax changes.

At a glance:

- The CDCC, also sometimes called the child care tax credit or daycare tax credit, helps working families offset the cost of childcare and other dependent care expenses.

- For 2025, the credit is worth 20% to 35% of your qualifying expenses, up to a maximum of $3,000 for one dependent or $6,000 for two or more dependents.

- Starting in 2026, the OBBB increases the maximum percentage to 50% (with expanded phaseouts for higher-income families), though the maximum expense limits remain the same.

- Qualified expenses may include daycare expenses, day camps, babysitters, and more.

- To claim the credit, you must have earned income and pay for care so you can work or look for work.

What is the Child and Dependent Care Tax Credit?

The Child and Dependent Care Credit is a nonrefundable tax credit that helps offset child care expenses (or the cost of caring for another qualifying individual) while you work or actively look for work. It’s designed to support working families, whether you’re paying for a daycare center, babysitter, childcare provider, or even someone providing care for a disabled spouse or aging parent.

The Child and Dependent Care Credit is not a tax deduction (which reduces your taxable income). It’s a tax credit, which directly reduces your tax liability and lowers the total amount of federal income tax you owe.

Who qualifies for the dependent care credit?

To qualify for the dependent care credit, you must meet the following eligibility rules:

- You (and your spouse, if filing jointly) must have earned income during the tax year.

- You must have paid the child care expenses so you could work or look for work.

- The care must have been provided for a qualifying person (see below).

- The amount you can claim depends on your adjusted gross income, or AGI (more on this later).

If you’re married filing separately, you generally cannot claim this tax credit unless you meet specific IRS exceptions for couples who are legally separated or living apart from their spouse.

Who is considered a qualifying person for the child care tax credit?

To meet the eligibility requirements for the Child and Dependent Care Credit, the person receiving care must be one of the following:

- A qualifying child (who was under age 13 at the time of care) who lived with you for more than half the tax year.

- A spouse who lived with you for at least half the year and is physically or mentally unable to care for themselves.

- Another dependent (like a parent or relative) who lived with you for more than half the year and is unable to care for themselves.

If the person isn’t your dependent due to certain exceptions (e.g., they earned more than $5,050 in 2024, more than $5,200 in 2025, or filed a joint return), you might still qualify.

The IRS lays out all the details and definitions under Who Is a Qualifying Person? in Publication 503, including some nuances for children of divorced parents and how to determine the custodial parent.

Is there an income limit for the child care tax credit?

Yes, the percentage of qualifying expenses you can claim is based on your adjusted gross income (AGI). For 2025, the credit is worth up to 20% to 35% of qualifying expenses. But starting in 2026, the One Big Beautiful Bill (OBBB) raises the maximum percentage from 35% to 50% and expands the phaseout ranges.

We’ve included tables below so you can compare the limits for tax year 2025 and the new rules that begin in 2026.

Tax year 2024 and 2025 limits:

| AGI range | Percentage of qualifying expenses |

| $15,000 or less | 35% (maximum allowed) |

| $15,001 to $43,000 | Begins to gradually decrease |

| Over $43,000 | 20% (minimum allowed) |

Tax year 2026 limits:

| AGI range | Percentage of qualifying expenses |

| $15,000 or less | 50% (maximum allowed) |

| $15,001 to $75,000 | Gradually decreases from 50% down to 35% |

| $75,001 to $150,000 (joint) | Gradually decreases from 35% down to 20% |

| Over $75,000 (single) | |

| Over $150,000 (joint and single) | 20% (minimum allowed) |

These limits mean higher-income families will still qualify to claim the credit, just for a smaller percentage of their care costs.

What daycare expenses are tax-deductible?

Technically, you can’t “deduct” daycare costs, but you may be able to claim them under the Child and Dependent Care Tax Credit. Here’s a breakdown of qualifying expenses.

Examples of eligible child care expenses:

- Daycare expenses (including daycare centers and in-home daycare)

- Fees paid to a babysitter

- Preschool or nursery school (before kindergarten)

- Before- and after-school programs

- Day camps or summer camps (overnight camps don’t count)

- Household services paid to someone like a cook or housekeeper who also provides dependent care

- Care payments made to a relative who is not your dependent

Remember, the above are only considered qualifying expenses if you paid for the child care so you could either work or look for work. In other words, costs paid to a babysitter to watch your child while you go out for the evening aren’t an eligible expense. But paying a babysitter to watch your toddler while you’re at work would be a qualified expense.

Examples of non-eligible expenses:

- Kindergarten and up (education is not a qualified expense)

- Overnight camps

- Summer school or tutoring

- Child support payments

- Payments made to your spouse or the parent of the qualifying person

- Payments made to your own child under age 19 or another dependent

How much is the Child and Dependent Care Tax Credit worth?

If you and the person receiving care meet all eligibility requirements, you can claim up to:

- $3,000 in expenses for one qualifying dependent

- $6,000 for two or more qualifying dependents

Depending on your adjusted gross income, you’ll get back between 20% and 35% of those costs in 2025.

Examples of how to calculate the child care credit in 2025

Low income (< $15,000 AGI)

Let’s say you’re a single parent who spent $4,000 on childcare for your 2-year-old. Your AGI for the year is $14,000. Based on the 2025 income limits, you’re eligible for the maximum 35% credit.

35% of $3,000 (the max for one dependent) = $1,050 maximum credit

Now, let’s say you had two kids and spent $7,000 on daycare; the maximum amount you can claim for two dependents is $6,000. If your AGI still qualifies you for a 35% credit, that’s a maximum tax credit of $2,100.

High income (> $150,000 AGI)

Suppose you’re married filing jointly with an AGI of $160,000, and you paid $12,000 for childcare for two kids. Because your AGI is above the phaseout threshold, your percentage drops to 20% (the minimum allowed).

20% of $6,000 (the max for two dependents) = $1,200 credit

How employer-provided benefits affect the CDCC

If your employer offers dependent care benefits, these can count toward the total amount of child and dependent care expenses you report to the Internal Revenue Service.

What are dependent care benefits?

- Money your employer pays directly to you or your childcare provider for care while you work

- The fair market value of care provided through an employer-sponsored daycare facility

- Pre-tax contributions you make to a dependent care flexible spending account (FSA)

If you receive any dependent care benefits, you may be able to exclude these benefits from your income when calculating the CDCC.

How much can you exclude from income with dependent care benefits?

There’s a cap on how much dependent care benefits you can exclude from your taxable income. The amount you can exclude depends on a few different factors, but essentially, you’re limited to the smallest of the following:

- The total dependent care benefits you received during the tax year

- The total amount of qualified expenses you paid for care

- Your earned income

- Your spouse’s earned income (if you’re married)

- The maximum allowed by your employer’s dependent care plan

For 2025, that maximum is still $5,000 if you’re single or married filing jointly, or $2,500 if you’re married filing separately.

Starting in 2026 (due to changes under the OBBB), the maximum will increase to $7,500 if you’re single or married filing jointly, or $3,750 if you’re married filing separately.

Tax Tip: You should receive a Form W-2 from your employer showing the total amount of dependent care benefits paid to you in box 10.

How does a dependent care FSA affect the child care tax credit?

If you participate in a dependent care FSA through your employer, you’ll need to reduce the expenses you claim for the dependent care credit by the pre-tax money you paid through your FSA.

For example, let’s say you contributed $5,000 to your FSA during the tax year. You have two qualifying dependents and an AGI of $45,000, meaning you can claim 35% of up to $6,000 in expenses (using the ranges for 2025).

Here’s the math:

$6,000 total max CDCC for two or more dependents – $5,000 FSA contributions = $1,000 limit

So, in this case, you can only claim up to $1,000 in additional expenses for two or more dependents.

$1,000 limit × 35% (your allowed percentage based on your AGI) = $350 tax credit

For more information on this topic, check out the section on Dependent Care Benefits in IRS Publication 503.

How to claim the dependent care tax credit

To claim the Child and Dependent Care Tax Credit, you’ll need to file IRS Form 2441. You’ll then transfer the final credit amount to Schedule 3, line 2 on your Form 1040.

To calculate the credit, you need the following information:

- Your care provider’s name, address, and taxpayer identification number — usually a Social Security number for an individual or an employer identification number (EIN) for a company or organization.

- A list of the qualifying persons receiving care.

- The care expenses you paid during the tax year.

If you’re using TaxAct®, our tax software will help you complete the forms automatically based on your answers to our interview questions. We’ll then calculate your tax credit for you.

To complete Form 2441 in TaxAct, follow these steps.

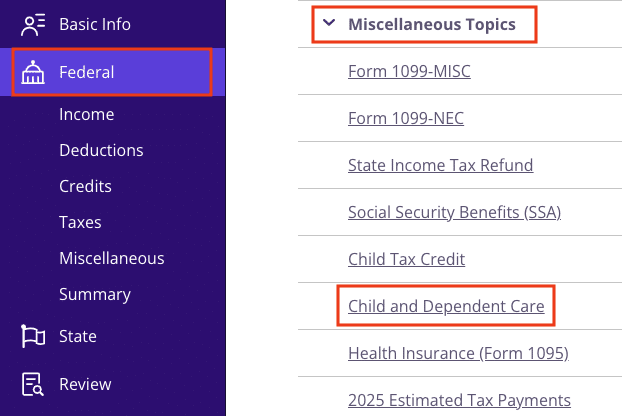

- In your TaxAct return, click Federal in the left sidebar menu.

- Scroll down. Under Miscellaneous Topics, click Child and Dependent Care as shown below.

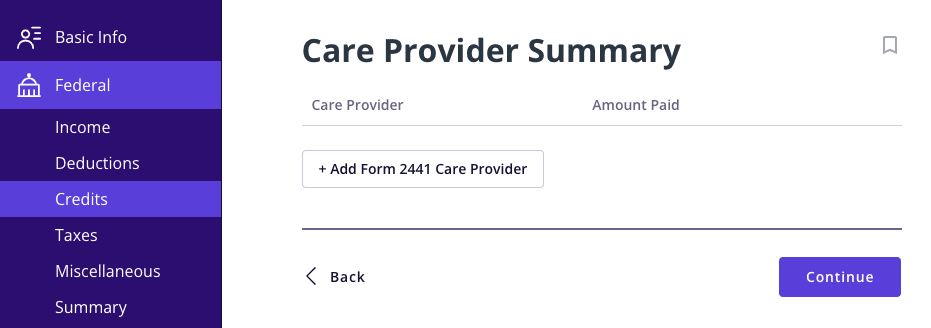

- Click + Add Form 2441 Care Provider to create a new copy of the form as shown below or click Edit to edit or update an existing form.

- Continue with the interview process to enter the provider information and answer any relevant questions.

- When you get to the Care Provider Summary page, click Continue.

- On the How much How much did you spend for each dependent’s care? screen, click Start beside the first dependent’s name to enter how much of the total paid was for that dependent, as shown below.

- If none of the amount paid to a provider was for that dependent, check the Child is a qualified dependent, but did not incur expenses box and click Continue.

- Once you have added amounts or checked the box for each dependent, click Continue to proceed.

- A summary page will display the results of the credit calculation.

- If the credit is not allowed, a reason is shown.

- If the credit is allowed, the amount will be displayed. The credit carries to Form 2441, and Form 1040, Schedule 3, line 2.

FAQs

The bottom line

Paying for childcare or care for a loved one can take a big bite out of your budget — but the Child and Dependent Care Tax Credit can help soften the blow. Figuring out which care expenses qualify and how much you can claim might feel complicated, but we can help. TaxAct makes it easy to claim and calculate the child care tax credit. Just answer a few simple questions, and our tax preparation software will handle the math, tax forms, and everything in between.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.