Updated for tax year 2024.

Knowing your way around IRS Form 1040 can make the tax filing process much easier. This guide will walk you through everything you need to know about Form 1040: what it is, how to complete Form 1040 accurately, and which related tax forms and schedules you might need. Let’s dive right in.

| Form | Description | Due Date |

|---|---|---|

| 1040 | Standard individual tax return for U.S. taxpayers. | April 15 (or next business day if it falls on a weekend/holiday) |

| 1040-SR | Another version of Form 1040 for taxpayers aged 65 and older. | April 15 |

| 1040-ES | Used to file quarterly estimated tax payments for those who are self-employed or taxpayers with untaxed income. | April 15, June 15, Sept 15, Jan 15 (next year) |

| 1040-V | Payment voucher for those filing paper returns and sending tax payments by mail. | April 15 |

| 1040-X | Used to amend a previously filed tax return. | 3 years from original due date (or 2 years after taxes paid, whichever is later) |

| 1040-NR | Used by nonresident aliens to report U.S.-sourced income. | April 15 (or next business day if it falls on a weekend/holiday) |

What is Form 1040?

Form 1040, U.S. Individual Income Tax Return, is the main Internal Revenue Service (IRS) form used to file your federal income tax return. It collects all the details about your income, tax deductions, and tax credits to determine how much you owe or whether you’ll get a tax refund. If you’re a U.S. taxpayer and earned income during the tax year, you likely need to file Form 1040.

Form 1040 also helps determine your filing status (like single, married filing jointly, etc.) and lets you claim dependents, which can reduce your taxable income.

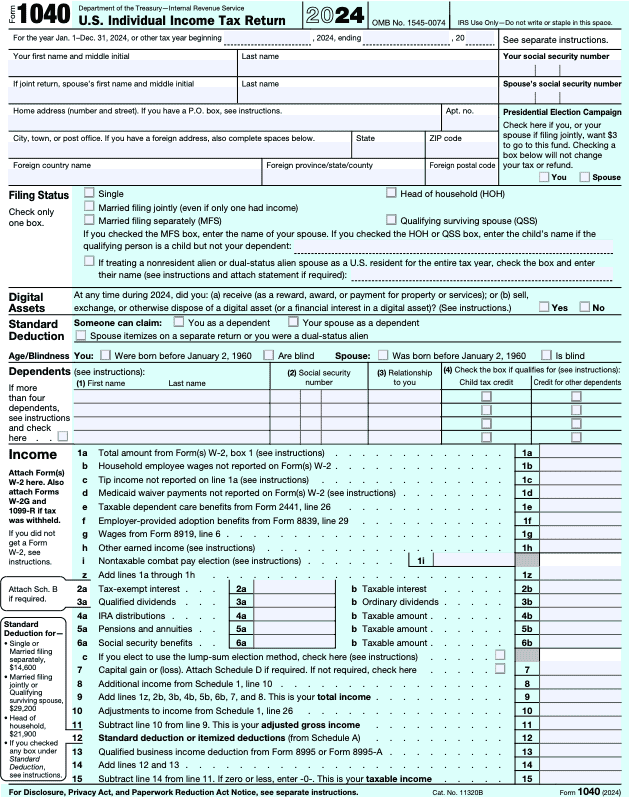

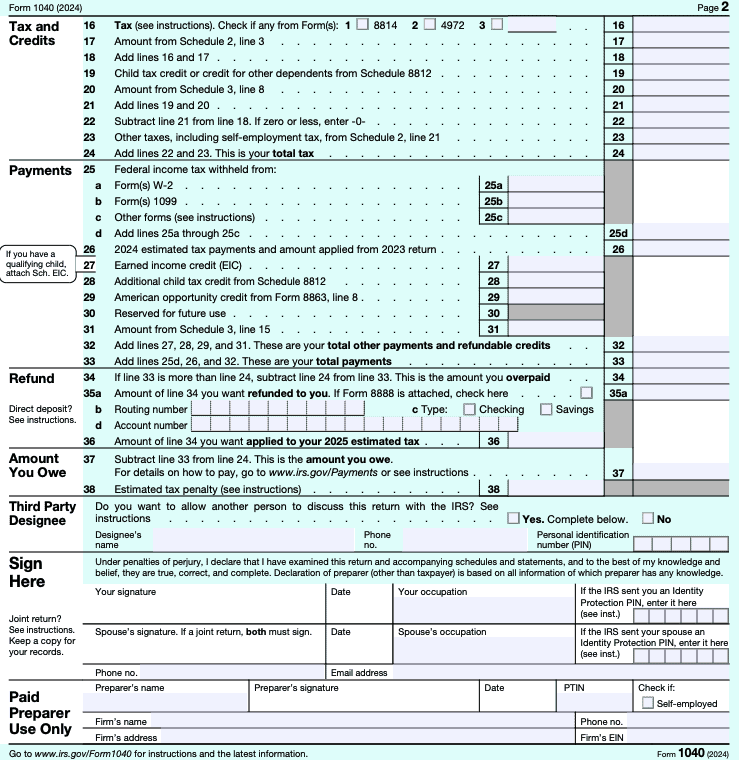

Form 1040 example

Below is an image of Form 1040 so you can see exactly what this IRS tax form looks like. It consists of two pages:

While the form may look complex, it’s essentially asking for a few key details:

- Your personal information: The top section gathers details like your name, Social Security number (SSN) or individual taxpayer identification number (ITIN), and filing status. If you’re married or have qualifying dependents, their information goes here too. You can check boxes for each dependent indicating their eligibility for the Child Tax Credit or the Credit for Other Dependents.

- Income: Here, you’ll report all types of income, including wages, distributions, ordinary dividends, and capital gains, to calculate your total income. You’ll also include tax deductions you want to claim. This is all used to determine your adjusted gross income (AGI) and, by extension, your taxable income (what is subject to income tax).

- Tax and Credits: This part accounts for all the tax credits you qualify to claim, such as the Earned Income Credit or Child Tax Credit. It then calculates your total tax liability for the year (line 24).

- Payments: This section accounts for tax payments you already made, such as withholding from your regular paychecks or estimated tax payments you made. Line 33 shows your total tax payments for the year.

- Refund or Amount You Owe: The final sections will tell you if you’re getting a tax refund or need to make an additional tax payment. If line 33 is greater than line 24, you’ll be refunded the difference. If line 24 is greater than line 33, you owe the IRS the difference.

Overview of key schedules for Form 1040

Sometimes, Form 1040 is just the start. Depending on your situation, you may need to file additional schedules along with it to fully report your income or credits, such as:

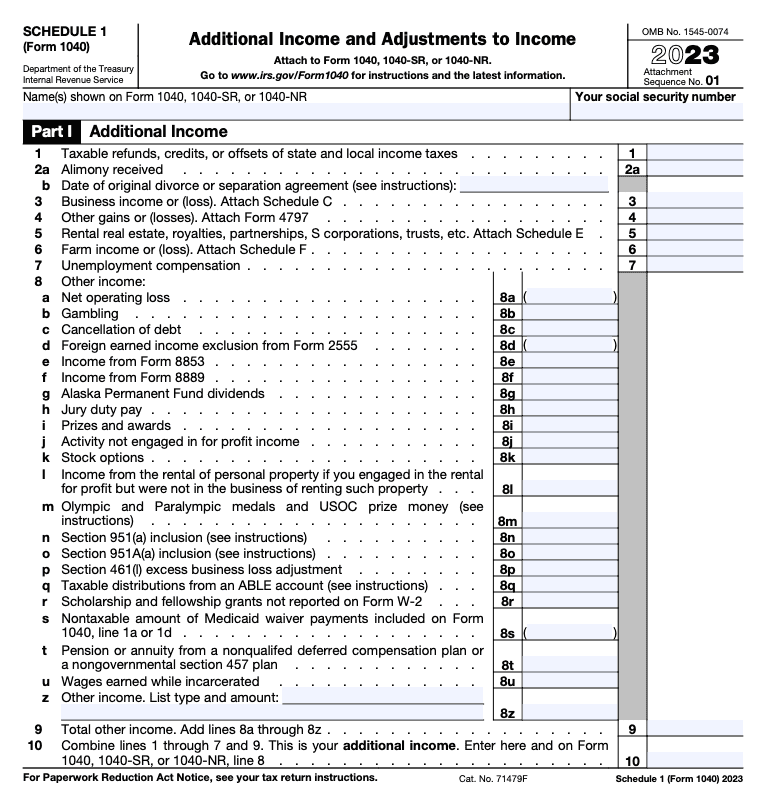

Schedule 1: Additional Income and Adjustments to Income

Page 1 of Schedule 1 reports additional income and looks like this:

Some reasons for filing Schedule 1 include having any of the following income types during the tax year:

- Unemployment compensation

- Alimony

- Business income or loss (you may also need Schedule C, Profit or Loss From Business)

- Rental income or loss (you may also need Schedule E, Supplemental Income and Loss)

- Farm income

- Gambling winnings

- Canceled debts

- Prizes and awards

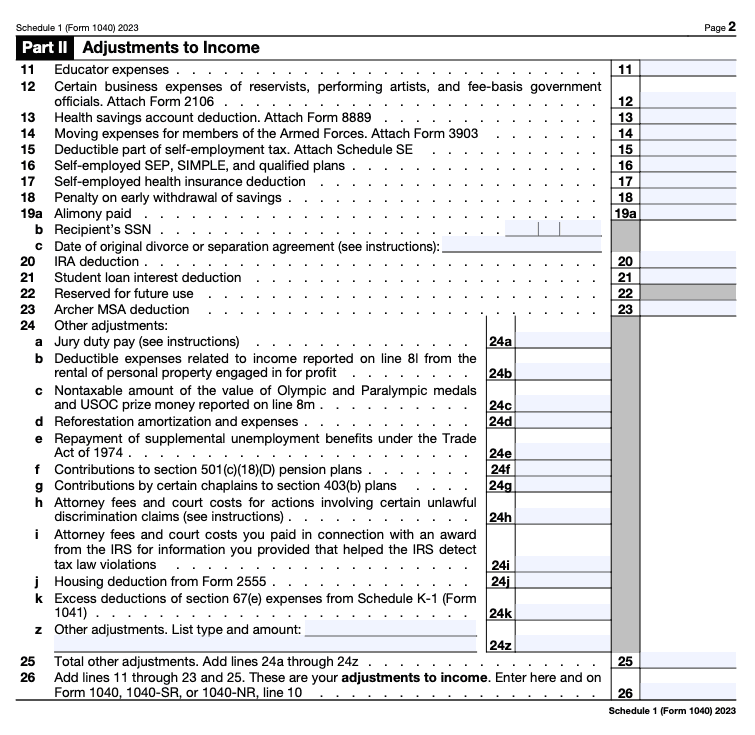

Page 2 of Schedule 1 covers adjustments to income and looks like this:

Here, you can report income adjustments like the following:

- Student loan interest deduction

- Deductible educator expenses

- Deductions for retirement contributions

- Health savings account (HSA) deductions

- Self-employment health insurance deduction

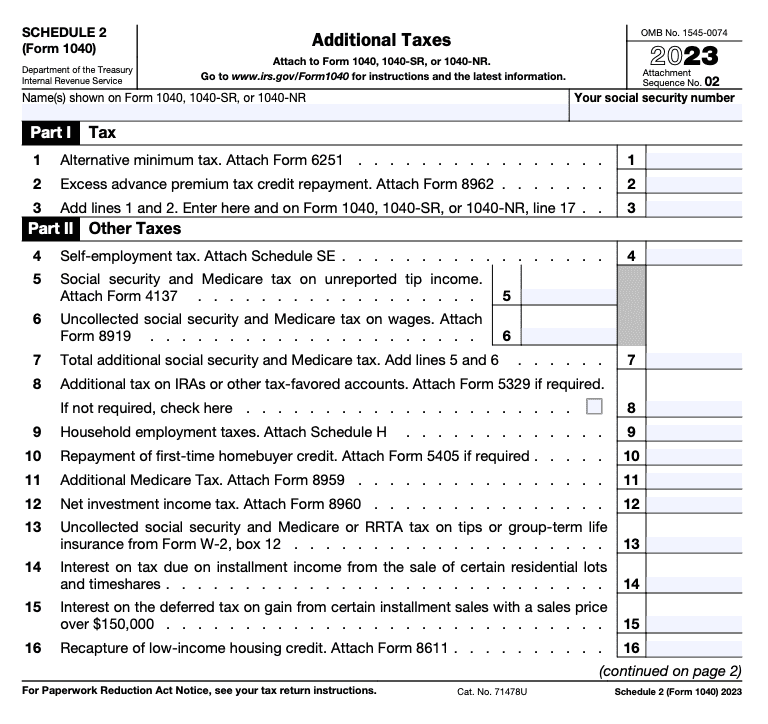

Schedule 2: Additional Taxes

Schedule 2 reports additional taxes and looks like this:

Some reasons for filing Schedule 2 include having any of the following during the tax year:

- Alternative minimum tax (AMT)

- Excess advance premium tax credit repayment

- Self-employment tax

- Additional Social Security and Medicare tax

- Additional taxes on IRAs and other tax-favored accounts

- Household employment taxes (you may also need Schedule H, Household Employment Taxes)

- Repayment of first-time home buyer credit

- Recapture of low-income housing credit

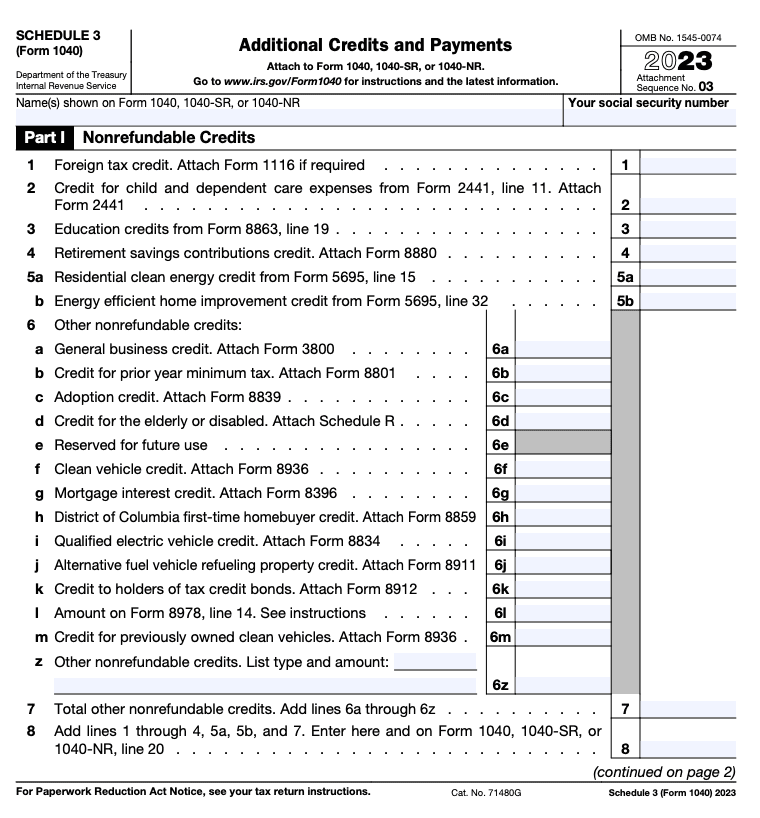

Schedule 3: Additional Credits and Payments

Schedule 3 reports additional tax credits and payments. Here’s what it looks like:

Use Schedule 3 to claim nonrefundable credits like:

- Foreign tax credit

- Child and dependent care expenses

- Education credits (such as the American Opportunity Credit or Lifetime Learning Credit)

- Adoption credit

- Residential energy credits

- Clean vehicle credit

- Mortgage interest credit

- General business credit

- Credit for the elderly or disabled

Form 1040 instructions

Filling out Form 1040 and its schedules isn’t as complicated as it may seem, especially if you use tax software like TaxAct®. We walk you through the filing process, filling out Form 1040 and any accompanying schedules for you based on the information you give us.

Here’s how to get started:

- Gather documents: Before filing, collect all necessary tax documents like your W-2s, 1099s, and any statements for IRAs, pensions, or other retirement plans. You’ll also need any information about tax deductions and additional forms related to your tax situation. Use our Form 1040 tax preparation checklist to help you with this!

- Fill out your personal information: Start with your name, address, and SSN. Don’t forget your filing status and dependent information.

- Report your income: Report all types of income. This could include wages, self-employment tax, unemployment compensation, or Social Security benefits. If you have additional income or adjustments, you’ll also use Schedule 1 (more on schedules in the next section).

- Claim tax deductions and credits: Claim any tax deductions and credits that apply to you. When you file with us at TaxAct, we ask you questions to determine which deductions and credits may apply to your situation and might help you save on your tax bill. Our software can also help you choose between the standard deduction or itemized deductions (using Schedule A).

- Pay your bill or get a refund: TaxAct will calculate your total tax liability based on all the information you provided. We’ll help you fill out your direct deposit information if you qualify for a tax refund. If you owe a tax bill, we can help you pay it or even set up a payment plan if necessary.

Other types of 1040 tax forms

There are multiple versions of the 1040 form, each designed to address specific taxpayer situations. Here’s a deeper look at some of these and how they differ from the standard Form 1040:

1040-SR

This form is designed for older taxpayers, specifically those aged 65 and above. It features a larger print and a simpler layout to make it more accessible for seniors. Form 1040-SR includes the same sections as the regular Form 1040, but the formatting is adjusted to be more user-friendly, particularly for those who may have difficulty reading smaller text. It also includes a table showing the larger standard deduction amounts available to taxpayers over 65.

1040-ES

This form is used to make estimated tax payments throughout the year, typically by individuals with income not subject to withholding, such as self-employment income, rental income, or investment income. Unlike the regular Form 1040, which is filed annually, Form 1040-ES involves making quarterly payments to ensure you stay current with your tax liability and avoid underpayment penalties. This form helps you calculate and pay your estimated taxes on time.

Tax Tip: If you e-file your tax return with us, TaxAct can help you set up automatic estimated tax payments via Electronic Funds Withdraw.

1040-V

The 1040-V form is a payment voucher used when you owe taxes and submit a check or money order to the IRS by mail. It differs from Form 1040 in that it is not a tax return but a way to accompany your payment when filing a paper return. Using Form 1040-V helps ensure that your payment is correctly applied to your tax account.

1040-X

This form is called an amended tax return. If you realize you’ve made a mistake on your Form 1040 or need to make changes, such as correcting your income, deductions, or credits, Form 1040-X allows you to do that. Unlike the regular Form 1040, which is filed for the current tax year, Form 1040-X is used to adjust information from a prior year, typically within a three-year window from the original due date.

1040-NR

Form 1040-NR is used specifically by nonresident aliens who are not U.S. residents but have U.S.-sourced income, such as wages or investment returns. You may also need to use this form if you are a representative of certain trusts or estates or of a deceased person who would have needed to file Form 1040-NR.

FAQs about Form 1040

What documents do I need to fill out Form 1040?

You’ll need income documents like W-2s, 1099s, or IRA statements, plus proof of tax payments, deductions, credits, or other income from interest or dividends. If applicable, you’ll also need SSNs for you, your spouse, and your dependents. A copy of the prior year’s tax return is also good to have on hand.

Not sure if you have everything you need? Use our tax preparation checklist to check off documents for you, your spouse, and your dependents before filing.

What is the standard deduction for Form 1040?

The standard deduction changes yearly and depends on your filing status. For 2024, it’s $14,600 for single filers and those married filing separately, $21,900 for heads of household, and $29,200 for married couples filing jointly and surviving spouses.

Who should use Form 1040-SR?

Form 1040-SR is for taxpayers aged 65 and older who want a more straightforward form that’s easier to read and understand.

What’s the difference between Form 1040, 1040-A, and 1040-EZ?

Form 1040-A and Form 1040-EZ were simplified versions of Form 1040, but they are no longer in use as of 2018. Here’s how they used to work:

- Form 1040-A: This was a shorter version of Form 1040, available to taxpayers with straightforward tax situations. You could use it if you didn’t itemize deductions and only had income from wages, interest, dividends, pensions, or certain other sources. It allowed some adjustments and credits but was more limited than the standard Form 1040.

- Form 1040-EZ: This was the simplest version, designed for individuals with very basic tax situations. It was available for single or married filers with no dependents, taxable income below $100,000, and no adjustments or itemized deductions. You couldn’t use it if you had income from self-employment or investments beyond simple interest.

How to file Form 1040 with TaxAct

TaxAct makes tax filing easy. Here’s how to get started:

- Sign up or log in: Head to TaxAct.com and create an account.

- Enter information: Follow the guided prompts to input your personal and income information. If you filed with us last year, we’ll pull information from last year’s return to save you even more time.

- Review and file: TaxAct will double-check your return for errors and guide you through the e-file process. We’ll submit everything to the IRS for you when you’re done.

The bottom line

Form 1040 is often seen as the most important tax form but completing it doesn’t have to be stressful. With the right documents plus some guidance and assistance from TaxAct, you can complete Form 1040 with confidence and be well on your way to spending your tax refund in no time.