Investment Spending: How to Spend Tax Refunds and Unexpected Checks

File your taxes with confidence.

Your max tax refund is guaranteed.

The biggest question most Americans have when they get their income tax refund is: where do I spend it?

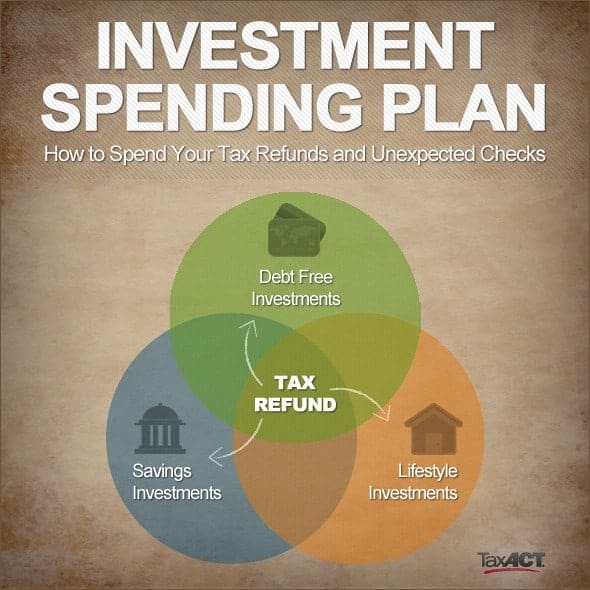

I believe that you can make a wise choice on how to use your tax refund that will have lasting benefits by learning the “Investment Spending Plan” method.

I developed the Investment Spending Plan when my husband and I were first married and we would occasionally get an unexpected check in the mail. Whether it was a birthday check from my grandma or an insurance refund check, our first thought was to make sure we spend it on something that can be considered an investment purchase, rather than just blowing it.

When it comes to your tax refund, I offer the same advice: invest your spending through a strategic spending plan.

What is investment spending?

Investment spending is not investing in gold bullion or buying rental property.

Mainstream Americans usually cannot venture into those kinds of investments on a regular basis because you should be free of consumer debt before entering those markets.

I’m talking about the kind of investment spending that average Americans can afford to make that will help them in the long run financially.

The items acquired are not necessarily appreciating assets, but they are purchases that will help them pay off consumer debt, build savings, provide for their family’s needs and have the added value of investment into family time and relationships.

I divide my Investment Spending Plan into three basic categories:

- Debt Free Investments

- Savings Investments

- Lifestyle Investments

Debt Free Investments

When you get a refund check, unexpected insurance refund, a performance bonus from work, a small inheritance, or if you are military—special duty pay, it’s important to consider purchases that will help your overall financial picture.

Debt free investment spending is the use of these funds to pay off some of your consumer debt.

If you can pay off one of your credit card balances, then the amount you would normally send toward that card could now be redirected to the next credit card you want to pay off—thereby doubling (or tripling) up on your monthly minimum balances.

A snowball effect takes place and the ability to reduce consumer debt gains momentum with the eventual goal of becoming completely free from credit card debt.

The same principle applies toward paying down student loan debt or paying off a car loan early.

This “snowball effect” is one of the ways our family paid off 40K in consumer debt in only 2.5 years on one military man’s income.

A second kind of debt free investment spending involves putting the money toward the purchase of an item that you may normally buy on a credit card.

For example, if you have a student going away to college, they will need a laptop computer.

Or you may have a new baby and really want to invest in a digital video camera—something you might normally put on a credit card.

Other items that fall into this category are tires that will need to be replaced within the next six to twelve months—use the unexpected funds for these necessary items and you will keep from accruing further debt and get ahead financially.

Savings Investments

This part of the Investment Spending Plan involves two areas.

The first step is to use some of the refund money to bolster a regular savings account.

Every family should have 6 to 12 months worth of living expenses in a savings account they can access easily. Share this advice!

This is a good opportunity to build up that account.

The second aspect of this kind of investment spending involves items that you have saved to purchase and the money for them is already in your regular savings account.

For example, you need a new refrigerator, stove, or a washer and dryer because you are moving to a new house that does not include these.

Or, your old appliances are wearing out and require frequent service calls to stay functional.

Another example is when you are saving for your annual property taxes and this money is also in the savings account.

When you get a refund check, instead of taking the money out of savings, keep it in your savings account where these funds can grow and use the refund check to pay for these items.

Some people set aside money into savings for new bikes for the kids, baby items for a new child in the family, or even a family vacation.

Pay cash instead and don’t deplete the savings account!

Lifestyle Investments

The final category is a moderate to major purchase that the family is willing to buy in order to bring a quality of life to your entertainment or recreation lifestyle.

For example, buying nice patio furniture or swing sets is a lifestyle investment because you are providing meaningful ways for your family and friends to have fun in your backyard.

I remember when we bought a quality play set when our kids were little. Even though the initial investment was a bit of a stretch for our budget, we were able to get more than our money’s worth in terms of the number of hours our kids spent playing outside.

Not only did the purchase keep our children active and healthy, but my sanity also benefited from the investment as the kids worked off their energy close to home.

Other examples in this category include big screen televisions for the family who makes the decision to invest their entertainment dollars at home instead of paying $60 for a family of four to go to the movies and have popcorn.

These families choose to make a lifestyle choice by switching the temporary enjoyment of a movie theater for the more permanent investment of an in home entertainment system.

No matter how you choose to handle your windfall, keep in mind that you can develop a strategic Investment Spending Plan in order to use this money wisely.

I’ve never regretted paying down our consumer debt, paying cash for our snow tires, buying the play sets when our kids were toddlers, the big-screen television when they became teens, or the laptop computers when they went to college.

When you invest in your family, there are never regrets! Share this!

What will your personalized Investment Spending Plan include?

Photo credit: StockMonkeys.com via photopin cc