When dealing with tax matters, you might need someone else to handle things for you. Whether you’re facing an audit, resolving a tax liability, or just want your CPA to speak with the Internal Revenue Service (IRS) on your behalf, IRS Form 2848 is what you need. Let’s break down this form and how to fill it out so you can complete Form 2848 without any added stress.

At a glance:

- Form 2848 grants a power of attorney for tax matters with the IRS.

- This means a CPA, tax attorney, or enrolled agent can represent you for tax matters of your choosing.

- TaxAct® can help you fill out this tax document, but you must submit Form 2848 via mail or fax to the IRS.

What is IRS Form 2848?

IRS Form 2848, also called the Power of Attorney and Declaration of Representative, is a legal document that allows a taxpayer to authorize another individual to represent them before the IRS. This person — called the designated representative — can discuss your tax issues, access confidential tax information, and act on behalf of the taxpayer (you) regarding specific tax matters.

This form must be filled out and submitted to the IRS via mail or fax, but TaxAct can still help you complete and print the form when you file with us. Once the IRS processes the form, they will assign a CAF number (Centralized Authorization File number) for tracking purposes.

Why is Form 2848 important?

Form 2848 simplifies dealing with complex tax matters by allowing you to designate a trusted representative as your legal authority. Whether you’re navigating an audit, handling business tax issues, or needing expert assistance, this form ensures you have the right support when interacting with the IRS.

This power of attorney authorizes the representative to perform duties such as signing consents, extending the time to assess tax, recording interviews, or executing waivers agreeing to a tax adjustment.

Who should use Form 2848?

You should use Form 2848 if you need to grant someone authority to represent you before the IRS. Some scenarios may include:

- A taxpayer giving an enrolled agent (EA) the ability to respond to IRS notices and represent them in an audit.

- A business owner authorizing their CPA to handle business tax matters.

- A senior citizen allowing a legally qualified family member to manage their tax-related matters.

- A corporate officer granting authority to an attorney to negotiate a tax debt.

- A taxpayer working with a low-income taxpayer clinic to resolve tax disputes.

Form 2848 example

IRS Form 2848 (page 1) looks like this:

When filling out this tax form, you’ll need to provide:

- Taxpayer information: Your name, taxpayer identification number, phone number, and mailing address.

- Representative information: Your representative’s name, preparer tax identification number (PTIN), address, and phone number.

- Specific tax matters you are authorizing: For example, certain tax years and types of tax.

- Signatures: From both the taxpayer (you) and the designated representative.

Common terms explained in plain talk

- Power of attorney (POA): A legal document allowing someone to act on your behalf. In the context of Form 2848, it only applies to specific tax matters.

- CAF number: A unique identifier assigned to representatives by the IRS. This number is used to track their interactions with the IRS.

- Tax matters: The specific tax issues the representative is authorized to handle (e.g., income tax, employment tax).

- Enrolled agent (EA): A licensed tax professional authorized to represent taxpayers before the IRS.

Form 2848 instructions: How to fill out Form 2848

Here’s how to complete Form 2848 step-by-step:

- Fill out your information: Provide your taxpayer name, Social Security number (SSN) or employer identification number (EIN), and mailing address.

- List authorized representative info: Enter the representative’s information, including name, address, phone number, PTIN, and CAF number (if they have one). If the representative does not have a CAF number yet, write “None,” and the IRS will issue them one.

- Note: If the IRS has not assigned a PTIN, but the representative has applied for one, write “applied for” on the line. Unenrolled return preparers must possess a valid PTIN to represent a taxpayer before the IRS.

- Specify acts authorized: Detail the type of tax matters the representative is authorized to handle. For example, the tax form number (e.g., Form 1040, Form 941), tax periods, and specific use for which you grant authority. You can also specify acts not authorized if needed. The representative may list any amount of previous tax years, but can only list up to three future tax years.

- Indicate retention/revocation: Indicate whether this form will revoke previous powers of attorney or if you want prior authorizations to remain active. If the box on line 4 is checked, it will not revoke any prior powers of attorney recorded on the CAF. If it isn’t checked, just make sure you are intentionally revoking prior powers of attorney.

- Sign form: The taxpayer must sign and date the form. The designated representative must also sign Part II, the Declaration of Representative.

Form 2848 FAQs

Can I authorize more than one representative?

Yes, you can appoint multiple representatives, but they will each need their own CAF number. If you want to name more than four representatives, write “See attached for additional representatives” in the space to the right of Form 2848, line 2 and attach an additional Form 2848.

Who can represent me?

Only individuals may be named as representatives. Your representative must be an eligible individual, such as a certified public accountant (CPA), enrolled agent (EA), tax attorney, or other qualified tax professional. Depending on the specific tax situation, a family member, corporate officer, or even an unenrolled return preparer may be authorized.

How long does the authorization last?

The authorization typically remains in effect until you revoke it, the tax period specified expires, your representative withdraws it, or another representative files a POA for the same taxpayer and time period.

How do I revoke the authorization?

If you need to revoke the authorization, you can submit a new Form 2848 stating that you are revoking all prior authorizations:

- If you have a copy of the executed POA, you need to write “REVOKE” across the top of the first page with a current signature and date.

- If you do not have a copy of the executed POA, you need to send the IRS a statement that:

- states the POA is revoked for a representative, providing their name and address;

- lists the tax year(s) and matters that are being revoked; and

- is signed and dated.

- If you are fully revoking all authority, you can send in a statement that says “revoke all years/periods” instead of listing the specific matters/years.

Does Form 2848 authorize my representative to manage my finances?

No, this tax form only grants authority over tax-related matters you specified. It does not give access to your bank accounts or assets.

Is a Power of Attorney required for all tax matters?

No, you may not need IRS Power of Attorney for simple inquiries. Instead, you may be able to use Form 8821 (Tax Information Authorization).

What’s the difference between Form 2848 and Form 8821?

While both tax forms grant authority to another person, Form 2848 allows your designated representative to act on your behalf in tax matters, including speaking with the IRS and making decisions. Form 8821, on the other hand, only allows someone to access your confidential tax information (but not act on your behalf).

Form 8821 can also allow a corporation, firm, organization, or partnership to inspect or receive your confidential information, whereas POA only grants power to individuals.

What is the Form 2848 mailing address?

The mailing address for Form 2848 depends on where you live and the type of tax matter involved. You can find the correct address on the IRS website under the Where To File Chart in Instructions for Form 2848. Alternatively, you can fax the form to the fax number listed in the form’s instructions.

How to file Form 2848 with TaxAct

If you do your tax filing with TaxAct, you first need to indicate that you want to attach and mail Form 2848 with Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return (when e-filing the income tax return). Here’s how to do this:

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

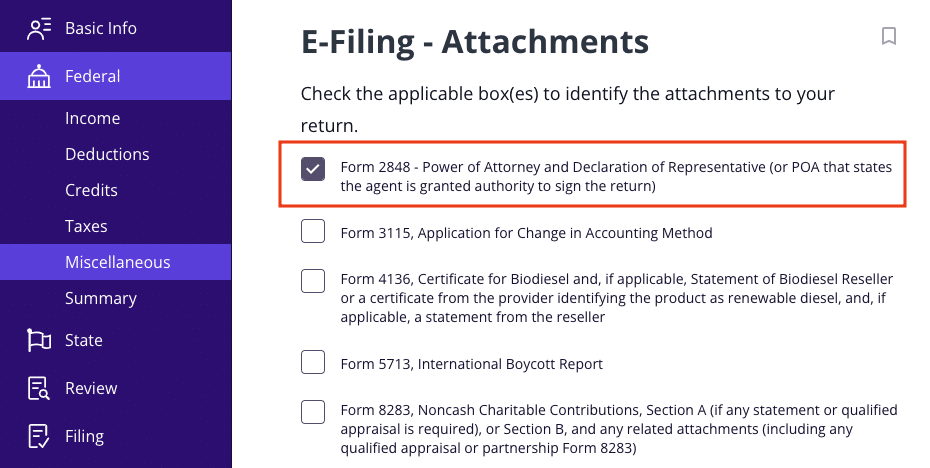

- Click the Miscellaneous Topics dropdown, then click the Additional Information for E-Filing dropdown, then click Attachments for E-Filed Returns as shown below:

- On the screen titled E-Filing – Attachments, click the Checkbox next to Form 2848 – Power of Attorney and Declaration of Representative (or POA that states the agent is granted authority to sign the return) as shown below, then click Continue.

For more information about filling out Form 2848 with TaxAct, check out our Form 2848 support page.

The bottom line

If you need someone to handle your tax-related matters, IRS Form 2848 is the way to go. Whether you’re a business owner, an individual taxpayer dealing with an audit, or just want a tax professional to help with tax preparation, granting power of attorney can make your life easier. Make sure to complete Form 2848 accurately and submit the form properly by mail or fax to avoid delays. And don’t forget — TaxAct can help you complete and print this form when you e-file with us.