If you’ve received a 1099-LTC tax form this tax year, it’s likely because you were paid long-term care benefits or accelerated death benefits, and the Internal Revenue Service (IRS) wants to know about it. While these benefits aren’t always taxable, it’s important to understand what this form means. Let’s break down what’s on the form, what you need to do with it, and how to report it correctly.

At a glance:

- Form 1099-LTC reports payments from long-term care insurance policies and accelerated death benefits.

- Not all the benefits listed on this tax form may be taxable.

What is a 1099-LTC form?

IRS Form 1099-LTC, Long Term Care and Accelerated Death Benefits, is what the IRS calls an information return. If you’ve received this form, you likely got a payout from an insurance company, governmental agency, or viatical settlement provider. These payouts could be from a long-term care (LTC) insurance policy or, in some cases, early payments of a life insurance contract death benefit.

What are LTC benefits and accelerated death benefits?

Long-term care insurance benefits cover medical and personal care expenses for those who become chronically ill. Similarly, insurers may pay accelerated death benefits if you’ve been certified as terminally ill or chronically ill by a licensed healthcare practitioner.

The 1099-LTC form helps the IRS track payments related to long-term care expenses or terminal illnesses. The good news? You may not need to worry about taxes on your total amount of benefits (we’ll get into that a little later).

Form 1099-LTC example

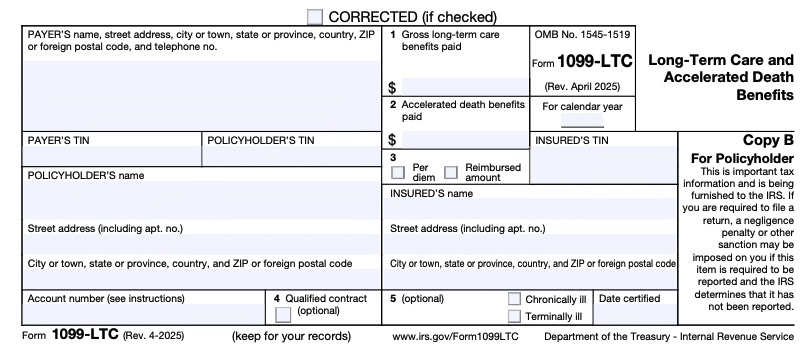

Form 1099-LTC looks like this:

The payer (the insurance company or other institution) sends Copy B to the policyholder who owns the contract and Copy C to the insured (note that you may be both the policyholder and the insured). They will also send a copy of Form 1099-LTC to the IRS.

Here’s a breakdown of what’s included on the 1099-LTC form:

- Box 1: Gross long-term care benefits: This is the total amount you received from your LTC insurance contract.

- Box 2: Accelerated death benefits: If you received an early payout of life insurance due to a terminal illness, the gross amount will be listed here.

- Box 3: Per diem vs. Reimbursed amount: These checked boxes tell the IRS whether the benefit payout was based on actual costs incurred or made on a per diem basis. Per diem indicates you received a regular fixed payment, regardless of your actual incurred costs. This box might not be checked if you are terminally ill.

- Box 4: Qualified contract: This shows whether the benefits were from a qualified LTC insurance contract.

- Box 5: This box shows if the insured was certified as a chronically ill individual or a terminally ill individual and the date certified.

Your 1099-LTC should also contain contact information for the payer, policyholder, or other details related to the payment. You might see:

- The payer’s name, address, and phone number

- The payer’s taxpayer identification number (TIN)

- Your name, contact info, and TIN (your TIN is often your Social Security number)

- The account number of the policy

Instructions for Form 1099-LTC

So, what should you do with your Form 1099-LTC as a taxpayer? Here are some general instructions to follow.

1. Determine if your payments were taxable.

First, it’s important to remember that not all the amounts reported on Form 1099-LTC are automatically taxable. Whether or not you need to report it on your tax return depends on the following factors:

- Was the payment for long-term care? If yes, you might not owe taxes on it, especially if the payments were for qualified LTC services and didn’t exceed the actual costs of care. For per diem benefits, you can exclude a certain amount from your income each day. In 2025, the tax-free daily limit is $420 (increasing to $430 in 2026). However, if you exceed this daily limit, you may have to pay taxes on the excess amount.

- Was the payment for accelerated death benefits? Accelerated death benefits are typically excluded from taxable income if you received them because you were terminally or chronically ill.

2. Fill out Form 8853 if needed.

You’ll need to file Form 8853, Archer MSAs and Long-Term Care Insurance Contracts, to claim an exclusion for accelerated death benefits made on a per diem basis. Don’t worry, though — TaxAct® will walk you through the filing process step by step and pull the proper tax forms for you.

FAQs about Form 1099-LTC

How to File Form 1099-LTC with TaxAct

E-filing your 1099-LTC form with TaxAct is easy to do. Once you gather your documents, log into your TaxAct account and follow these steps:

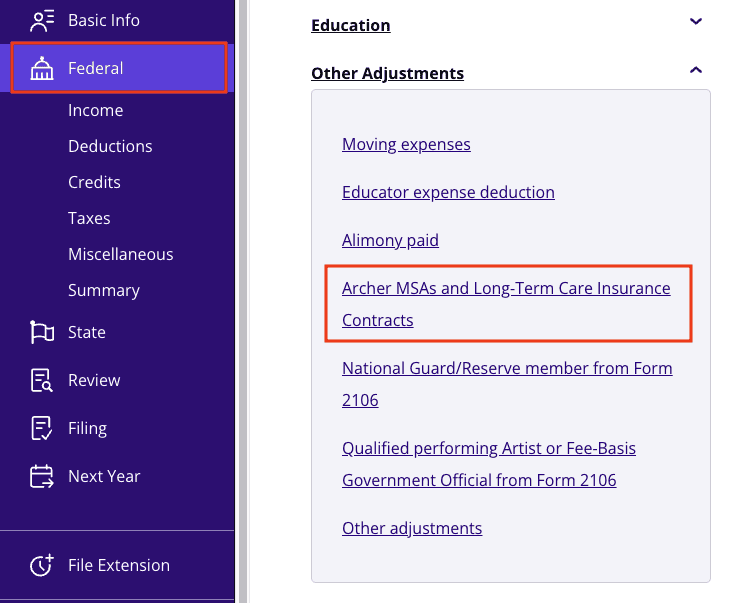

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Other Adjustments dropdown, then click Archer MSAs and Long-Term Care Insurance Contracts as shown below:

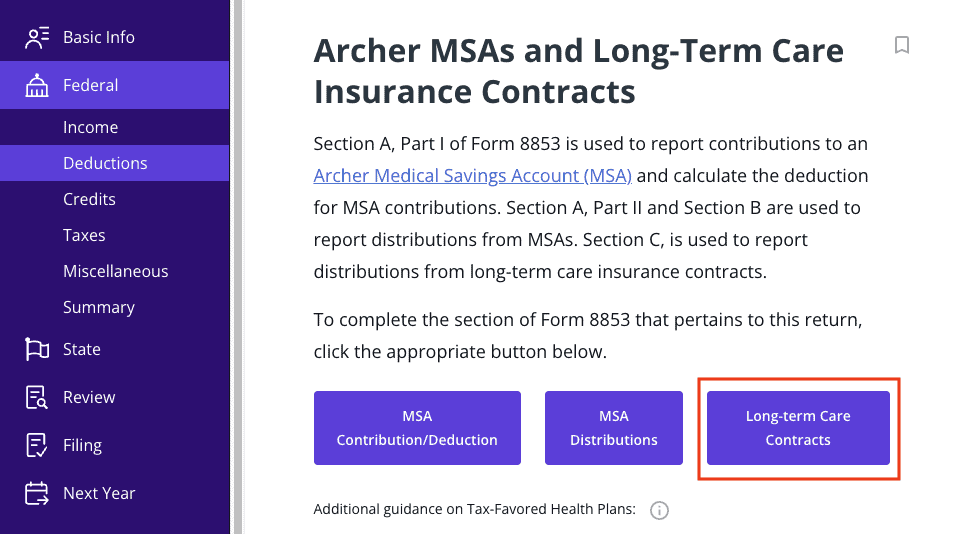

3. Click Long-term Care Contracts as shown below and continue the interview process to enter your information for Section C of Form 8853.

You’ll then be asked to enter information from your Form 1099-LTC one step at a time. For more information on how to report this tax form, head over to our Form 1099-LTC Help Center page.

The bottom line

The 1099-LTC form allows the IRS to track long-term care or accelerated death benefit payments. While some of this money may be taxable, receiving this form does not automatically mean it will impact your tax bill. The key is knowing what to report and when. And with TaxAct in your corner, you’ll have your 1099-LTC and the rest of your tax filing documents conquered in no time.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.