Updated for tax year 2024.

Did you sell any stocks or other investments during the tax year? If so, prepare to receive Form 1099-B. Here’s what you need to know about this important tax document.

At a glance:

- Brokerages send Form 1099-B to taxpayers who sold investments like stocks or bonds. The IRS also gets a copy of this form.

- 1099-B details your capital gains and losses from each transaction, which are reported on Schedule D when you file your taxes.

What is a 1099-B?

The Internal Revenue Service (IRS) requires brokerages and other financial institutions to send out Form 1099-B, Proceeds from Broker and Barter Exchange Transactions, during tax season. You’ll receive this tax form if you sold stocks, bonds, mutual funds, or other investments in your account. Your 1099-B is an informational document that details which securities were sold, as well as your capital gains and losses.

The deadline for brokers to send Form 1099-B is Feb. 15, so you should receive year-end statements from each brokerage or other financial institution by the end of February.

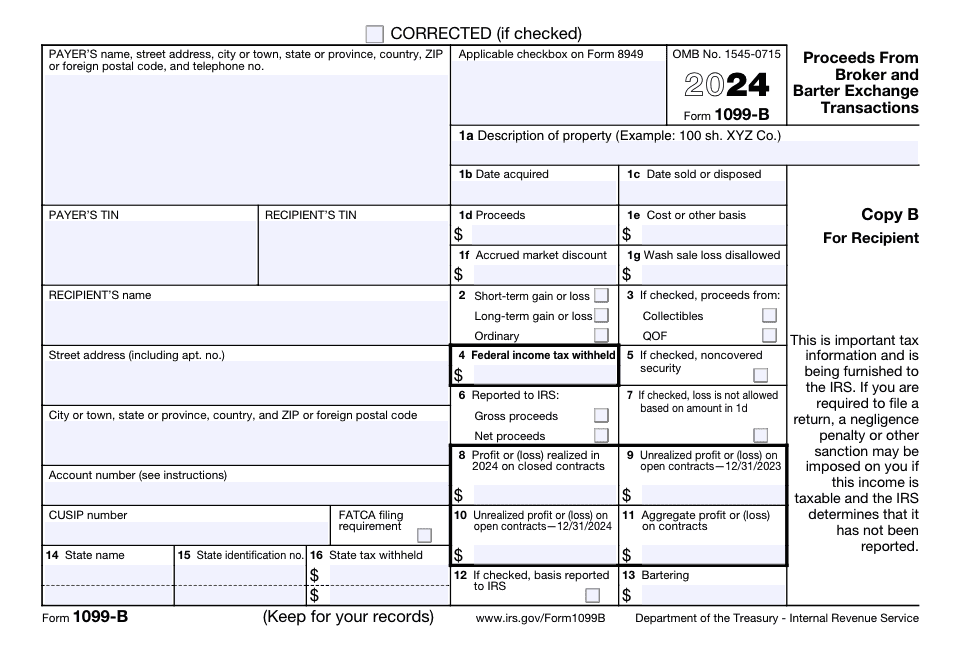

Example of Form 1099-B

Here’s a visual example of Form 1099-B to help you understand the layout and information reported on this tax form:

How to read a 1099-B

Box 1a: Description of property: This is the “what” of your transaction — the name of the stock, bond, or other security you sold.

Box 1b: Date acquired: Here, you’ll see the date you originally acquired the property.

Box 1c: Date sold or disposed: This box shows when you sold your investment.

Box 1d: Proceeds: This box shows the gross proceeds from the sale.

Box 1e: Cost or other basis: This tells you what you originally paid for the property plus any applicable expenses. If it’s blank, you may need to compare it against your own records to determine your basis. Subtract this from your proceeds to figure out the taxable amount.

Box 2: Type of gain or loss: This box helps you understand how your gain will be taxed depending on if it’s a short-term or long-term gain. If “ordinary” is checked, your security might be subject to special rules.

- Box 5: If this box is checked, box 2 might be blank. A “noncovered security” just means the broker is not required to report certain information.

These are the main boxes you need to understand on Form 1099-B. TaxAct® can help walk you through the rest of the form if you e-file with us.

Form 1099-B instructions

If you sold any stocks, options, commodities, or other securities, your 1099-B form will detail your profits and losses from those transactions.

On Form 1099-B, you’ll find:

- A description of each investment sold

- The purchase date and cost basis (generally how much you paid for the investment)

- The sale date and sales price

- Your resulting gain or loss

- If taxes were withheld

The information on Form 1099-B helps you determine your net capital gain or loss for each transaction. Any capital losses can offset your capital gains up to a certain amount. Your purchase and sale dates are important because they determine whether you have a long-term capital gain or a short-term capital gain. Long-term gains have their own tax rates, while short-term gains are simply taxed as ordinary income.

To help you determine your taxable income from capital gains, try out our capital gains tax calculator.

Different types of transactions

Form 1099-B covers various types of transactions, including:

- Sales of stocks

- Sales of bonds

- Redemptions of mutual funds

- Other securities transactions

FAQs about Form 1099-B

Do I need to report Form 1099-B on my taxes?

You don’t need to attach Form 1099-B to your tax return, but you’ll need the information from your 1099-B to accurately report your income and losses during the tax filing process.

Brokers must also send copies of Form 1099-B to the IRS. The IRS cross-checks the information on their 1099-B copy from the brokerage to the amounts you report on your tax return. If any information is missing, you’ll receive a letter with a correction from the IRS.

Why is there other information on my 1099-B?

Sometimes, brokers will consolidate multiple sales into one Form 1099-B. If this is the case, you’ll still need to add each transaction separately in TaxAct. This allows our tax preparation software to report your gains and losses accurately.

You may have also received a consolidated 1099 tax statement that includes other 1099 forms, such as Form 1099-DIV, 1099-INT, 1099-MISC, or 1099-OID. If your tax statement includes multiple 1099s, you’ll need to enter each one separately in our tax software as well.

Does Coinbase® issue a 1099-B?

Yes, Coinbase will issue you a Form 1099-B if you traded Futures via Coinbase Finance Markets. Read more about how to report cryptocurrency on your taxes.

Do I need to adjust my cost basis from Form 1099-B?

Sometimes, your cost basis on Form 1099-B requires an adjustment using a specific code. We have another article that covers a scenario about cost basis adjustment on Form 1099-B in more detail.

How to report Form 1099-B on your tax return with TaxAct®

If you received a 1099-B, you’ll need to file Schedule D with your federal tax return. Schedule D reports your capital gains and losses for the tax year. When you e-file with us at TaxAct, we’ll ask you detailed interview questions about your capital gains and losses to help you accurately report the transactions from your 1099-B on Schedule D.

Where do you report 1099-B?

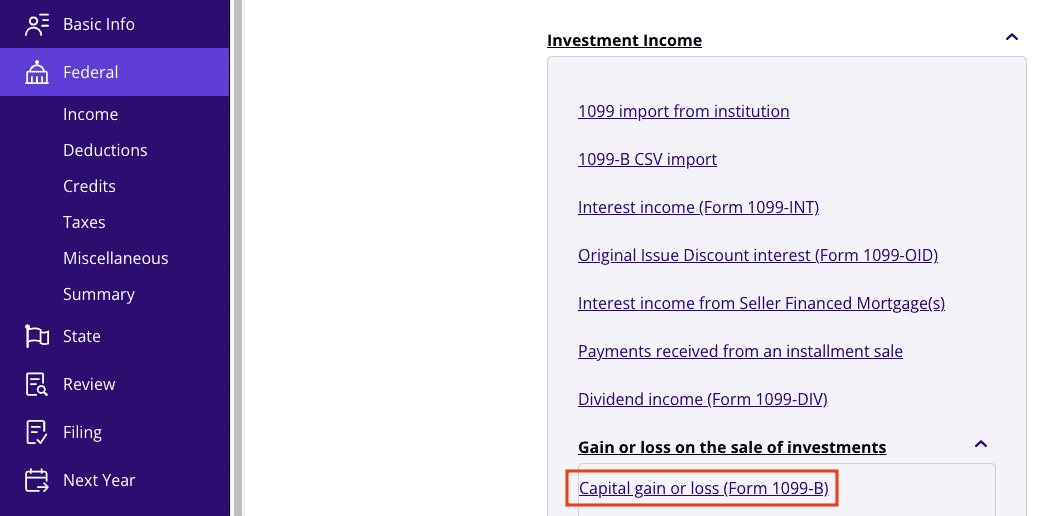

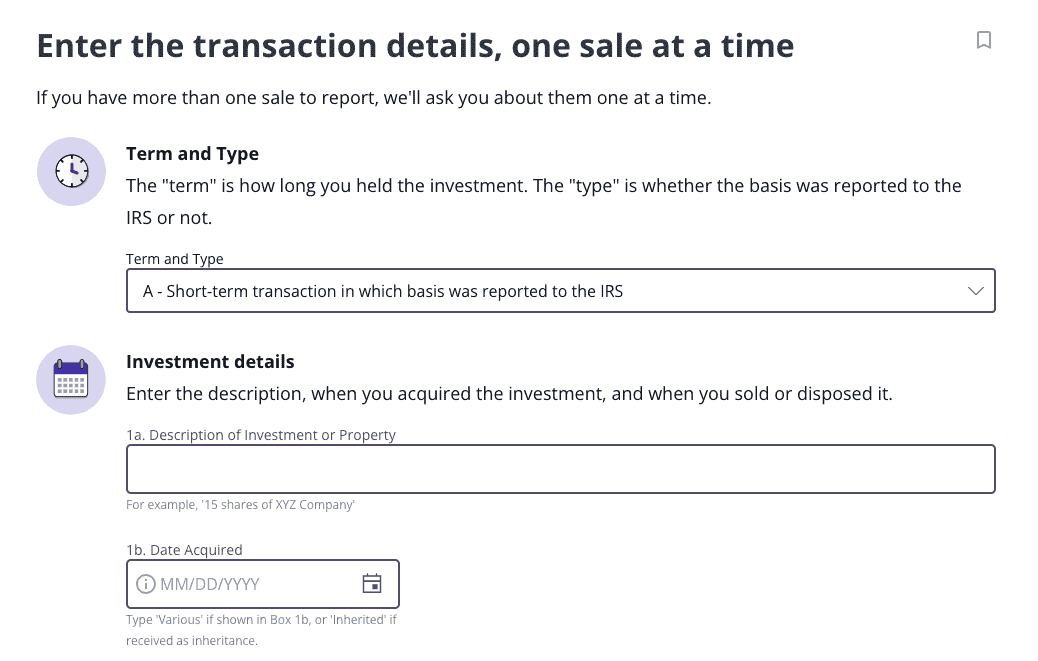

To enter your Form 1099-B information in TaxAct, follow these steps and reference our TaxAct product screenshots if needed:

1. From within your TaxAct return, click Federal (on smaller devices, click in the top left corner of your screen, then click Federal).

2. Click the Investment Income dropdown menu, then select Gain or loss on the sale of investments, then Capital gain or loss (Form 1099-B).

3. Click + Add Another Sale to create a new copy of the form or click Edit to edit an already-created form (for our desktop program: click Review instead of Edit).

4. Continue with the interview process by entering your transaction details.

Noncovered securities

If you have received a Form 1099-B with box 5 checked, do the following when e-filing with TaxAct:

- From within your Form 1099-B, continue with the interview process until you reach the screen titled Investment Sales – Category.

- Click the Form 8949 category drop-down, and click “B-Short-term transaction in which basis was NOT reported to the IRS” or “E-Long-term transaction in which basis was NOT reported to the IRS”

The bottom line

Form 1099-B provides detailed information on your capital gains and losses, which are essential for completing your tax return. Take the stress out of reporting your 1099-B gains and losses by using a tool like TaxAct, which can help you input your transactions step by step. Managing your 1099-B properly not only keeps you in the IRS’s good books but also helps you make the most of any potential tax benefits from your investments. For more information about Form 1099-B, head on over the the IRS website.