Tax documents can be confusing, and Form 1099-C, Cancellation of Debt, is no exception. Let’s explore what Form 1099-C is, why you might receive it, what information it contains, and how to use it when filing your income tax return.

At a glance:

- You may get Form 1099-C from a lender when they cancel or forgive a debt of at least $600.

- In most cases, canceled debt counts as income, and you must pay taxes on the forgiven amount.

What is Form 1099-C, and why did I get one?

Form 1099-C, Cancellation of Debt, is a tax form that reports canceled or forgiven debt to the Internal Revenue Service (IRS). When a lender forgives a debt totaling $600 or more, they must send a copy of Form 1099-C to you and the IRS. This form helps ensure you report your canceled debt as income when filing your taxes.

The IRS generally considers canceled debt taxable income, meaning you’ll need to report it as such on your tax return. Because canceled debt is often taxable, it can affect your tax refund amount.

Scenarios that may result in Form 1099-C

Receiving Form 1099-C means that you’ve had at least $600 of debt forgiven or canceled by a creditor. Some common scenarios could include:

- Credit card debt forgiveness: Credit card companies may forgive a portion of your debt if you negotiate a settlement or participate in a debt relief program.

- Mortgage debt forgiveness: If you are a homeowner facing financial hardship, you may have mortgage debt forgiven through processes like short sales, foreclosures, or loan modifications on your principal residence.

- Student loan forgiveness: As a student loan borrower, you may qualify for loan forgiveness under certain circumstances.

- Car loans or personal loans: Loans from banks or financial institutions, such as car loans, that are forgiven or settled for less than the full amount owed may result in a 1099-C. This includes any instances of repossession or return of property to the lender.

Note: The American Rescue Plan temporarily made all student loan forgiveness from 2021 through 2025 tax-free. This means you shouldn’t receive Form 1099-C for any student loan debt discharged within these five years.

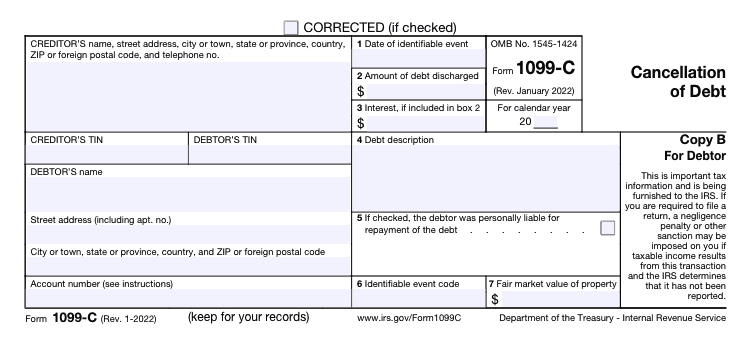

Example of Form 1099-C

Here is an example of what Form 1099-C looks like and the information that’s included on the tax form:

Form 1099-C instructions

Information reported on IRS Form 1099-C

Form 1099-C is fairly easy to read. It contains basic information about your canceled debt that you will need for tax reporting purposes. The key details include:

- Taxpayer information: Your name, address, and taxpayer identification number (usually your Social Security number).

- Creditor information: The name, address, and taxpayer identification number of the financial institution forgiving the debt.

- Canceled debt information: In box 2, you’ll see the total amount of debt forgiven or canceled by the creditor, as well as any interest. The form will also include when the debt was forgiven and whether you were personally liable for repayment.

- Identifying codes: In box 6, you may see a code, such as A, B, or C, indicating the reason for the debt cancellation. For example, Code A represents bankruptcy, Code B is for insolvency, and Code G means there was a decision or policy to discontinue collection, such as some instances of student loan cancellation.

- Fair market value (FMV) of property: If you had a foreclosure or abandonment of secured property in connection with the canceled debt, the FMV of that property is reported in box 7.

Exclusions: non-taxable canceled debt

Not all canceled debt is taxable. The IRS allows for some exclusions, which include:

- Bankruptcy: Debt discharged through Chapter 7 or Chapter 13 bankruptcy is generally not considered taxable income.

- Insolvency: If your debts exceed the fair market value of your assets at the time your debt is forgiven, you may be able to exclude the forgiven amount from taxable income.

- Qualified farm indebtedness or real property business indebtedness: If your debts are directly related to the trade or business of farming or real property used in a business or trade, you may be able to exclude the canceled debt from your income.

- Qualified principal residence indebtedness: This exception applies to forgiven mortgage debt related to your primary residence that is discharged before Jan. 1, 2026.

There are other exceptions, such as certain qualified student loans, but don’t worry — TaxAct can help you determine if your canceled debt is taxable by simply asking a few questions about your situation. As always, consult with a tax professional for personalized guidance if you have any questions or concerns about Form 1099-C.

FAQs about Form 1099-C

How to File Form 1099-C with TaxAct®

Lenders should send Form 1099-C by Jan. 31 in the year after they canceled or forgave your debt. When you receive a Form 1099-C, you must include the forgiven amount as income on your tax return. TaxAct will walk you through this process if you decide to e-file with us.

To report cancellation of debt within our tax preparation software:

- From within your TaxAct return, click Federal (on smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Other Income dropdown, then click Cancellation of debt (Form 1099-C).

- Click + Add Form 1099-C to create a new copy of the form or click Edit to edit a form already created (desktop program: click Review instead of Edit).

- Continue with the interview process to enter your information.

Based on the information you provide, our product will calculate if any of your canceled debt qualifies as income and help you report it accordingly. In certain situations, you may be able to exclude the canceled debt amount from your gross income.

The bottom line

Understanding Form 1099-C is crucial for accurately managing your tax obligations when dealing with canceled or forgiven debt. This form ensures transparency and compliance with IRS requirements, helping you avoid potential tax issues. Remember, while canceled debt often counts as taxable income, there are important exceptions and exclusions that may apply to your situation. Using tax preparation software like TaxAct can simplify the process, guiding you through the reporting process. By staying informed and using helpful tax filing software, you can navigate the complexities of canceled debt and its tax implications with confidence.