Welcome to our comprehensive tax extension guide. Whether you’re a seasoned taxpayer or new to navigating the intricacies of the tax system, it’s important to understand what tax extensions are and how they work.

This page is designed to be your one-stop resource for all things related to tax extensions. We’ll cover the benefits of filing a tax extension in more detail, explore how to file one correctly, provide valuable tips to streamline the process and address common misconceptions about tax extensions. Whether you’re seeking clarity on the extension filing process or looking for expert tips, you’ll find everything you need right here.

Let’s dive in so you can make informed decisions about your tax obligations and when a tax extension might be right for you.

Understanding tax extensions

What is a tax extension?

Simply put, a tax extension allows individuals and businesses more time to file their tax returns. By requesting an automatic extension, you can extend the filing deadline (usually April 15) and get six extra months to file, making the new deadline typically Oct. 15.

Having this extra time to file can be extremely helpful if you’re feeling overwhelmed. It allows you more time to gather all the necessary tax documents, review your financial records thoroughly, and ensure that your taxes are filed accurately. Extending the tax deadline can ease the rush and stress of tax season, providing a more thorough and thoughtful approach to tax preparation.

Reasons to file a tax extension (individuals)

There are several good reasons to file a tax extension. Filing a tax extension with the IRS can be strategic when you need extra time to ensure your tax return is accurate and complete. Here’s a breakdown of why you might consider this option and how to go about it:

- You’re still waiting on tax forms: One of the primary reasons to file an extension is if you’re still waiting on essential tax or financial information. For instance, if you’re an individual waiting on your W-2 or certain 1099 forms, it’s best to wait until you have all the necessary information to prevent errors and ensure your tax return is accurate. Similarly, filing an extension is a practical step if you’re a partner in a business or part of an organization that hasn’t yet sent out necessary forms like a Schedule K-1. It allows you to wait until you receive these documents before completing your return, avoiding potential discrepancies.

- Emergencies or unforeseen circumstances: Emergencies or unexpected events can also disrupt your tax preparation timeline. Whether it’s a sudden hospitalization, a family emergency, or a busy period at work, these situations can make it challenging to focus on completing your tax return by the deadline. In such cases, filing for an extension gives you the breathing room to handle these urgent matters without the added stress of looming tax deadlines.

- Retirement plan contributions: Additionally, if you’re considering contributing to a retirement plan or need more time to evaluate tax elections and their impact, an extension can provide the necessary flexibility. For example, contributions to an IRA are tax-deductible, and filing an extension allows you more time to make these contributions for the tax year and then claim them on your return.

Next, we’ll cover some frequently asked questions about tax extensions to ensure you understand who qualifies, if there is a cost to request an extension, and more.

Common FAQs about tax extensions

Pros and cons of tax extensions

Tax extensions offer numerous advantages for filers, but they aren’t always the best option. Let’s explore some of the benefits of filing a tax extension and when NOT to file an extension.

The benefits of filing a tax extension

- Extended deadline: With an extension, you gain six more months to file your tax return, shifting the deadline to Oct. 15 (or the next business day if the 15th falls on a weekend or holiday). This extra time can ease the pressure and give you the breathing room needed to ensure accuracy.

- Reduced stress: If tax season caught you off guard or you’re dealing with other commitments, filing an extension can alleviate stress. It provides the flexibility to manage your tax preparation more easily.

- Penalty avoidance: One significant advantage of filing an extension is avoiding penalties from the IRS for late filing. By requesting an extension, you buy yourself time to prepare your return thoroughly and submit it without a failure-to-file penalty.

- Accurate tax filings: Rushing to meet the original deadline can lead to mistakes and oversights in your tax return. An extension allows you to review your finances more carefully, maximizing deductions and credits while minimizing errors.

- Financial planning: If you need more time to evaluate tax strategies, such as retirement contributions or elections, an extension provides the necessary flexibility to make informed decisions without rushing.

Do tax extensions give you more time to pay your tax bill?

Many people ask whether tax extensions give you more time to pay your tax bill. While tax extensions give you more time to file, you still need to pay any tax due by the April due date. An extension does not give you more time to pay your tax bill.

You can request an IRS payment plan if you need more time to pay your tax bill. The IRS offers short-term payment plans and long-term installment agreements — you can even set these up through TaxAct® when you e-file with us. Keep in mind that even with a payment plan, you will still owe applicable interest and penalties until your tax bill is paid.

Reasons NOT to file a tax extension

While tax extensions can be beneficial, they aren’t the best option for everyone. Here are three reasons why an extension may not be the best choice for you:

- You need more time to pay your tax bill. As we know, filing an extension doesn’t delay your tax payment, and you must still pay any taxes owed by the deadline. If you need more time to pay, consider setting up a payment plan with the IRS rather than filing an extension.

- You know you’re getting a refund, so why not? Even if you’re expecting a tax refund, you might owe money for your taxes, even if you didn’t owe anything in the previous year. Tax laws can change, and the exact amount of taxes you owe cannot be determined until you file your tax return. It’s best to file early if you can so you know for sure how much you will owe or not owe.

- You always file an extension. If filing an extension has become a habit, it might be time to ask yourself why and remind yourself about the benefits of filing early. Unless you’re waiting for critical tax forms or have a valid reason to request an extension, it’s best to file while the previous year’s tax information remains fresh in your mind. This can help ensure you don’t miss out on any tax deductions and reduces the likelihood of tax identity theft. Filing early gives potential fraudsters less time to file a fraudulent return on your behalf.

How to file an individual tax extension

Wondering how to request an extension? This section provides a guide to filing a tax extension for individuals, plus answers to common questions.

When is the deadline to file a federal tax extension in 2024?

You must request a tax extension by Tax Day (April 15, 2024). Note that this does not affect the date tax payments are due; it is just the filing deadline. Once granted an extension, you’ll have until Oct. 15, 2024, to file your tax return.

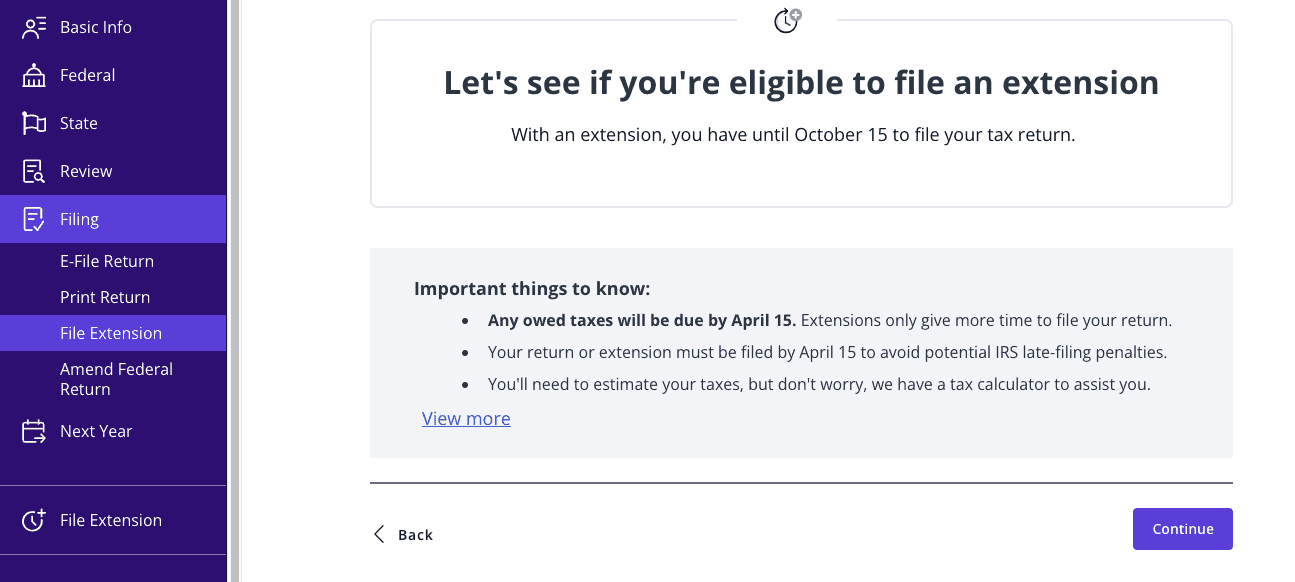

How do I file a tax extension with TaxAct?

The easiest and most convenient way to request an extension is by using IRS Form 4868. You can easily do this through TaxAct when you file with us. Our tax preparation software can also help estimate your tax liability and allow you to file any necessary state extensions. There is an option to print out Form 4868 and mail it as well.

To complete your extension request, you’ll need basic information such as your name, Social Security number, and address. If this information has changed since your last tax filing, ensure you update the relevant organizations beforehand.

By using TaxAct to file your tax extension electronically, you can streamline the process, reduce stress, and gain the extra time needed to prepare and file your federal income tax return accurately.

How to file a tax extension for your business

The IRS offers tax extensions for businesses as well. Here is our guide to filing a business tax extension.

Can all business types file a tax extension?

Yes. Sole proprietorships, partnerships, corporations, and limited liability companies can all file a six-month business tax extension request to get extra time to file without penalty. Different business types use different extension request forms (more on that below).

What is the deadline to file a business tax extension?

The deadline to request a business tax extension depends on your business type:

- March 15 is the deadline for partnerships and S corporations to request an extension to file. The new due date with an extension is Sept. 15.

- April 15 is the deadline for sole proprietors, multi-member LLCs, and C corporations to request an extension to file. The new due date with an extension is Oct. 15.

Note that if any of the above dates fall on a weekend or holiday, the deadline is pushed to the next business day. For example, in 2024, the extended deadline for partnerships and S corps is Sept. 16, as the 15th falls on a weekend.

How do I file a tax extension for my business?

To request an extension for your business, you’ll need a different form depending on your business type:

- Sole proprietorships and single-member LLCs should use Form 4868.

- Partnerships, multi-member LLCs, and corporations should use Form 7004.

TaxAct makes it simple to file Form 4868 or Form 7004.

For Form 4868:

- From within your TaxAct return, click Filing on the left to expand, then click File Extension.

- Continue with the interview process by entering all the appropriate information.

- On the screen titled Filing Extension Step – Extension Options, you can print or e-file your federal extension only. State extensions can be printed later in the interview process.

If you need help filing Form 4868 with TaxAct, please read our Form 4868 help topic for answers to your questions and further details.

For Form 7004:

- Click the Filing tab within your TaxAct return (Online or Desktop).

- Under Filing, click File Extension and continue as applicable to your required filings.

- The program will continue with the interview questions to help you complete the required information for an extension request.

For more detailed information about filing Form 7004, reference the IRS instructions for Form 7004.

What information will I need to provide when requesting a business extension?

Form 4868 will ask you to provide your name, Social Security number, and address. You’ll also need to estimate any tax liability for the current tax year.

Form 7004 will ask you to indicate which type of return you are requesting the extension for. You’ll also need to provide basic information about your business, such as your business structure, business address, and applicable EINs. Lastly, you’ll need to estimate your tentative total tax and include any payments and credits to determine how much tax you owe.

What to do after filing a tax extension

If you’ve already filed for a tax extension this year, great job! Don’t get too comfy, though. You have six extra months to file, but what should you do after filing a tax extension? Follow our top tips to help you navigate the extension tax filing process smoothly and effectively.

1. File as early as you can.

First, try to use the additional time to finish as much of your tax return as early as possible before the new deadline. Even if some information is still missing, like data from third-party sources or documentation on specific deductions, making estimations and indicating these placeholders in your return can simplify the final filing process. This proactive approach reduces the chance of last-minute rushes and potential mistakes.

2. Keep good notes.

Keeping comprehensive tax notes can prove invaluable during the tax preparation phase. Maintaining a detailed list of required documents, unanswered questions, and calculations can serve as a reference guide when you’re finally ready to file. These notes not only help in gathering the necessary information but also provide a clear explanation of figures and decisions made on the tax return if any clarifications are needed later.

3. Organize your tax documents.

Another key aspect of staying on track is organizing tax documents effectively. A tax return checklist can be helpful in this stage. Arranging paperwork, receipts, statements, and other relevant documents in a structured format ensures easy access and efficient retrieval when filing your tax return. Additionally, annotating documents with relevant information and checkmarks to indicate items already included in the return can further streamline the process.

4. File ASAP.

As the October deadline approaches, prioritizing completing your tax return becomes critical. Avoiding unnecessary delays or procrastination can alleviate stress and potential issues down the line. While it may be tempting to hold off in hopes of uncovering additional tax deductions, it’s essential to strike a balance and file your return as soon as you can. Remember, the longer you wait, the more challenging it will be to recall relevant financial transactions and deductions.

5. Factor in payments you’ve already made.

It’s important to factor in any payments made during the initial extension filing on April 15. Accurately incorporating these payments into your tax return is necessary to ensure that all financial aspects are accounted for and compliant with IRS regulations.

Things to consider after filing a tax extension

We know that a tax extension gives you an additional six months to complete your tax return, shifting the deadline to Oct. 15, 2024. While it may be tempting to relax and postpone tax-related tasks, it’s essential to stay focused and consider a few key points before putting taxes aside. Here are three things to consider after filing for a tax extension.

- Delaying the completion of your return until October won’t necessarily make filing any easier. In fact, it may make it more difficult, as the tax year won’t be as fresh in your mind. It’s wise to continue working on your return diligently, utilizing estimates if needed to gauge potential tax liabilities accurately.

- Remember that you can only receive a tax refund once you file your return. Allowing the IRS to hold onto your money means you’re delaying positive ways to use that money, such as paying down debt or investing it. Filing sooner rather than later ensures you get your refund promptly, allowing you to put it to good use.

- Putting off filing may lead to penalties if you discover you owe more tax than you initially estimated. You may even find that you owe more tax after you have filed for an extension. This situation is not uncommon and can lead to penalties and interest on top of your tax bill. And the longer you wait to file your complete tax return, the more you’ll have to pay in monthly penalties and interest.

Recap: How to beat the tax extension deadline

As the tax extension filing deadline approaches, it’s natural to feel a sense of urgency to complete your tax return. However, rushing through the process can lead to errors or oversights that may result in paying more taxes than necessary or receiving inquiries from the IRS regarding mistakes. Before finalizing your tax return, it’s crucial to take a step back and ensure everything is accurate and complete. Here are our tips for beating the tax extension deadline.

- Meticulously review your tax return for accuracy. While our tax software can guide you, manually checking each detail is essential. Make sure all expected deductions and tax benefits are included, verify the accuracy of income totals and dependent information, and confirm any carryovers from the previous year are accounted for. Comparing this year’s figures with last year’s can also help identify discrepancies or missed opportunities for tax breaks. If you filed with us last year, TaxAct provides a side-by-side comparison to last year’s return to help you with this.

- Double-check entered information: If you started your return earlier but have yet to complete it, revisit any previously entered information or estimates to update outdated or incorrect data. When you file with us, TaxAct uses an Alerts feature to identify and flag potential errors or missed opportunities before filing. Addressing these issues beforehand can prevent complications later on.

- File by the deadline to minimize penalties. It’s crucial to file your tax return by the extension deadline, even if you anticipate owing more taxes than you have already paid. This will help you avoid late filing penalties, and it’s better to accurately assess your tax liability upfront than face additional fees for late filing and payment.

Putting off doing your taxes until the last minute can cause stress and may lead to fines. It’s best to get your taxes done early, keep things in order, and track your spending closely. After asking for more time to file, finish your taxes quickly to prevent problems and make the most of tax breaks.

To streamline the filing process and alleviate future stress, consider starting your tax return with TaxAct now. Our tax software saves your progress as you file for a smoother filing experience as the deadline approaches, allowing you to file with confidence and accuracy.