Updated for tax year 2025.

Did you purchase an electric vehicle (EV) recently? Many EVs, plug-in hybrid electric vehicles (PHEVs), and fuel cell vehicles (FCVs) can score you a nice tax break. Let’s see if you qualify and, if so, how to claim this tax credit.

Note: Due to a provision in the One Big Beautiful Bill Act, you can only claim the EV tax credit for qualifying vehicles delivered on or before Sept. 30, 2025. You cannot claim the EV tax credit for electric vehicles purchased after Sept. 30, 2025.

What is the electric vehicle tax credit?

Officially called the Qualified Plug-In Electric Drive Motor Vehicle Credit, the EV tax credit was designed to reward taxpayers for purchasing more eco-friendly vehicles.

Depending on what type of new EV you buy and its battery capacity, the EV tax credit can be worth up to $7,500. But only certain EVs, plug-in electric vehicles, and FCVs qualify for the tax credit.

Can I claim the electric vehicle tax credit for a used car purchase?

Yes! Beginning in tax year 2023, used EVs purchased from licensed dealerships may also be eligible for the clean vehicle credit, up to a maximum of $4,000 or 30% of the sale price, whichever is lower.

Do I get the EV tax credit if I get a refund?

The clean vehicle credit is non-refundable, meaning it can reduce your tax liability to $0, but if your credit exceeds the tax you owe, the excess won’t be refunded to you.

EV tax credit requirements: new electric vehicles

The Inflation Reduction Act of 2022 introduced major changes to this credit, including new requirements for income eligibility, battery components, and final assembly locations.

Qualifying EVs

Not all electric cars qualify for the federal EV tax credit. Vehicles must meet specific criteria. To qualify for the credit in tax year 2024, your vehicle must:

- Have been purchased new. In addition, the manufacturer’s suggested retail price (MSRP) cannot exceed:

- $80,000 for vans, SUVs, and pickup trucks.

- $55,000 for all other vehicles.

- Have a battery capacity of at least 7 kilowatt hours.

- Have a gross vehicle weight rating of less than 14,000 pounds.

- Be made by a qualified manufacturer (not required for fuel cell vehicles).

- Undergo final assembly in North America.

- Meet the critical mineral and/or battery component requirements (for vehicles placed in service April 18, 2023, or after).

When purchasing the vehicle, the dealership also needs to report the required information (your name and taxpayer identification number) to both you and the IRS, otherwise you will not be eligible to claim the credit.

If you’re purchasing an EV, always check the list of qualifying vehicles at fueleconomy.gov to confirm eligibility.

Who qualifies: Clean vehicle tax credit income limits for new vehicles

Your vehicle isn’t the only thing that needs to meet specific requirements — you do, too. The EV tax credit is available to individuals and businesses who meet the following requirements:

- You didn’t buy the vehicle for resale purposes.

- You mainly use the vehicle within the U.S.

Your modified adjusted gross income (AGI) also plays a role in your eligibility. These are the current EV income limits:

- $300,000 for married couples filing jointly or a surviving spouse

- $225,000 for heads of households

- $150,000 for all other filers

Using prior year income

If it helps you qualify for the tax credit, you can opt to use your AGI from the year before you took delivery of the vehicle. For instance, let’s say you’re a joint married filer who bought an EV in 2024 and your household AGI for 2024 was $350,000. However, in 2023, your AGI was only $275,000, putting you under the $300,000 limit for married couples filing jointly. In this case, you can use your 2023 income to qualify for the EV tax credit, even though you were over the AGI limit in the year you took delivery of the vehicle.

EV tax credit requirements: How does the credit work for used clean vehicles?

For 2023 and later years, you can claim a used clean vehicle credit for qualified used EVs from a licensed dealer, provided you and the vehicle meet certain requirements. Just like the regular EV tax credit, the used EV tax credit is nonrefundable, meaning if your tax credit exceeds the amount you owe in taxes, you won’t be able to claim the excess as a tax refund.

Qualifying used vehicles

Only certain used vehicles qualify for the EV credit. To qualify, the used vehicle must meet all the following requirements:

- Have a sale price of $25,000 or less (including dealer-imposed costs or fees not required by law; excluding fees required by law like taxes and title or registration fees).

- Have a model at least two years earlier than the calendar year in which you bought the vehicle. For example, only 2023 and older vehicles would qualify for the credit if purchased in 2025.

- Have been purchased from a licensed dealer.

- Not have already been transferred to a qualified buyer after Aug. 16, 2022.

- Weigh less than 14,000 pounds (gross vehicle weight rating).

- Have a battery capacity of at least 7 kilowatt hours.

- Be used primarily within the U.S.

The dealership must report the required information to you and the IRS at the time of sale to qualify for the used clean vehicle credit.

Who qualifies: Used electric vehicles

To qualify for the used clean vehicle credit:

- You cannot be the original owner of the vehicle.

- You must have bought the vehicle for your own personal use and not for resale.

- You can’t be claimed as a dependent on another person’s tax return.

- You can’t have claimed another used vehicle credit in the three years before the purchase date.

Income limits for used EVs

Just like the new clean vehicle credit, eligibility for the used EV credit depends on your income. To qualify for the used EV tax credit in 2024, your modified AGI cannot be more than:

- $150,000 for those married filing jointly or surviving spouse

- $112,500 for heads of household

- $75,000 for all other filers

Also, like the credit for new clean vehicles, you can use your prior year’s modified AGI if that helps you meet the used clean vehicle credit requirements above.

How to claim the EV tax credit with TaxAct

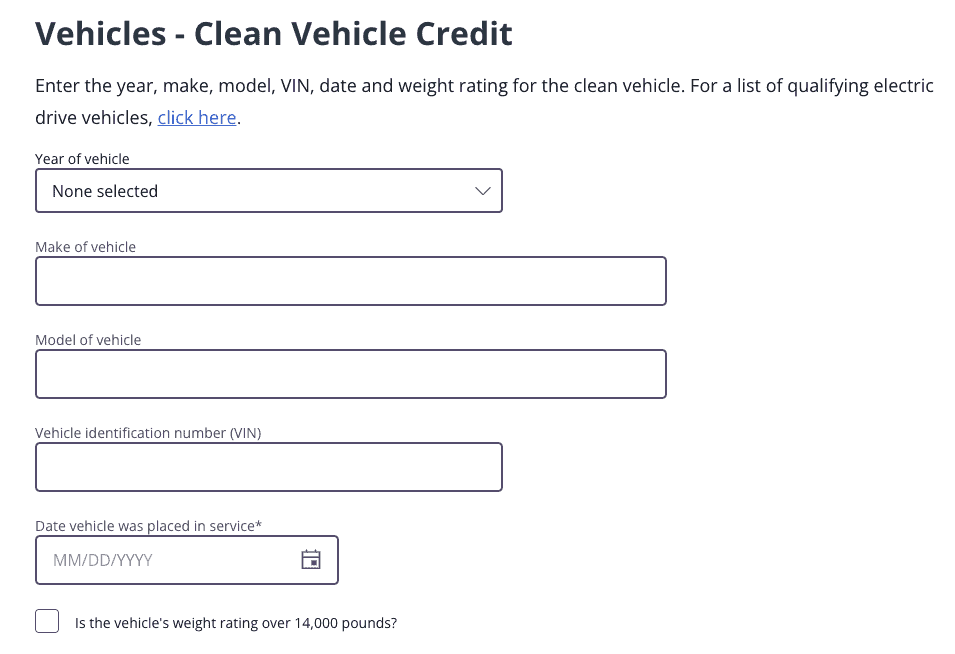

To claim the EV tax credit, you’ll need to file IRS Form 8936, the Qualified Plug-in Electric Drive Motor Vehicle Credit form. To properly fill out this form, you will need:

- A time-of-sale report from your dealer

- The dealer should provide a paper copy when you purchase the vehicle.

- If you didn’t get a time-of-sale report from your dealer when purchasing the vehicle, contact the seller to get a copy of the report.

- Your vehicle’s VIN.

Here’s how to claim the credit using TaxAct® to file your income tax return:

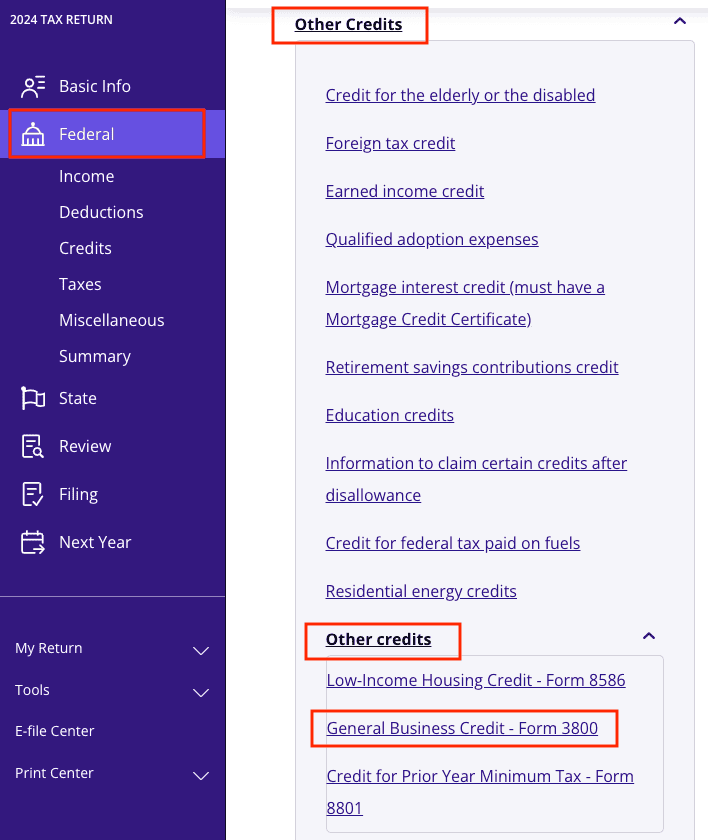

Step 1: Navigate to Form 8936.

- Within your TaxAct return (see screenshots below), click Federal. On smaller devices, click the icon in the top left corner, then click Federal.

- Click Other Credits.

- Another dropdown will appear — click the second Other credits dropdown.

- Now, click General Business Credit – Form 3800 as shown below.

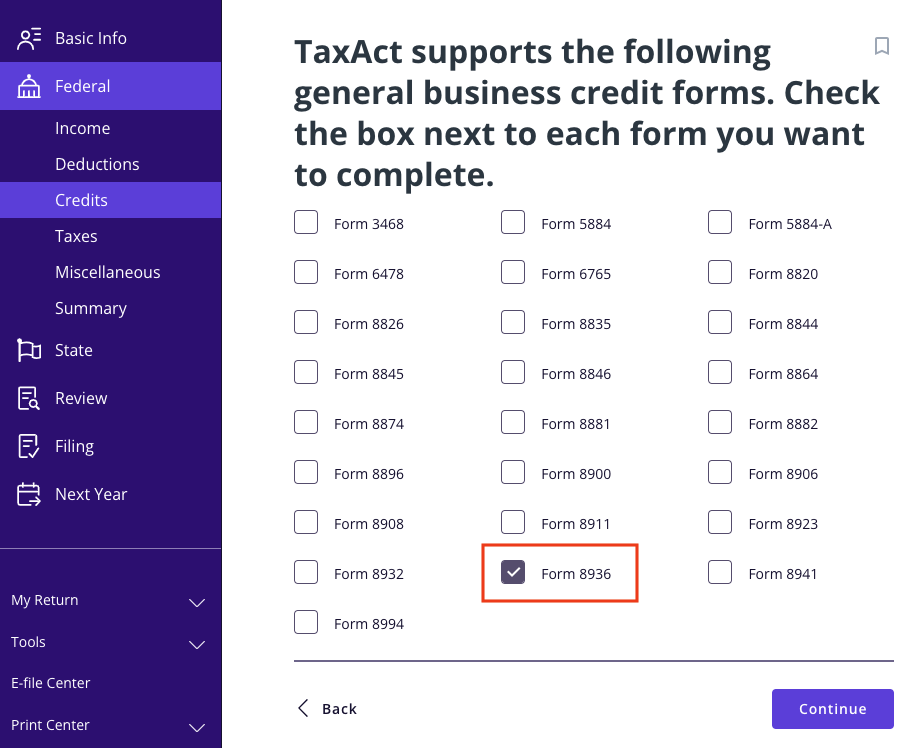

Step 2: Select Form 8936.

- Find Form 8936 in the list and check the box as shown below.

- Continue with the interview process to enter your vehicle details as shown below.

Step 3: Complete your return and file!

- Once you enter your vehicle information, TaxAct will calculate your credit amount and apply it to your tax return.

EV tax credit FAQs

State EV tax credits vs. the federal EV tax credit

Many states offer additional tax incentives for purchasing (or sometimes leasing) an EV. Some states provide rebates, while others offer excise tax credits or reduced registration fees.

Each state has different eligibility requirements, many of which differ from the federal EV tax credit requirements discussed above. Because of this, you may still be able to claim a tax rebate from your state even if you don’t qualify for the federal tax credit. So, don’t forget to check!

You can find each state’s unique laws and tax incentives on the U. S. Department of Energy website.

State EV credit example

Colorado residents can claim the state’s EV tax credit for qualifying vehicles titled and registered in Colorado that were purchased or leased before Jan. 1, 2029. How much of a credit you can claim depends on the vehicle type and year you purchased the vehicle but amounts range anywhere from $1,500 to $12,000.

Tesla and the EV tax credit

Tesla has been a leader in the electric vehicle space, and many Tesla models have qualified for the federal EV tax credit. However, eligibility changes frequently based on battery component sourcing and income limits.

As of right now, certain Tesla model years qualify for the full $7,500 credit, while others may only qualify for a partial credit or no credit at all. To confirm eligibility, check the list of qualifying Tesla models on fueleconomy.gov before purchasing a Tesla.

Other tax considerations when buying an EV

If you’re still on the fence about purchasing an electric vehicle, here are some more tax considerations and financial implications to keep in mind.

1. Higher upfront cost

EVs typically have a higher purchase price than gasoline-powered vehicles, but the tax credit can help offset the cost.

Purchasing an EV will likely land you with a higher monthly payment, and you’ll pay more in sales tax if you live in a state that charges sales tax. However, federal and state tax credits can help offset the extra upfront costs of purchasing an EV. And remember, you’ll also be saving money that you would otherwise spend on gas when driving a conventional vehicle.

2. Municipal excise taxes

You may also pay higher municipal excise taxes when driving an EV. Since these vehicles run on electricity, you would be subject to any local municipal taxes on electricity when charging your vehicle’s battery with an EV charger. While this might not seem like a big deal, receiving an unexpectedly high electric bill is never fun, so it’s something to keep in mind.

3. Extra vehicle registration fees

It’s also important to note that some states have imposed additional registration fees on clean energy vehicles.

These states justify the extra annual fee by claiming they get a large portion of public funding for highways and bridges through fuel tax revenue (the tax you pay when buying gasoline). Since EV drivers do not pay taxes on gasoline, some states have imposed special registration fees to offset this lost revenue.

As of 2023, 24 states charged extra annual fees for EVs and even some hybrid vehicles. The exact amount depends on your state and vehicle type, but fees currently range from an additional $50-$200 per year.

It’s unclear how long states will continue to impose these fees as more consumers decide to go electric. For now, at least, it’s something to consider when deciding if an EV will fit within your budget.

Claim the clean vehicle credit with TaxAct.

Now that you know how to claim the EV tax credit, it’s time to try it out for yourself. Start filing your income tax return with TaxAct today, and we’ll help you claim the EV tax credit with ease.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

All trademarks not owned by TaxAct, Inc. that appear on this website are the property of their respective owners, who are not affiliated with, connected to, or sponsored by or of TaxAct, Inc.