Digital currency wallets like Coinbase have made it easy to invest in blockchain technology such as cryptocurrency. If you’re new to investing or crypto exchanges, you might be wondering how to report cryptocurrency on your taxes. Not to worry — on this page, we’ll walk you through the tax implications of selling crypto. We’ll also cover how to report gains and losses from digital assets when filing your income tax return.

At a glance:

- Selling crypto for a profit results in capital gains and needs to be reported on your tax return.

- Receiving crypto can also be a taxable event (e.g., receiving crypto as income or mining crypto yourself).

- Crypto donations are not subject to capital gains taxes and may earn you a tax deduction.

Reporting crypto on your taxes

Any time you make or lose money on your investments, including cryptocurrency, you need to report it on your taxes using Schedule D.

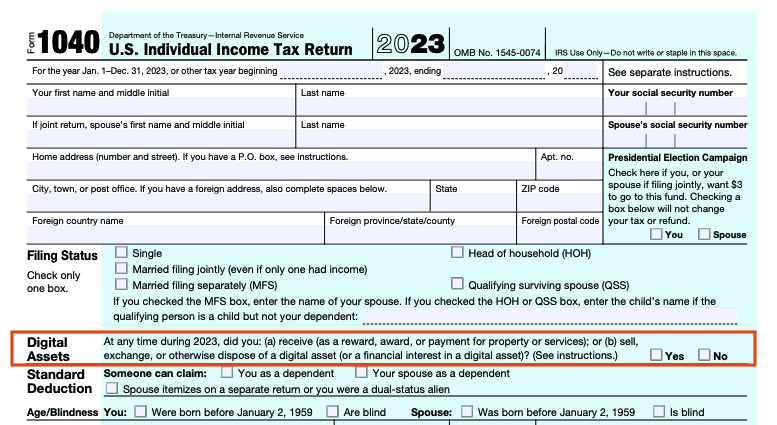

Ever since 2020, the IRS has added a question for taxpayers about virtual currency to IRS Form 1040 for tax reporting purposes. Under the section where you put your name, address, and other personal information, it will ask whether you received, sold, exchanged, or otherwise disposed of a digital asset (or financial interest in a digital asset).

You only need to check “Yes” if you made any crypto transactions during the tax year. If you just purchased crypto with real currency or held cryptocurrency but didn’t buy or sell it, you can mark “No.”

Taxes on crypto gains

When do I have to report cryptocurrency on taxes?

When you sell cryptocurrency as a capital asset, you incur a capital gain or capital loss that needs to be reported on your tax return.

- Short-term gains: If you profited from selling crypto you held for one year or less, it’s considered a short-term capital gain, and it would be taxed as ordinary income. Your federal tax rate would range from 10% to 37%, depending on your tax bracket.

- Long-term gains: If you profited from selling crypto you held for more than one year, it would be taxed as a long-term capital gain. Those capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income that year.

Your gain depends on your cost basis. Your basis is typically how much you originally paid for the crypto plus any associated fees. However, if you happen to lose money on your crypto investment, you can use it to offset your gains and income. There is a $3,000 yearly limit, but you can carry the rest over to subsequent years when you file. To read more about this, check out How Crypto Losses Can Lower Your Tax Bill.

What tax forms report crypto transactions?

When you sell virtual currency for a profit or loss, your cryptocurrency exchange should report the sale to you on Form 1099-B. Sometimes they may also use Form 1099-K.

New for 2025: Beginning in 2026 (when you file your 2025 taxes) you may start seeing Form 1099-DA, a new tax form for digital asset proceeds from broker transactions.

Save these tax forms, as they will help you accurately report your crypto gains and losses!

FAQs about how to report cryptocurrency

Answers to more crypto FAQs

For more information on reporting virtual currency, the IRS has a helpful Frequently Asked Questions on Cryptocurrency Transactions page. This page gives detailed information on holding periods and different crypto activities and scenarios. You can also check out the official IRS webpage on virtual currency for more helpful publications.

File your crypto taxes with TaxAct®.

If you’re confused about the reporting requirements for cryptocurrency, our tax software can help. When you e-file with TaxAct, we ask you questions about your crypto sales and guide you through the filing process step by step to ensure everything is reported correctly.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.