If you’re a freelancer or a career independent contractor, you’re probably familiar with a W-9 form. As far as tax paperwork goes, it’s one of the better ones because it generally means you’ve won a new client! The form makes it easy to submit all your vital information to the client, so you can start working and they can start paying you.

At a glance:

- A W-9 form provides information for issuing Form 1099-NEC at the end of the year.

- Differentiate between a W-9 form and a W-4 form based on your working relationship with the company; a W-9 form is for independent contractors, while W-4 is for employees.

- Update your W-9 form whenever your information changes for active clients.

What is a W-9 tax form?

Form W-9, Request for Taxpayer Identification Number and Certification, is primarily used to provide the information your client needs to issue you a Form 1099-NEC at the end of the year. Form 1099-NEC documents non-employee compensation. It includes similar information to a Form W-2, Wage and Tax Statement.

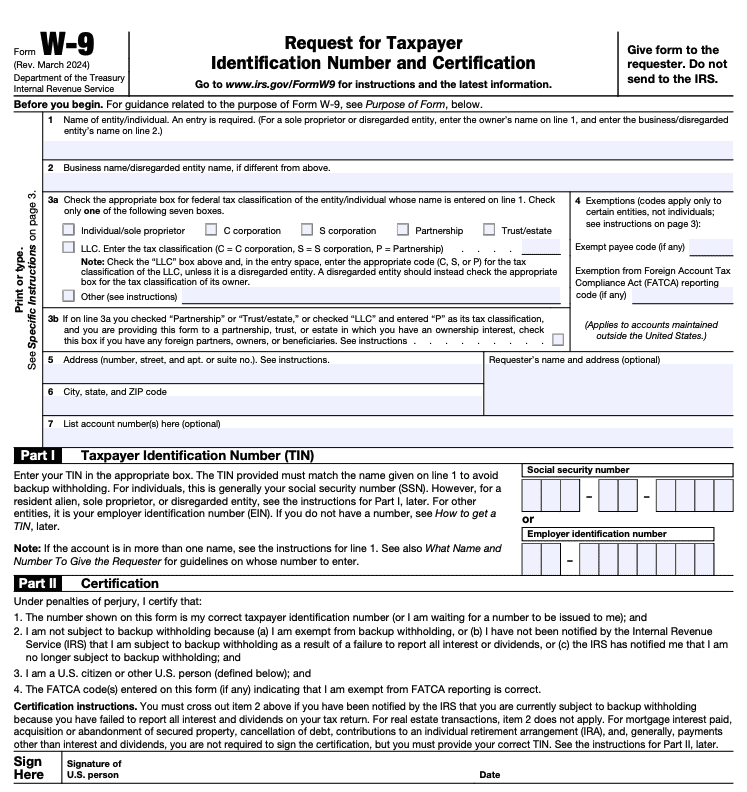

Form W-9 example

This is what Form W-9 looks like:

The W-9 form asks for several pieces of information: your name, business name (if applicable), address, taxpayer identification number (also called a taxpayer ID or TIN), and the type of business entity you operate. It’s pretty painless as far as tax paperwork goes.

Form W-9 instructions

How do I fill out a W-9?

To fill out Form W-9, follow these steps:

- Provide your personal information: At the top, fill in your name (or business name, if applicable), and check the box for your appropriate federal tax classification (e.g., individual/sole proprietor, LLC).

- Enter your taxpayer identification number (TIN): This is likely either your Social Security number (SSN) or Employer Identification Number (EIN). Enter the correct number based on your tax classification.

- Certify the form: In Part II, review the certification text carefully. If all the information is accurate, sign and date the form.

- Submit the form: Give your completed Form W-9 to the person or business that requested it. You don’t send this form to the IRS, only to the payer.

That’s it! Just make sure your information is accurate, as the payer will use it to report income paid to you.

Watch out for red flags

Although Form W-9 is a basic and widely used tax document, that doesn’t mean you should take any less care with handling it than you would handle other tax and financial documents. Here are a few things to look out for:

- The person or business asking you for a W-9 form seems shady. In general, you should be careful giving out sensitive information like your name, address, and Social Security number. Make sure you’re comfortable with the person or organization asking for a W-9 form before you supply that information.

- Use only secure channels to send a W-9 tax form. If you choose to email Form W-9, make sure to send it as an encrypted attachment. You can also use another secure delivery method, such as hand delivery or regular mail.

- The purpose of a W-9 form request is unclear. If you’re not sure why the requestor wants a Form W-9 from you, ask them what tax documents they’ll use it to prepare for you.

- You thought you were getting a Form W-4. If you’re starting a new job and the employer wants a W-9 instead of a W-4, clarify whether you’re an employee or an independent contractor. It’s against the law for them to require you to work like an employee but pay you like a contractor.

Special Form W-9 information for limited liability companies

- If the tax status of your limited liability company (LLC) is separate from you — such as a partnership, C-corporation, or S-corporation — list the LLC name, its federal employer identification number, and check the appropriate tax classification box on the W-9 tax form. Do not check the “limited liability company” box.

- If the LLC is owned by another LLC, check the “limited liability company” box. Also, indicate the tax classification of the parent LLC.

- If the LLC is owned by a single person, list the name of the owner on the “name” line and the name of the LLC on the “business name” line. The Internal Revenue Service (IRS) would rather have the owner’s Social Security number instead of the LLC’s federal employer identification number.

Form W-9 FAQs

What is a TIN?

A TIN is your taxpayer identification number, which you’ll need to provide on Form W-9. Your TIN is typically your SSN or EIN.

When do I need to fill out a W-9?

You’ll need to fill out a W-9 form when a business or individual (like a client or financial institution) requests your taxpayer identification information. A TIN request usually happens if you’re an independent contractor, freelancer, or receiving certain types of income, such as interest, dividends, or rent. The W-9 provides your SSN or EIN to the payer, so they can accurately report your earnings to the IRS.

In short, if you’re not a traditional employee but are getting paid outside of payroll, you’ll likely be asked to complete a W-9.

You may also need to provide a W-9 form if you use payment provider sites like eBay® or Venmo®. Sportsbook sites could also need you to fill out a W-9 form based on how much money you win betting on sports. A company or individual may also request a W-9 form from you for real estate transactions, mortgage interest payments, acquisition or abandonment of secured property, cancellation of debt, or your IRA contributions. Those are less common, however.

Usually, the party requesting a W-9 tax form will provide a blank one for you to fill out. You can also easily download the form from the IRS website. Only the party that requested it needs a copy — the IRS does not.

What’s the difference between Form W-9 vs. Form W-4?

The business you work for needs to classify you as either an independent contractor or an employee. If you’re an independent contractor, they’ll request a Form W-9 from you. If you’re an employee, they’ll ask you to fill out Form W-4 so they can withhold payroll taxes.

When you submit a W-9, the company won’t withhold any taxes on your behalf. You’re responsible for paying the appropriate amount of taxes to the IRS yourself, including both the employer’s and employee’s portions of Social Security and Medicare taxes.

It can sometimes be tricky to determine whether to complete a W-9 or W-4 based on the work you do. A better indicator is the nature of the working relationship. Generally, the more control an employer has over how you perform your job, the more likely you’re an employee rather than an independent contractor.

A quick rule of thumb: If the company controls key business aspects like how you’re paid, whether expenses are reimbursed, or who provides tools and equipment, you’re likely an employee. Benefits like pension plans, paid vacation, and matching 401(k) contributions also point to employee status.

Some employers may try to cut costs by classifying employees as independent contractors, avoiding their share of Social Security and Medicare taxes. If this happens to you, it’s important to address the issue promptly, as their “savings” will come out of your pocket.

When should you update or send out a new W-9 form?

You must send a new W-9 form to active customers or clients whenever your information (name, business name, address, or Social Security number) changes.

What should you do if you receive a request for a W-9 tax form from an unexpected source?

By law, you are only obligated to provide a W-9 form to parties that intend to pay you interest, dividends, non-employee compensation, or any other type of reportable income. If someone unexpectedly asks for a W-9, ask them why they need it. If their answer doesn’t align with any valid reason, you legally don’t have to provide one.

What if I don’t submit a Form W-9?

If a business appropriately requests a W-9 form and you do not submit one, you’ll likely be subject to backup withholding up to 24% on your payments.

The bottom line

Form W-9 is a straightforward but important document for independent contractors and freelancers. It helps ensure your client has the necessary information to accurately report your earnings to the IRS. Keeping your details up to date and securely submitting your W-9 when requested will help you avoid any tax hiccups down the road. While handling tax forms can feel like a chore, getting it right from the start will make tax time a breeze!