Running a small business like a corporation has plenty of perks, but let’s face it — corporate taxes can get complicated. This guide will give you a better understanding of Form 1120, U.S. Corporation Income Tax Return, and its accompanying schedules, including what each tax form is for and how to file it. Here’s what corporation owners need to know before filing business taxes this season.

Table of Form 1120 schedules

Click on the links below to jump to each schedule.

| Schedule | Description |

|---|---|

| Schedule B | Provides additional questions for Schedule M-3 filers with assets over $10M. |

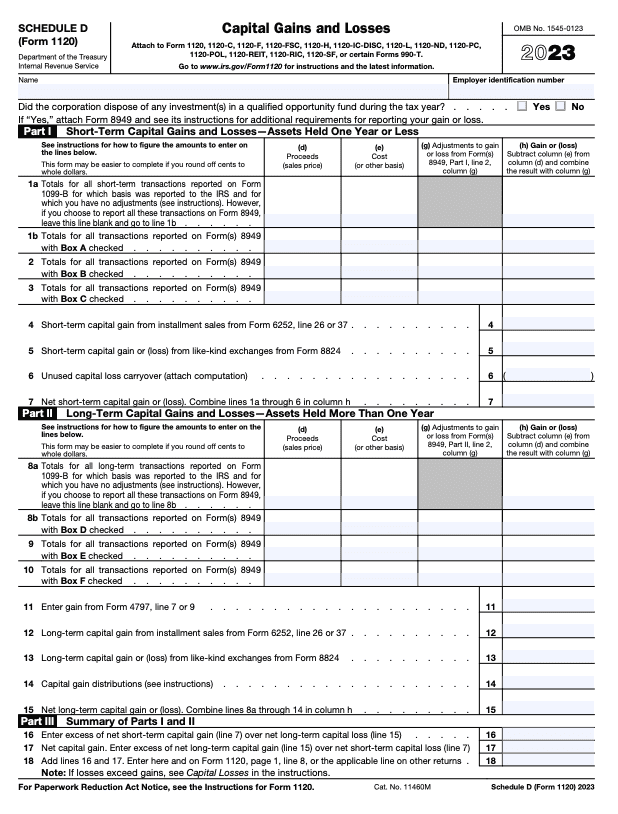

| Schedule D | Used to report capital gains and losses and certain transactions. |

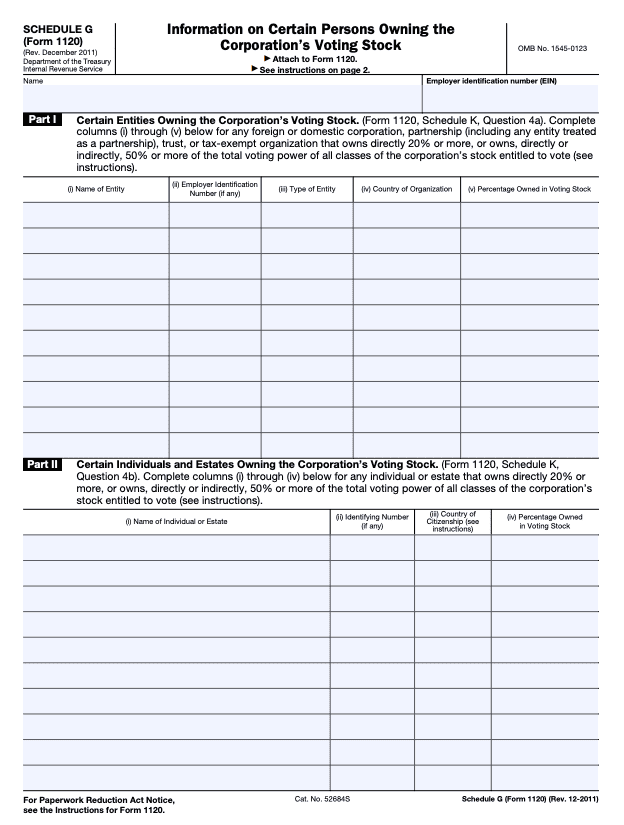

| Schedule G | Reports ownership by certain entities or individuals with large voting power. |

| Schedule H | Applies to Personal Service Corporations for deduction limits. |

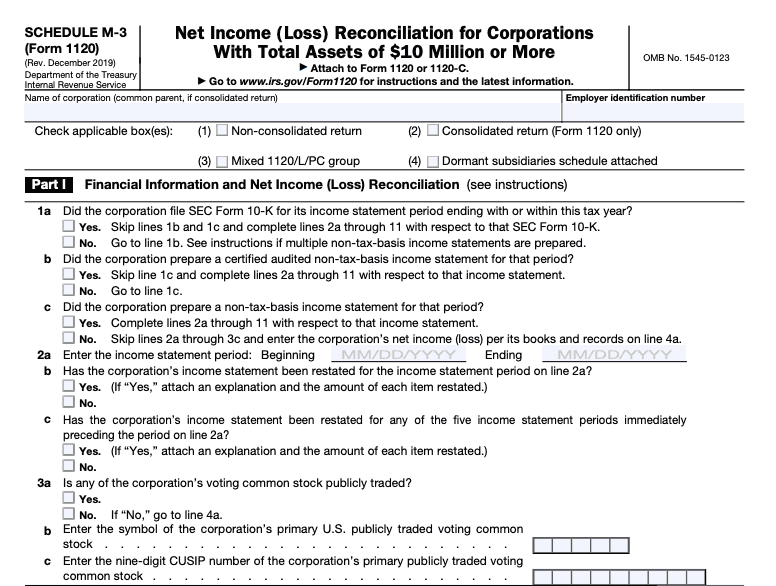

| Schedule M-3 | Reconciles financial statement income to taxable income for large corporations. |

| Schedule N | Reports foreign operations and assets of U.S. corporations. |

| Schedule O | Used for apportioning taxable income in controlled groups. |

| Schedule PH | Used to calculate the personal holding company tax. |

| Schedule UTP | Reports uncertain tax positions for corporations with assets over $10M. |

What is IRS Form 1120?

Form 1120 is the U.S. Corporation Income Tax Return. C corporations (C corps) and some limited liability companies (LLCs) must file this form to report their taxable income, gains, losses, tax credits, and deductions to the Internal Revenue Service (IRS). Essentially, this is how the IRS knows how much tax a corporation owes based on its total income. All domestic corporations must file Form 1120 unless they are exempt.

For example, if your corporation owns a chain of local coffee shops, you’ll use Form 1120 to report your gross receipts, subtract the cost of goods sold (like coffee beans and cups), and detail other expenses such as employee wages and rental costs. Filing Form 1120 allows you to determine your net income and calculate the taxes you owe.

How corporations are taxed

The IRS considers C corps to be separate business entities. This means they are subject to “double taxation,” where the corporation pays a flat corporate tax rate (currently 21%) on its income after accounting for losses, deductions, and credits. Then, the shareholders’ dividend distributions are also taxed at the individual level. C corps can’t deduct earnings distributed to shareholders.

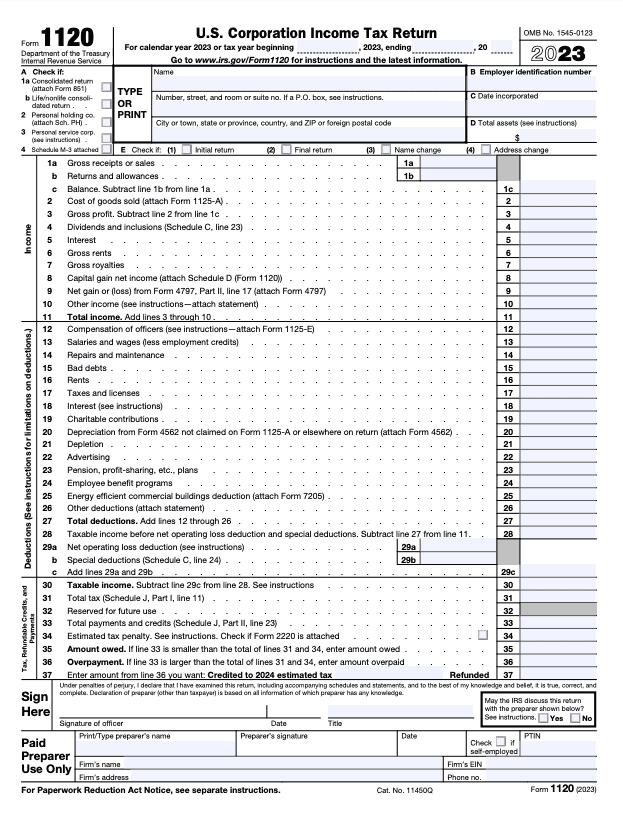

Example of Form 1120

An 1120 tax form is comprised of six pages. Here’s what the first page looks like:

This tax document includes several important sections, each requiring careful attention to detail. Here’s a breakdown of what each part is for:

- Income: This is where you report income — specifically, your corporation’s gross income, including gross receipts, cost of goods sold, and business income.

- Deductions: This section focuses on deductions, such as depreciation, salaries and wages, officer compensation, and special deductions. For example, if your corporation has a CEO with a set salary, this is where that compensation is recorded. It also includes deductions like office equipment that loses value over time (depreciation).

- Tax, refundable credits, and payments: In this section, you will use the information from earlier sections to record the total taxes, credits, and the amount of tax you owe or need to be refunded by the IRS.

Form 1120 also includes several schedules that make up the rest of the form:

- Schedule C (page 2): Reports dividends, inclusions, and special deductions.

- Schedule J, Tax Computation and Payment (page 3): Covers your tax computation, including the alternative minimum tax and estimated tax payments.

- Schedule K (pages 4-5): Provides a summary of your corporation’s other information, such as your accounting method and business activities, that are used to determine your income tax liability.

- Schedule L (page 6): This is your balance sheet, showing assets, liabilities, and equity at the beginning and end of the tax year. For example, if your corporation owns real estate or has outstanding loans, those details are included on this schedule.

- Schedule M-1, Reconciliation of Income (page 6): Reconciles the book income (accounting income) with the taxable income from Form 1120. Schedule M-1 helps ensure consistency between financial statements and tax returns. See our list of common book-tax differences on Schedule M-1.

- Schedule M-2, Analysis of Unappropriated Retained Earnings per Books (page 6): Reports changes to the corporation’s retained earnings. For example, if your corporation distributed dividends or had net income, Schedule M-2 shows how these changes affect retained earnings over the tax year.

Form 1120 variations

Form 1120 serves as the main tax form for corporations, but there are variations. Filing the proper tax form is critical because it determines your corporate federal income tax liability and how much of your hard-earned cash stays in your pocket. We go over two of the more common variations below.

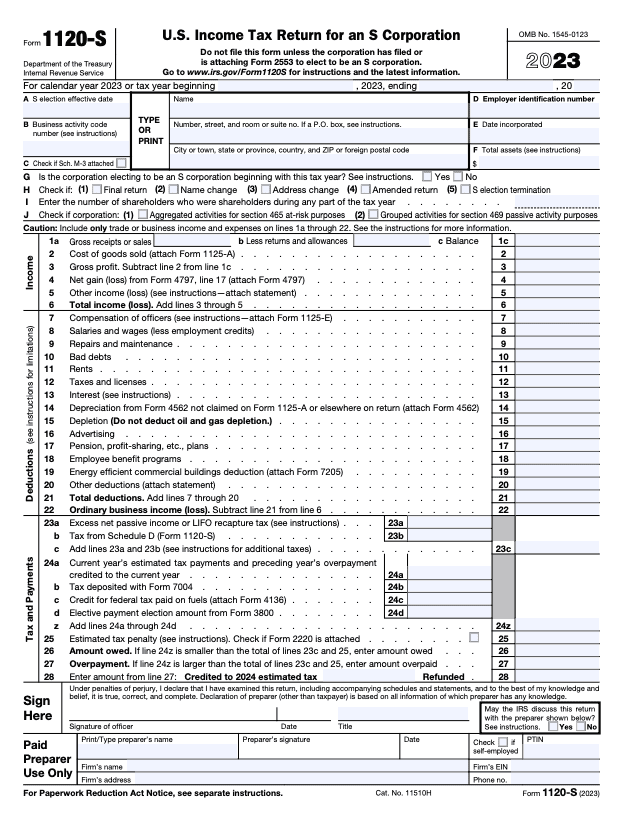

What is an 1120-S form?

Form 1120-S is specifically for S corporations (S corps), which pass their business income, losses, and deductions through to their shareholders for federal tax purposes. The biggest difference from C corps is that S corps don’t pay corporate income tax directly — rather, it’s the shareholders who include this information on their personal returns using Schedule K-1.

Example of Form 1120-S

Here’s an example of what Form 1120-S looks like and the information you’ll find on it:

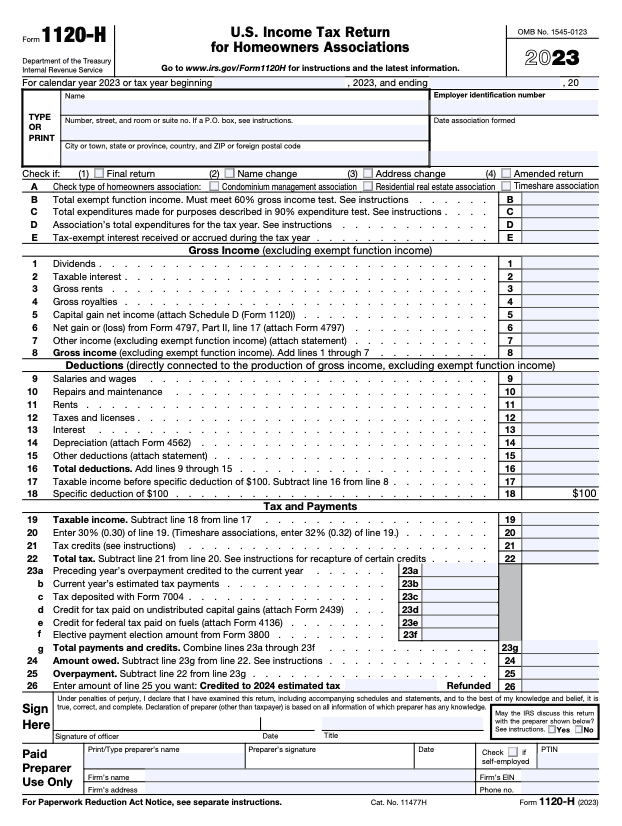

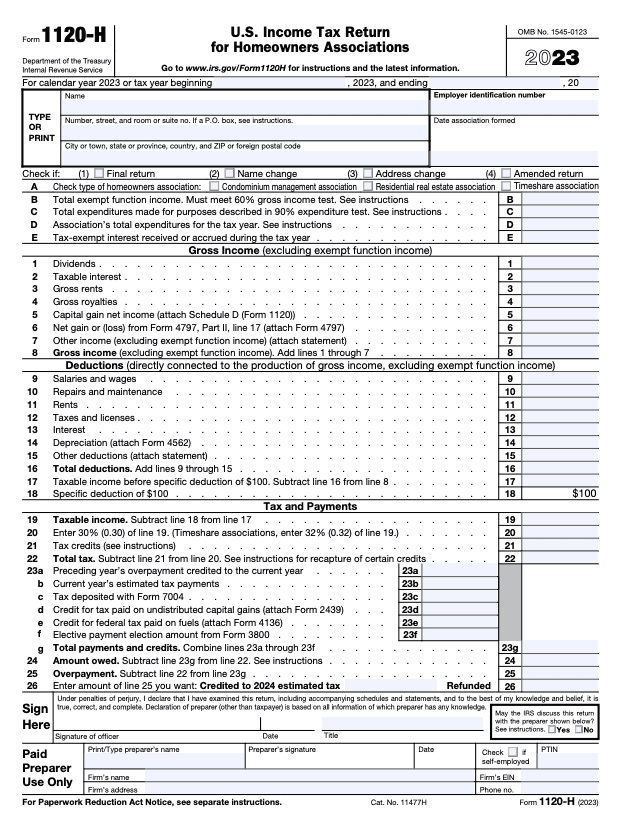

What is Form 1120-H?

Homeowners associations (HOAs) file Form 1120-H. Unlike traditional corporate tax returns, this form is much shorter, and specifically designed for HOAs. Any income from HOA facilities is taxed at a flat rate of 30% (32% for timeshare associations). On the 1120-H form, HOAs can exclude certain income from taxation, such as fees from members used for maintenance and services.

Example of Form 1120-H

Form 1120-H is only one page long and looks like this:

Instructions for filling out Form 1120

Accurate Form 1120 filing starts with preparation. Here’s what you’ll need to do:

Step 1: Gather the required documents.

Before diving into Form 1120, gather all relevant business and financial documents. Our 1120 tax preparation checklist can help you get started. Some documents and information you may need include:

- Last year’s tax returns (federal, state, and local)

- Gross receipts and sales

- Cost of goods sold (COGS)

- Tax deductions and tax credits (depreciation schedules, business use percentage of assets, mileage logs, etc.)

- Capital gains

- Dividend, interest, and royalties earned

- Liabilities

- Shareholder equity

You can find most of this information in your corporation’s financial statements, records, and previous tax returns or correspondence from the IRS.

Step 2: Fill out the business information.

The first part of Form 1120 requires basic details about your corporation, including:

- Name and address of the corporation

- Employer identification number (EIN)

- Date of incorporation

- Total assets at the end of the tax year

- Any name or address changes

You’ll also need to indicate if this is your first or final return.

Step 3: Complete the Income and Deductions section to calculate your tax liability.

Page 1 of Form 1120 focuses on your corporation’s income, deductions, and resulting tax liability. Here’s a quick breakdown:

- Income section: This includes gross receipts, cost of goods sold, and other income. If your corporation sold products, you’d need to report gross receipts minus COGS to determine gross income.

- Deductions section: This part of the form includes various business expenses like wages, rental costs, and advertising. Accurate reporting of deductions helps lower your taxable income.

Step 4: Complete the necessary schedules.

As previously noted, certain schedules must be attached to Form 1120 depending on your corporation’s activities. You may also need to complete other Schedules in addition to Form 1120, which we will review in the next section.

Step 5: File your Form 1120.

Once you’ve filled out Form 1120 and any necessary schedules, it’s time to file. You have two options:

- Mail your completed form to the address listed on the IRS website.

- E-file using tax preparation software like TaxAct®.

Using TaxAct Business makes filing your corporate income tax return easier by walking you through the process step by step. Just create an account with us, follow the prompts to fill in your corporation’s information, and we’ll help you submit it directly to the IRS.

Overview of the key schedules for Form 1120

Here are some additional schedules you might need to fill out in addition to Form 1120:

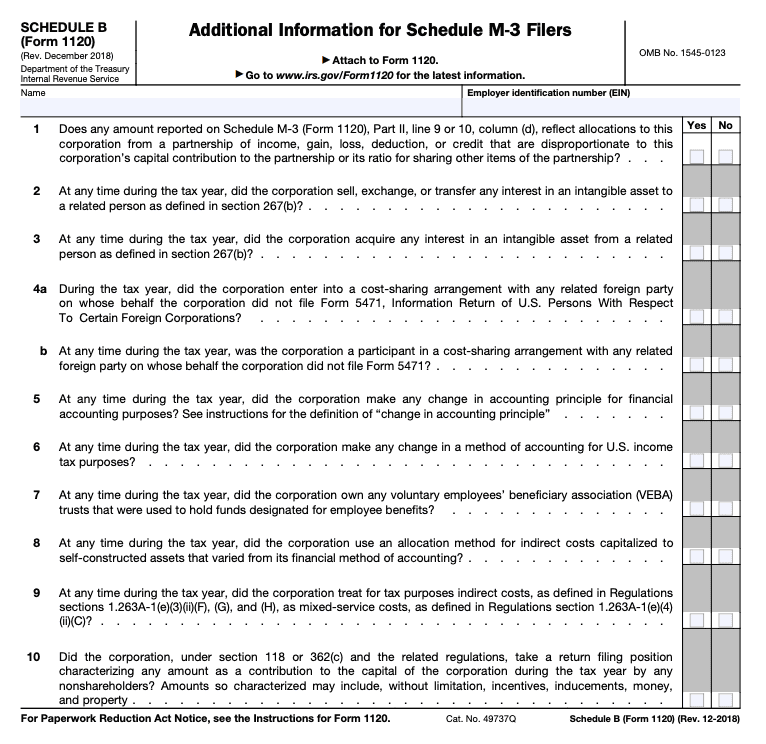

Schedule B

Generally, corporations filing Schedule M-3 need to file Schedule B. However, there may be exceptions if you have less than $50 million in total assets at the end of the tax year. This schedule asks specific questions to give the IRS a clearer understanding of your financials.

Schedule D

If your corporation deals with capital gains or losses from selling or exchanging assets, you’ll need to file Schedule D to report this to the IRS.

Schedule G

If you answer “Yes” to Schedule K’s questions 4a or 4b, you’ll need to file Schedule G. Any corporation with shareholders directly owning 20% or more (or owning at least 50% directly or indirectly) must file Schedule G. This is crucial for transparency around large ownership stakes. For example, if a shareholder owns 25% of your corporation, their information must be disclosed on Schedule G to ensure transparency with the IRS.

Schedule H

Personal service corporations (PSCs), like law firms or medical practices, use Schedule H to report limits on deductions. PSCs can elect a tax year other than a calendar year under section 444. When making this election, the PSC must meet certain minimum distribution requirements during the year. If it doesn’t, its deduction for payments to employee-owners is limited and the PSC needs to complete Schedule H and attach it to Form 1120.

Part 1 of Schedule H checks if the PSC meets the minimum requirement. If not, you can use Part 2 to calculate deduction limits.

Schedule M-3

In general, large corporations with total assets over $10 million need Schedule M-3 to reconcile bookkeeping income with taxable income (instead of Schedule M-1). This form contains three parts, with Part 1 pictured below.

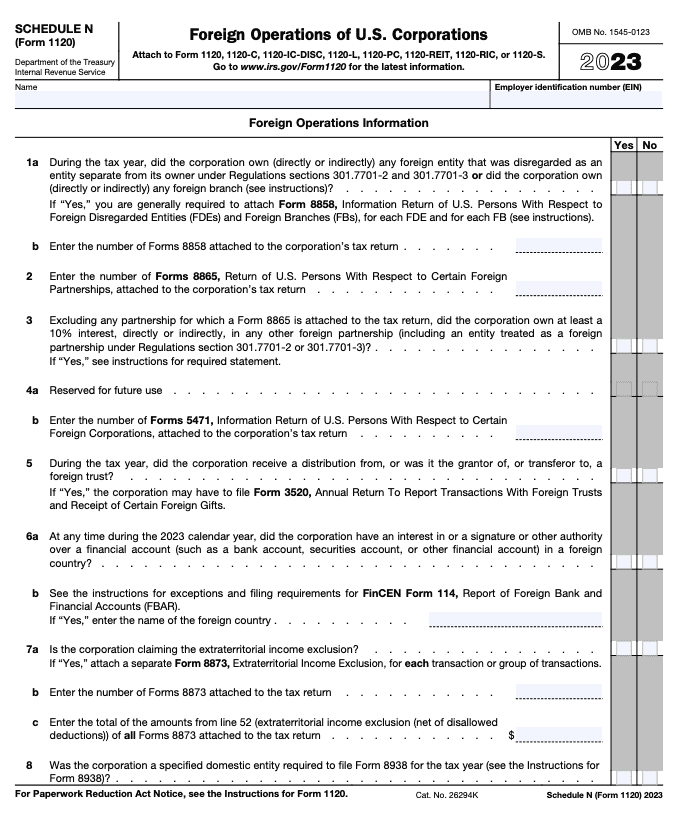

Schedule N

If your corporation has operations or assets outside of the U.S., Schedule N is required to report these foreign activities. For example, if your corporation owns a warehouse in Canada, Schedule N provides the IRS with information about those foreign assets. If you answer “Yes” to any question on Schedule N, you should attach it to Form 1120.

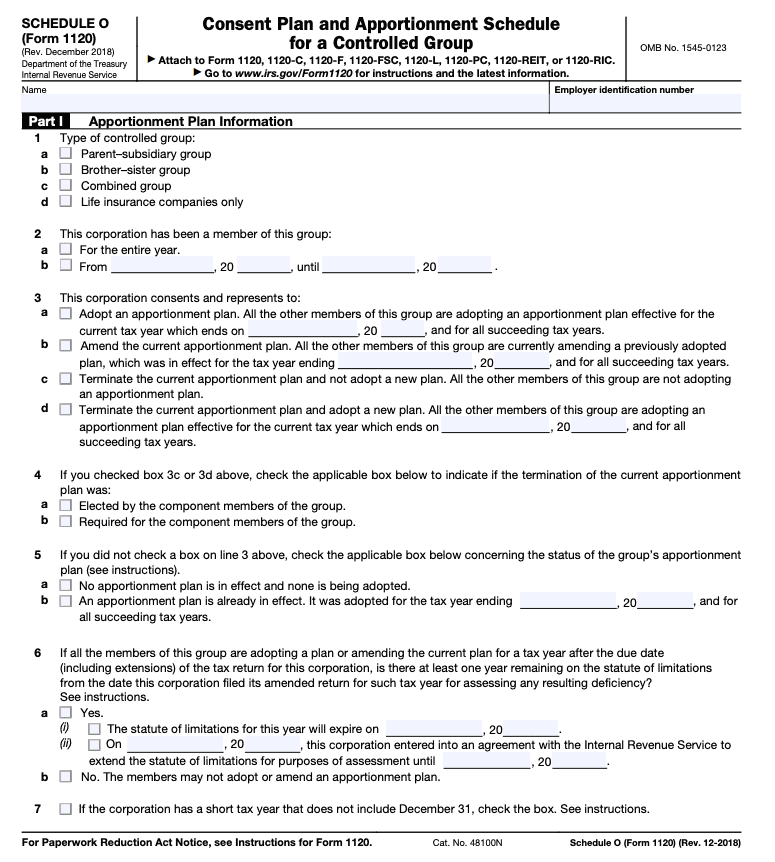

Schedule O

Schedule O is used to allocate taxable income between corporations in a controlled group. For instance, if your corporation is part of a group with a parent company and multiple subsidiaries, Schedule O helps divide the tax burden appropriately among them.

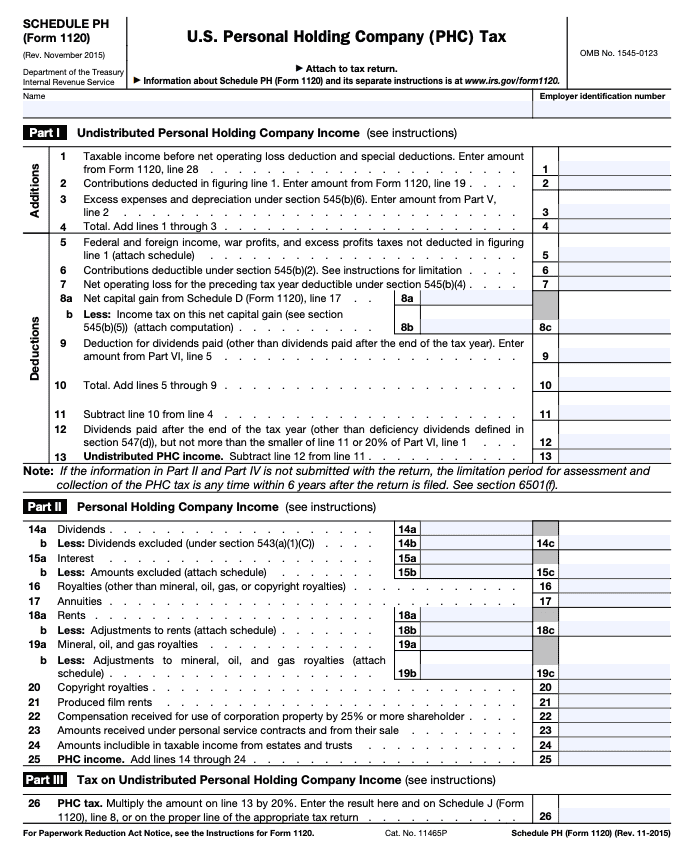

Schedule PH

This schedule is for corporations that qualify as personal holding companies (PHCs) and calculates the personal holding company tax. A PHC is a C corp in which more than 50% of its stock is owned by five or fewer people. Additionally, it must earn at least 60% of its income from passive sources. If your corporation is classified as a PHC, this schedule will determine your tax due.

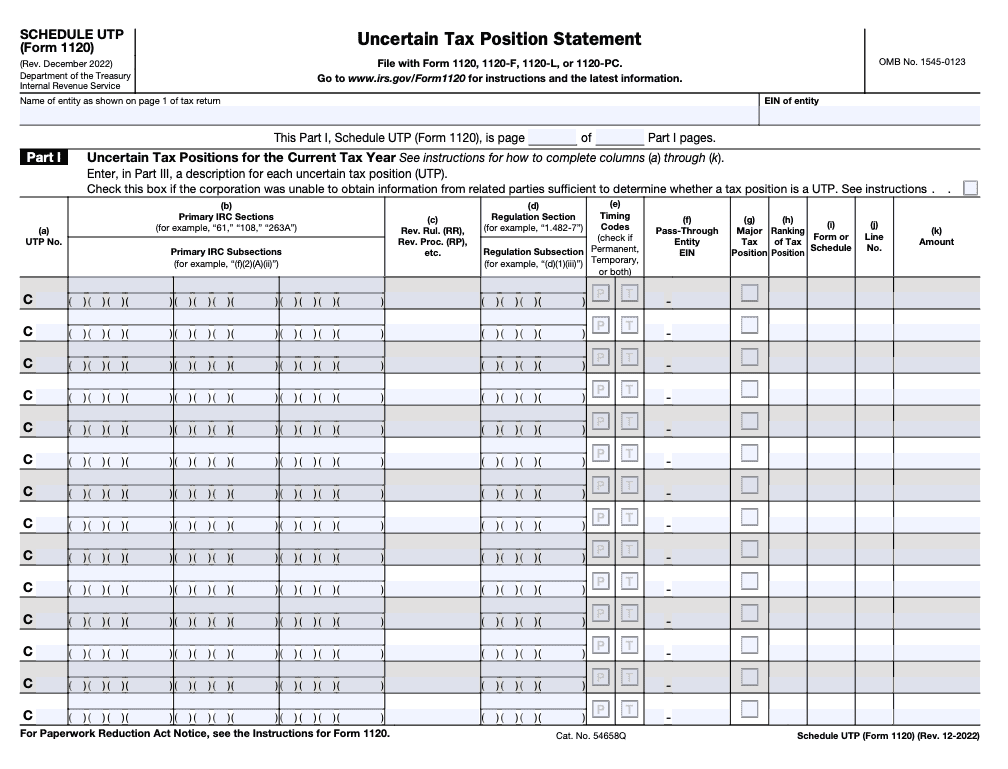

Schedule UTP

Schedule UTP is used by large companies with $10 million or more in assets to report uncertain tax positions. Basically, if a company takes a tax position that could be challenged by the IRS, they need to report it on this form.

For example, let’s say a company claims a big tax deduction on its return. If they know there’s a chance the IRS might disagree with that deduction, they need to report this on Schedule UTP.

FAQs about Form 1120

How to file Form 1120 with TaxAct

It’s easy to start filing Form 1120 with TaxAct. Here’s what you’ll need to do:

- Create a TaxAct account.

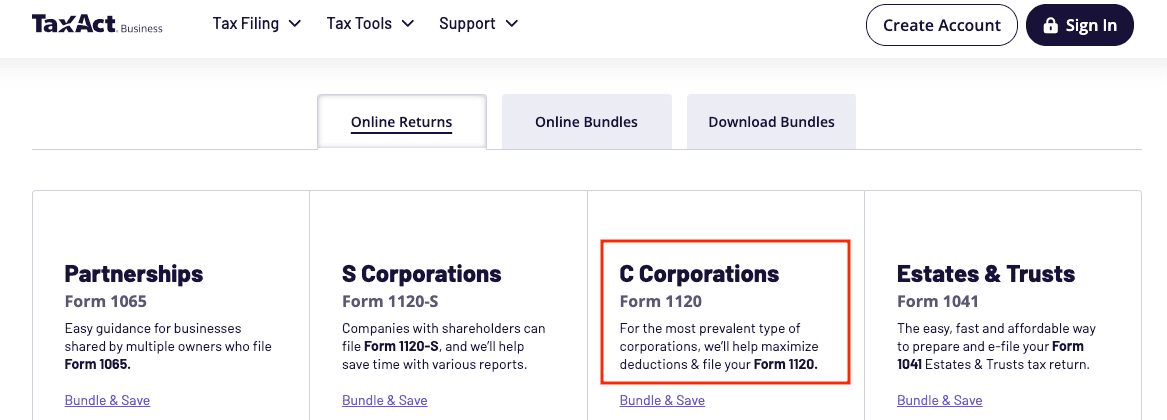

- Select C Corporations Form 1120 from the available options as shown below:

3. Follow the step-by-step instructions. We’ll start with asking you basic information about your corporation, and gradually work our way to your gross receipts, income, and deductions.

4. Continue with the interview process to fill out any necessary schedules.

5. Once complete, you can submit your corporate return directly to the IRS using TaxAct’s e-file option.

Can an 1120-H be filed online?

Yes, Form 1120-H can be filed online — you can even e-file it with TaxAct.

To file Form 1120-H within TaxAct 1120 Corporation:

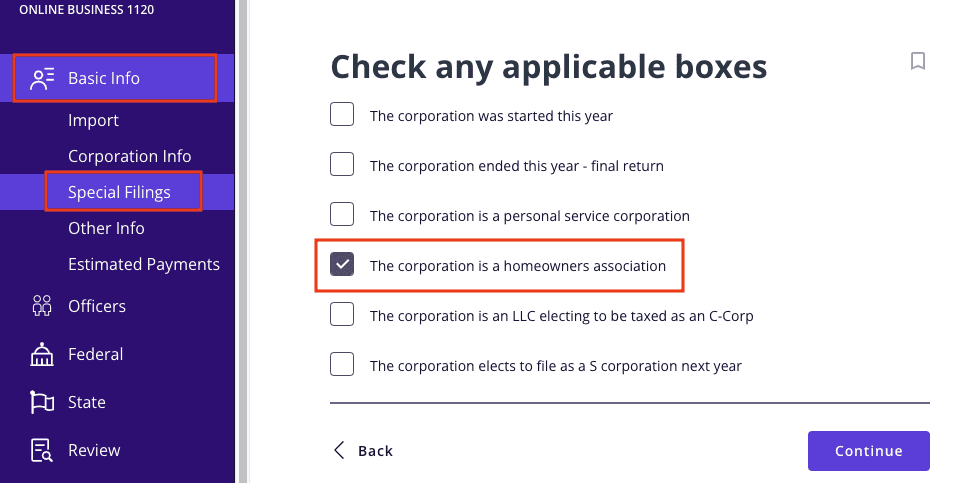

- From within your TaxAct return (Online or Desktop), click Basic Info on the left, then click Special Filings.

- On the screen titled Check any applicable boxes, check The corporation is a homeowners association, then click Continue as shown below.

3. Continue with the interview process to enter your information.

The bottom line

Corporate taxes don’t have to be a headache for taxpayers. You don’t have to be a tax professional to file your corporate tax return with TaxAct either! We can help save you time and stress filing Form 1120 this tax season, so you can focus on what you do best — running your business. Ready to get your tax filing out of the way? Get started with TaxAct Business.