Updated for tax year 2025.

Did you receive Form 1099-K this year? If you’ve never seen this document before and are unsure what to do with it, don’t freak out — we can help you understand your Form 1099-K and guide you through reporting any necessary income, if applicable.

Note: The One Big Beautiful Bill (OBBB) is now also being referred to by lawmakers as the Working Families Tax Cut Act. You may see one or both names used here, but they refer to the same set of tax changes.

At a glance:

- IRS Form 1099-K reports payments received via credit/debit cards and third-party networks.

- While there have been many proposed changes to Form 1099-K reporting thresholds, the One Big Beautiful Bill Act restored the threshold of $20,0000 and at least 200 transactions.

- This means third-party settlement organizations (TPSOs) are only required to send you a 1099-K for 2025 and beyond if you hit that transaction and payment threshold.

- Transactions are only taxable if they result in a profit.

What is Form 1099-K?

Form 1099-K is an informational return that records transactions from credit or debit cards and third-party payment networks. Once you hit a certain threshold in payments received from these platforms, the third-party app must send you Form 1099-K. They will also send copies of the form to the Internal Revenue Service (IRS) and the state.

Why did I receive a 1099-K?

Many types of 1099 forms exist, but Form 1099-K, Payment Card and Third Party Network Transactions, is most often sent to gig workers or those who use online payment platforms, apps, or payment processors. Rideshare drivers, independent retailers, or any small business that accepts credit card payments through a processor such as Square® or PayPal® are all examples of people who may receive a 1099-K.

You can receive Form 1099-K for a variety of reasons. How you report the income listed on your 1099-K depends on how you made that income, which can be confusing if you’ve never dealt with this form before.

You could also receive more than one 1099-K. For example, if you hit the $20,000 and 200 transaction threshold on both Venmo and Cash App, you’d receive a 1099-K from both companies.

1099-K requirements for 2025

TPSOs are required to send you a 1099-K in 2025 if you have at least 200 transactions and $20,000 or more in payments through the third-party platform (like Venmo®, PayPal, or Cash App®). The IRS originally planned to lower this threshold, but after some back-and-forth and the passage of the One Big Beautiful Bill (OBBB), the $20,000 and 200 transaction requirement is the federal rule for 2025 and every year going forward at this time.

1099-K requirements for 2024

The IRS temporarily lowered the 1099-K reporting threshold to $5,000 with no transaction minimum for tax year 2024. So, if you received a total of $5,000 or more through a payment app or online marketplace (even if it was just one transaction), you likely received a 1099-K for 2024.

For more details about how 1099-K requirements have changed in recent years, head over to The New 1099-K Reporting Thresholds: What You Need to Know. This article dives deeper into what these changes mean and some common Form 1099-K misconceptions. Or, check out the updated IRS FAQ page on Form 1099-K.

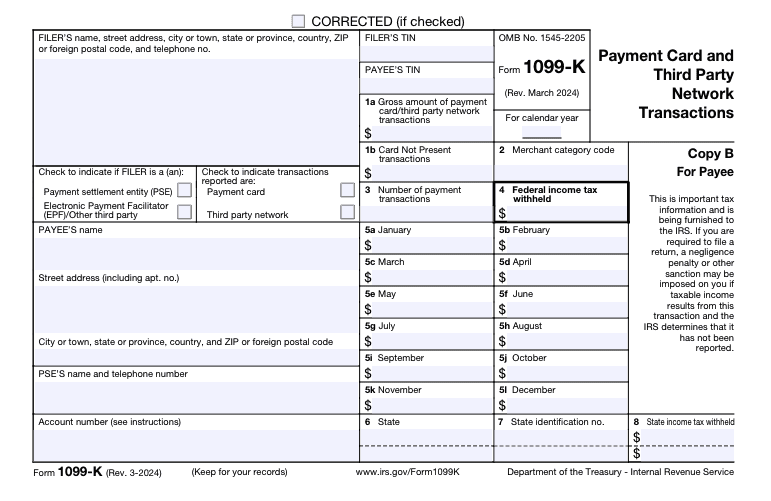

Example of Form 1099-K

Here’s an example of what Form 1099-K looks like and the information you’ll find on it:

Here’s a quick guide to the most important boxes you’ll want to pay attention to:

- Box 1a: Gross amount of payment card/third-party network transactions: Box 1a shows the total payments processed for you during the year. This figure is your gross income, meaning it doesn’t consider any refunds, fees, shipping, etc.

- Box 1b: Card not present transactions: This box details the total amount of payments where the card was not physically present (think online purchases).

- Box 2: Merchant category code (MCC): This code classifies the type of business you run (retail, food services, etc.), if applicable.

- Box 3: Number of payment transactions: The total number of payment transactions processed for you throughout the year. This is useful for your records and might be of interest if you compare year-over-year data or calculate average transaction amounts.

- Box 4: Federal income tax withheld: If any federal income tax was withheld from your payments, it will be reported here. This is unusual for most people, but if it applies to you, make sure to include this amount when you’re filing your taxes — it’ll go toward covering your tax liability.

- Box 5a-5l: Monthly gross amounts: These boxes break down the monthly gross payment amounts. This is handy if you want to track your income trends throughout the year or if you’re reconciling your own records with the 1099-K. It’s a snapshot of your monthly earnings, which can be useful if you’re trying to figure out why one month was so much better (or worse) than another.

Your Form 1099-K will also include the payer’s name (the form issuer) and taxpayer identification number (TIN). Your TIN, which could be your Social Security number (SSN) or employer identification number (EIN), will also be listed.

Form 1099-K instructions for real-life scenarios

To help put things into perspective, let’s review more detailed examples or reasons to receive a Form 1099-K and how to report your income accordingly.

1. Selling used personal items or reselling items

Did you sell any personal items during the year? If so, you typically only need to report the sale if you sold the item for more than you originally paid for it.

Taxable sale examples

Last year, you bought an old table for $50. After refinishing it, you sell it in 2025 for $300 through a payment app like Venmo. You made a $250 profit, which means you should report the $250 as a capital gain on your income tax return (even if you don’t receive a 1099-K from Venmo!).

You can use our capital gains tax calculator to calculate how much tax you might owe on a short- or long-term capital gain sale.

Reselling example

The same thing goes for reselling items. Say you bought concert tickets for $150, but you can’t attend, so you resell them online for $250 and get paid through PayPal. If your total sales through PayPal cross the reporting threshold (remember, it’s $20,000 and 200 transactions for 2025), PayPal will send you a 1099-K. But regardless of whether you receive a 1099-K, you’ll need to report the $100 profit as income.

Nontaxable sale example

You bought a TV eight years ago for $800 and sold it this year for $100. You received the money through Cash App. Even if you do get a 1099-K from Cash App, you don’t owe tax on this sale because you sold the TV at a loss. You don’t need to report the loss — personal losses aren’t deductible, but you don’t owe tax either.

Tax Tip: Form 1099-K reports your total payments, not just profits, so you may see nontaxable transactions on your form. Always check your own records to determine if anything is taxable!

2. Selling goods or services as a side hustle

Let’s say you ran a side hustle selling goods for a profit, such as produce at a farmers’ market. You had multiple payment methods — in addition to cash sales, you collected debit and credit card payments from buyers through Square. When tax season rolls around, Square sends you a 1099-K with a list of all your gross receipts from these transactions.

Because you sold all your goods for a profit, the IRS treats this as business income, and you will need to pay taxes on that income.

The same goes for freelancers and independent contractors. If you accept electronic payment card transactions for your services, you may get a 1099-K from the third-party payment network (like Square in the example above) and need to report that income, typically on Schedule C.

Tax Tip: You may receive a 1099-K for all your digital transactions, but remember to also document and report any cash sales you made!

3. Hobby selling

The IRS defines hobby selling as an activity that you engage in for sport or recreation with no intent to make a profit. If you sell handmade pottery as a hobby and earn $1,500 through Etsy® in 2025, you may or may not get a 1099-K, depending on the total number and value of your sales.

But either way, you must report the $1,500 as hobby income on your tax return, even if you don’t get a tax form from Etsy. Hobby income goes on Schedule 1, line 8j of Form 1040.

Unfortunately, you cannot deduct hobby expenses (like the clay and glaze for your handmade pottery) from your hobby income as you would deduct business expenses to reduce your profit.

4. Renting out personal property

When you rent out personal property — maybe household tools, yard equipment, or even your car or a room in your home — you must also report this income on your tax return.

For example, if you occasionally rent out some yard equipment during the summer and collect payments through an app like PayPal, you may receive a 1099-K reporting all your rental transactions. If you aren’t in the business of renting out your personal property (you only do it occasionally and don’t run it like a business), you’d report this income much like a hobby, but on Schedule 1, line 8l.

Unlike a hobby, you can deduct expenses related to the rental of personal property. You can do this on line 24b of Schedule 1 (Form 1040).

FAQs about Form 1099-K

Why you might still get a 1099-K (even if you didn’t meet the reporting threshold)

There are still instances where you might receive Form 1099-K, even if you didn’t meet the IRS reporting threshold. Let’s look at why you might receive Form 1099-K even if your transactions totaled less than $20,000 with at least 200 transactions in 2025.

1. You were subject to backup withholding.

Sometimes, if a payer does not have your correct TIN, they must start withholding a percentage of your payments. This is called backup withholding. It acts as a failsafe to ensure the IRS receives the required taxes on your income. The current backup withholding percentage rate is 24%.

For example, let’s say you sold various items on an online marketplace like eBay® or Etsy® this year. Because the payer (the online marketplace) did not have your TIN (typically your Social Security number), they started withholding 24% of your payments.

In the scenario above, since you were subject to backup withholding, the online marketplace would send you Form 1099-K listing your gross payment transactions for the calendar year.

2. You live in a state with a lower 1099-K reporting threshold.

When you receive Form 1099-K also depends on your state. Not all states follow the IRS filing threshold and instead implement their own requirements. Here’s a list of states that could issue more Form 1099-Ks for tax year 2025 due to lower reporting thresholds.

1099-K threshold by state

- Arkansas – $2,500 threshold

- District of Colombia – $600 threshold

- Illinois – $1,000 threshold and 4 transactions

- Maryland – $600 threshold

- Massachusetts – $600 threshold

- Montana – $600 threshold

- New Jersey – $1,000 threshold

- North Carolina – $600 threshold

- Rhode Island – $100 threshold (if no state tax was withheld)

- Vermont – $600 threshold

- Virginia – $600 threshold

Note: The list above is subject to change, as state regulatory agencies still need to fully finalize their requirements.

3. The third-party payment network decided to implement a lower threshold anyway.

While payment platforms and online marketplaces are only required by law to send a 1099-K if you meet the minimum threshold for your state or for the IRS, some companies may choose to issue 1099-K forms for lower amounts, especially given all the recent changes to 1099-K requirements.

So, if you get a 1099-K for less than the threshold, don’t panic. It doesn’t automatically mean you owe taxes on those payments — it just means the payment platform reported your transactions to the IRS (and possibly your state). As always, it’s a good idea to keep accurate records of your income and know what is and isn’t taxable.

How to report Form 1099-K income with TaxAct

TaxAct takes accurate tax reporting seriously. That’s why we’ve spent much time and care optimizing our 1099-K reporting. Our detailed Q&A includes various questions about what your 1099-K was for so we can help pull the proper tax forms for you.

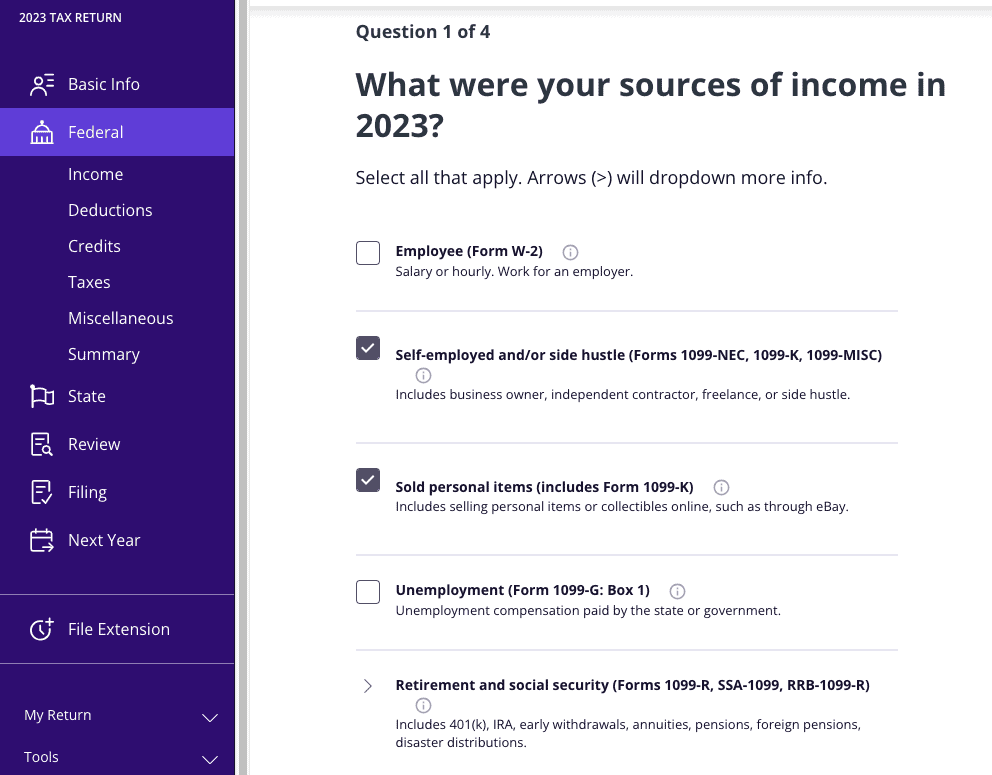

First, we’ll ask you for information about what types of income you’ve earned this year:

As you can see from the TaxAct product screenshot above, Form 1099-K appears in more than one place. Typically, those who received this form are self-employed, operate a side hustle, or sell personal items online. You could also receive a 1099-K for real estate rentals, royalties, or farming.

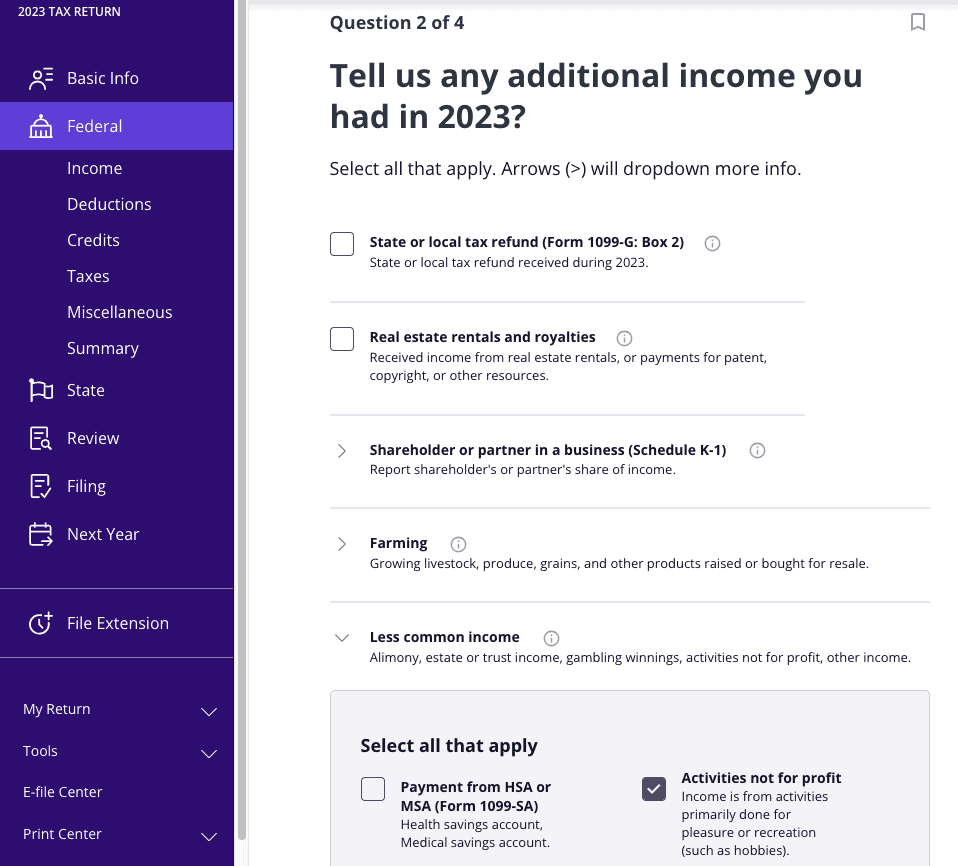

If you received a 1099-K for goods you sold as a hobby, you can select this in the next section under Less common income. Then select “activities not for profit,” as shown below:

As you go through our 1099-K reporting process, we’ll ask you comprehensive questions about your payment transactions and who sent you the 1099-K. If you have more than one 1099-K, we’ll go through them one at a time. You may also have multiple businesses on a single 1099-K; if so, we can also help walk you through that process.

Knowing what the payments were for helps us determine whether you owe taxes on that income. Based on your answers, we’ll help you correctly report the income and enter any expenses to reduce your taxable income, if applicable.

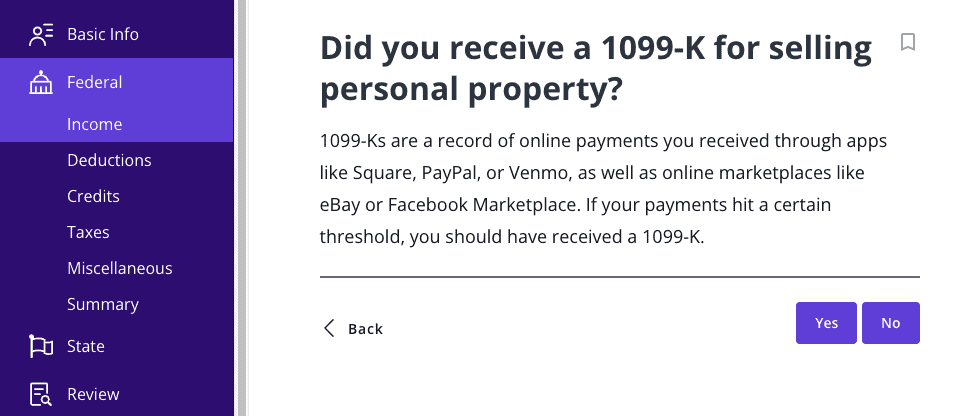

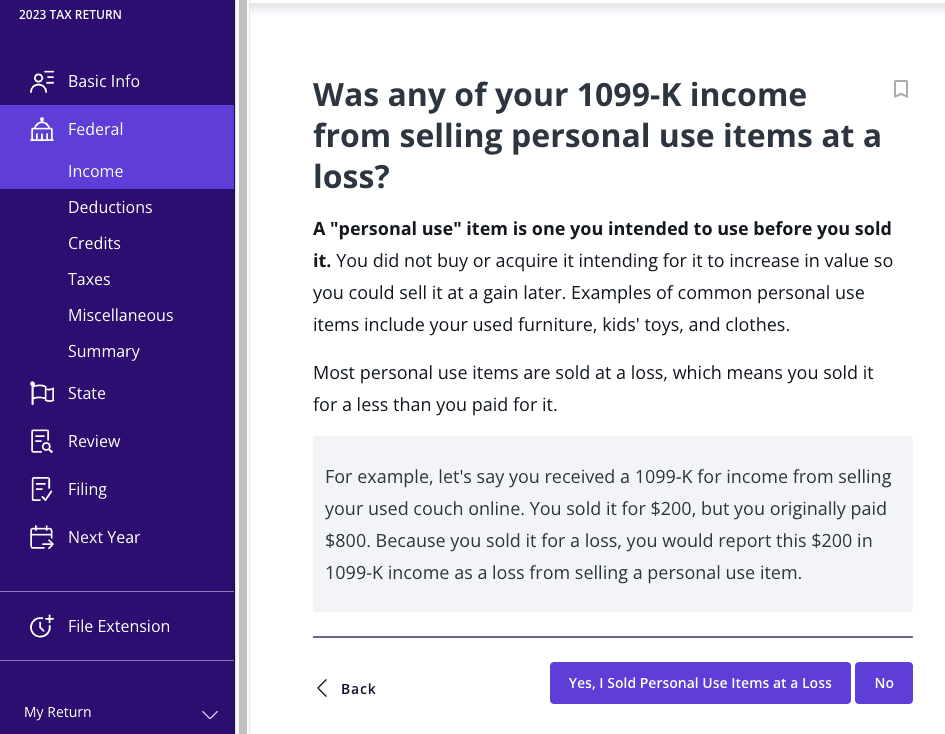

Here’s an example question:

This would be a good time to reiterate that not all the transactions on your 1099-K are necessarily taxable income. Form 1099-K only shows the gross amount of all your payment transactions, while you only owe taxes on your net income. For instance, if you sold a personal item at a loss, no income would be recognized, and you would not owe income tax.

Our tax preparation software will help you decide which transactions are taxable and which are not based on the information you provide. After you’ve entered all the applicable transactions from your 1099-K, we’ll review what you told us. At this point, you can go back in and edit or add to each section if necessary. After that, you’re done with your 1099-K!

The bottom line

If you receive an unexpected Form 1099-K this year, knowing what it’s for and how to use it is essential. TaxAct makes the reporting process as simple and straightforward as possible. When you e-file with us, you can rest easy knowing we’ll guide you through it step by step.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

All trademarks not owned by TaxAct, Inc. that appear on this website are the property of their respective owners, who are not affiliated with, connected to, or sponsored by or of TaxAct, Inc.