If you’re new to being a self-employed taxpayer or you’ve hired an independent contractor for the first time recently, one of the first things you need to understand is the different tax forms you’ll be dealing with. In this article, we will focus specifically on IRS Form 1099-NEC, which details nonemployee compensation.

At a glance:

- 1099-NEC reports payments of at least $600 to nonemployees in 2025.

- Beginning in tax year 2026, this $600 threshold will increase to $2,000 and be indexed for inflation each year after that.

- Nonemployee compensation used to be reported on Form 1099-MISC but now has its own separate form.

- Payers should file Form 1099-NEC by Jan. 31 to avoid penalties.

What is IRS Form 1099-NEC, Nonemployee Compensation?

Form 1099-NEC, Nonemployee Compensation, is a tax form specifically designed to report payments made to those who aren’t considered employees. Freelancers, independent contractors, or those who are otherwise self-employed, may receive one or more 1099-NEC forms from clients detailing how much they were paid during the tax year. As a payer, you’ll need to file this form to comply with IRS rules. As a payee, you’ll need this form to correctly report your income when filing your income tax return.

Who needs a 1099-NEC form?

If you provide services as an independent contractor, freelancer, or self-employed individual during the year, your payers must send you a 1099-NEC form detailing your compensation if they paid you at least $600 during the year. Starting in 2026, payers are only required to send Form 1099-NEC for payments of at least $2,000.

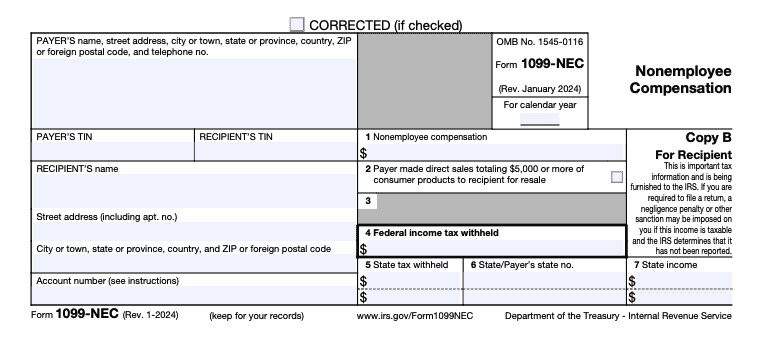

Example of Form 1099-NEC

Here’s a visual example of Form 1099-NEC to help you understand the layout and information reported on this tax form:

What is reported on a 1099-NEC form?

Nonemployee compensation refers to compensation paid to independent contractors who are not traditional employees. While employers will automatically withhold payroll taxes for employees, independent contractors will likely not have any taxes withheld from their pay. And if no tax is withheld from your pay, you’ll have to make those payments yourself each quarter.

Your 1099-NEC form simply reports the total amounts you were paid during the year from each payer. This form helps the IRS track income you receive outside traditional employee-employer relationships.

Here’s a breakdown of what information you’ll find on your 1099-NEC form:

- The payer’s information: This is the information of the person who paid you. On the 1099-NEC, you’ll find their name, address, and taxpayer identification number (TIN), so you know who the 1099-NEC is from.

- Your information: As the recipient, your name, address, and TIN will be on the 1099-NEC form as well. Your TIN can be your Social Security number (SSN) or your employer identification number (EIN).

- Payment details:

- Box 1: Here, you’ll be able to see your total nonemployee compensation.

- Box 2: Your client will only check this box if they made direct sales totaling $5,000 or more of consumer products to you for resale.

- Box 3: Box 3 is not used on 1099-NEC forms and should be grayed out.

- Box 4: This box is for federal income tax withholding. If the payer collected any backup withholding from you, you’ll find that amount here.

- Boxes 5-7: The IRS provides these boxes for convenience, but payers do not have to complete these sections, so they may be blank. If any state income tax was withheld, you’ll see that amount in box 5. Box 6 is for the state identification number, and box 7 records the amount of state income.

If you choose to file with us at TaxAct®, we can help walk you through reporting your 1099-NEC income on your federal and state income tax returns.

FAQs about Form 1099-NEC

The bottom line

The 1099-NEC form is vital for accurate reporting of nonemployee compensation. As a 1099-NEC payer or recipient, you should understand what gets reported on this tax form, the deadlines for filing it, and the importance of accuracy to mitigate any potential penalties and ensure a smooth tax-filing experience for everyone.

Ready to file your gig work taxes? TaxAct can help you get started.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.