Updated for tax year 2024.

It happens. You filed your tax return on time, and you planned to forget about taxes for another year … but you just discovered a mistake on your federal tax return. What do you do? Do you file a new return with the Internal Revenue Service and tell them to forget about your original return? Do you amend your tax return to fix it? Do you owe a penalty for making a mistake?

Don’t worry. The IRS allows you to correct your return even if you make a massive mistake, like forgetting to enter your Form W-2 earnings. The IRS has seen it all before. Unless you committed fraud or tax evasion, they wouldn’t hold it against you.

We will walk you through the four Ws (What, When, Why, Where) of amending a tax return and offer suggestions to prevent the need for an amendment.

Why file an amended tax return

You found an error on your original federal return. Did you enter your Social Security number incorrectly? Did you check the wrong box for your filing status? Did you simply make a typo when entering your Form W-2 wages? Did you forget to record a charitable contribution or other tax deduction?

Not all errors are created equally. Some errors are worthy of an amendment, while others are not.

Errors worthy of amendment include:

A substantial noncash contribution

Additional business deductions

Income, such as unemployment benefits, that you didn’t know you should report

A corrected form from your employer, financial institution, or a partnership

An incorrect Social Security number for yourself, your spouse, or a dependent

Other inconsequential errors are not worthy of amending a tax return. For example, if you found a small $20 receipt for a charitable contribution or additional mileage for a business trip, it’s not worth your time to amend your return.

If you calculated your return by hand, didn’t use tax software, and made a math error, generally, the IRS will “find” these errors and make the corrections for you. The IRS will send you a letter informing you they found an error and corrected it. You do not need to file an amended return if you agree with the corrections.

When to file an amended return

Don’t wait! File the amendment when you discover the error. You’ll have to complete a separate amendment for each year if you need to amend more than one year’s tax return. Filers don’t have forever to amend a tax return. But you generally have three years to amend your tax return. In cases where you paid tax after you filed your original return, you only have two years to amend.

If you discover you missed a tax credit for several years, you generally can only amend returns for the prior three years to claim a tax refund. For example, you realized you qualified for the Earned Income Tax Credit (EITC) but didn’t take it. The EITC is a refundable tax credit. So even if you owed no taxes, you could file an amendment and claim a tax refund.

Other tax credits, such as the child care credit or dependent care credit, are non-refundable. Therefore, if you owed no taxes, there is no use in filing an amendment for these unclaimed credits.

Note: If your amendment is to claim an additional tax refund, wait until you receive the original refund before filing the amended tax return.

What to file when amending your return

Repeat after us: Amend a tax return, don’t file a new return!

Filing an amended federal return may be easier than you think. You don’t have to start over. Instead of resubmitting your original return or filing a new one, you file Form 1040-X, Amended U.S Individual Income Tax return, to change incorrect items.

And most importantly, only correct the forms that change. For example, if you are correcting your self-employment income on Schedule C, only file Form 1040-X and the corrected Schedule C. Do not file any other schedules or forms. If you filed Schedule A with your original return, don’t file it again with your amendment. Just keep reminding yourself that less is more.

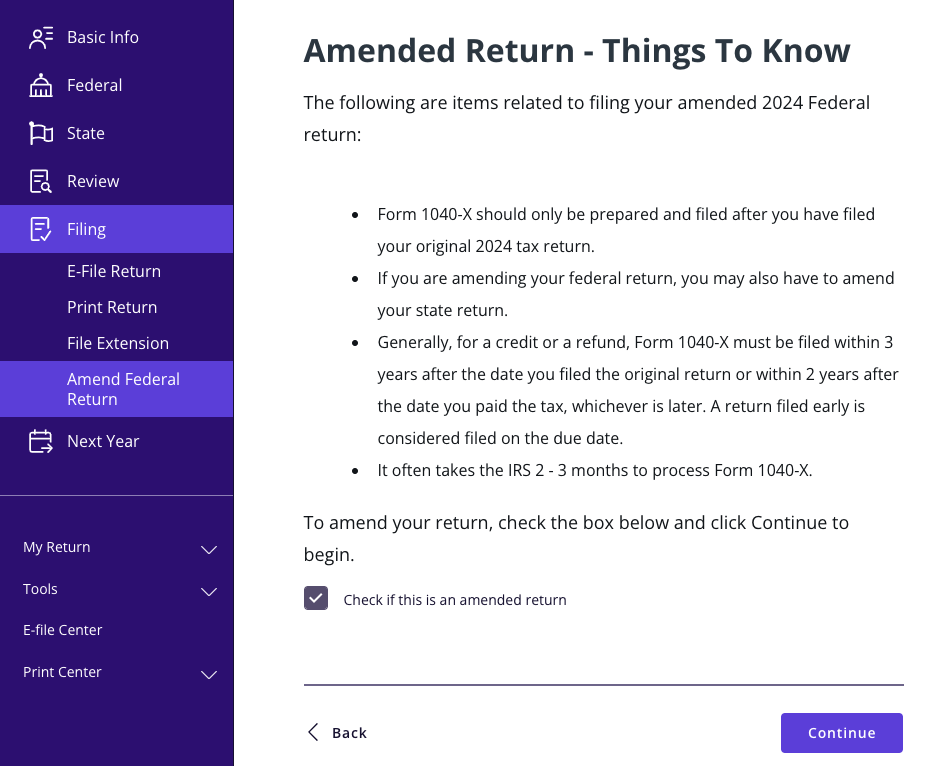

To file Form 1040-X using TaxAct®, sign into your account, open your return, and click Amend Federal Tax Return under the Filing tab as shown below.

Once you hit the amendment steps, follow the prompts, and revise your return as needed.

And before you finish, don’t forget your state return. Changing your federal income tax return could affect your state income tax return. You must amend both returns if you live in a state with income tax.

Where to file your amended return

If you filed Form 1040 or 1040-SR electronically and it was accepted by the IRS, you can e-file Form 1040-X. You can create and e-file an amended return with TaxAct using these instructions. If you mailed in your amended return instead of e-filing, you can track its status through the IRS Where’s My Amended Return tool.

What if I owe money? Will I have to pay a penalty?

If it’s after the tax deadline, and you discover you underpaid your taxes, you may owe a penalty plus interest. Pay the tax due immediately to minimize interest and penalties.

However, if you have a good cause, such as erroneous information sent to you, be sure to attach a statement with your amended return and ask for an abatement of the penalty. The IRS often grants abatements when taxpayers attempt to correct problems on their own and as soon as possible. In fact, the IRS can be pretty reasonable.

Note: Amending your tax return does not increase the risk of being audited.

How to avoid mistakes in the future

You can avoid most tax return mistakes by organizing your information before filing your taxes. It also helps to not wait until the last minute to start your return. Tax software handles the math for you and checks your return for errors, missing information, and potential tax savings.

It is also essential to read your tax return before you file it. Comparing it to last year’s return can help jog your memory about potential deductions and other items you should report.

Don’t hang on to your unfiled return too long just because you’re afraid it’s not perfect. It’s better to file your return on time than pay penalties for filing late, even if you have to amend it later.