Now Available: TaxAct’s Stimulus Registration

Need to register for your stimulus payment? Find out here.

Last updated: April 13, 2020

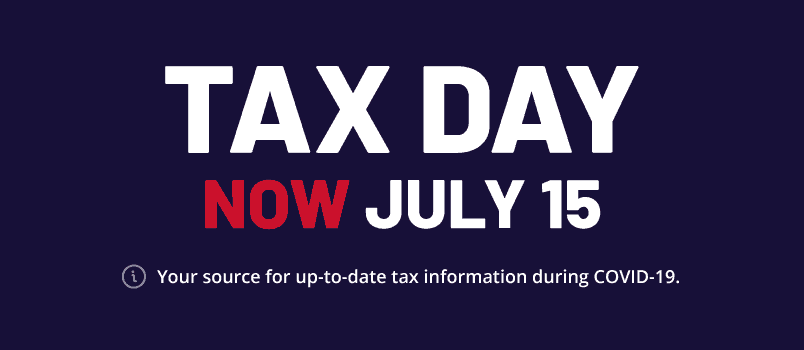

COVID Tax Relief – The deadline to make tax payments has been extended.

As your email inbox floods with school closure announcement, a falling stock market, and measures to self-quarantine, filing your taxes has likely slipped your mind. And for good reason. The impact of the Coronavirus on taxes is vast and rapidly changing day-by-day.

At TaxAct, nothing is more important to us than the health and well-being of our customers, employees, and the communities in which we live and work. During this time, we encourage you to make every effort to stay as protected as possible. And when you have time to put the focus back on your taxes, we’ll be here to help. Rest assured, we are equipped to continue offering all of our services without interruptions.

Impact of COVID-19 on taxes

Amid all of the COVID-19 news, there has been a lot of speculation this week regarding how the pandemic may impact tax season. Numerous changes and updates occurred over the past few days. We’d like to help set the record straight, according to the most recent developments.

On March 20, the Secretary of Treasury announced the tax deadline to file your federal individual income tax return has been extended to July 15, 2020. All filers now have an extra 90 days to file their federal individual income tax returns without being subject to late filing penalties. Read more about the COVID-19 tax relief in the official notice released by the IRS.

Other important details to know:

- Deadline to make tax payments has been extended: The deadline to make tax payments was also pushed back to July 15, 2020. That means if you have a tax bill this season and need extra time to pay it, your wish was granted. All individual and non-corporate tax filers can hold off on submitting those payments (up to $1 million for tax year 2019) until July 15 without accruing penalties and interest. This deferment also applies to estimated tax payments originally due on April 15 for tax year 2020.

- No extra forms needed: As a part of COVID-19 tax relief, you do not need to file a tax extension to take advantage of the new deadline. The IRS will automatically waive all interest and penalties.

- Note: If you need additional time beyond July 15 to file your return, you need to file an extension.

- State deadlines vary: Several state deadlines to make tax payments have been adjusted as well. Visit our COVID-19 Response: State Deadlines Extended page to check your state’s deadline.

- IRA, HSA, and MSA contribution deadline extended: As per the Coronavirus tax relief information, you now have until July 15, 2020 to make contributions to an Individual Retirement Account (IRA). That’s three extra months to beef up your retirement savings. (Tip: When you submit your contribution, make sure your IRA custodian knows to earmark that money for 2019 and not your 2020 return.)

Additionally, the contribution deadline for Health Savings Accounts (HSA) or Archer Medical Savings Accounts (MSA) was pushed to July 15.

Quarterly estimated tax payment deadlines extended: The due dates for Q1 and Q2 quarterly estimated taxes, normally April 15 and June 15 respectively, are extended to July 15.

Stimulus payments will be issued: The CARES Act was recently signed into law. Part of the economic relief included are the Economic Impact Payments – or otherwise known as stimulus relief checks. Find out more about your possible stimulus payment here.

Your refund is waiting

Despite the impact of COVID-19 on taxes, the IRS is still processing returns as usual. If you expect to receive a refund, we highly encourage you to not wait to file your return. You can anticipate receiving your refund at the normal rate. E-filing your return makes it easy to keep yourself and your private tax information safe and secure.

Continue to check this page for the most recent updates on the tax season changes related to COVID-19. And as always, if you have any questions, our Customer Care Team is ready to help.