Updated for tax year 2025.

If you engaged in crypto trading last year, it’s possible you could receive Form 1099-K this tax year. But what is this form telling you, and what should you do with it? Let’s break it down together.

At a glance:

- Third-party payment networks process crypto transactions and may issue Form 1099-K for tax purposes.

- Crypto is taxed as property, and taxpayers must report gains and losses accordingly.

- Form 1099-K doesn’t detail gains and losses; it only summarizes transactions.

What are third-party payment networks?

To make virtual currency trading more user-friendly, crypto exchanges (like Coinbase® or Gemini®) have enabled users to make transactions through third-party payment networks. Third-party payment networks are companies that process credit card and other online payment transactions for online retailers (or crypto exchanges, in this instance). Some examples are PayPal®, Venmo®, Google Pay®, and Apple Pay®.

Why did I receive a 1099-K from my cryptocurrency exchange for crypto trading?

Third-party payment networks and online retailers use Form 1099-K for crypto taxes to report the transactions from your processed payments. Not all crypto exchanges utilize Form 1099-K — they may instead issue other 1099 forms like 1099-MISC, 1099-B, or a new form for 2025 called Form 1099-DA — but some do. And if you use more than one crypto exchange or other third-party payment network, you may receive multiple 1099-K forms.

In the past, the IRS only required third-party payment networks to report transactions to the IRS if you had at least 200 third-party network transactions totaling at least $20,000 in a year. This was the standard for years.

For a while, there was a lot of buzz and confusion because the IRS planned to dramatically lower the 1099-K threshold to $600, regardless of transaction count. However, the One Big Beautiful Bill Act (passed in 2025) officially restored the original thresholds for 1099-K reporting. That means third-party payment networks are only required to send you a 1099-K if you have more than 200 transactions AND more than $20,000 in total payments for the year.

So, if you had 10 cryptocurrency transactions totaling $6,000 in 2025, you wouldn’t necessarily receive a 1099-K because you’re under both the $20,000 and 200-transaction limits. On the other hand, if you had 250 transactions totaling $25,000, you could expect a 1099-K.

Crypto exchanges may still choose to send you a 1099-K even if you don’t meet those thresholds, or they may use other 1099 forms instead. If you received a 1099-K for your crypto transactions this year or expect one next year, it just means your exchange is complying with the current IRS rules and reporting requirements.

Is cryptocurrency taxed? Do I need to report my crypto income to the IRS?

Yes, to both, although the way to report crypto income on your tax return differs from typical W-2 income.

The IRS considers cryptocurrency a digital asset for crypto investors and treats it as a form of property. There are two different ways virtual currency can be taxed:

- Capital gain: If you sell virtual currency for more than your cost basis (purchase price), you must report the profit as a capital gain. You can also use crypto losses to offset your gains and lower your taxable income.

- Ordinary income: If you were compensated with cryptocurrency, it’s considered ordinary income and taxed as such. In this case, you’d report the income as “other income” on your federal income tax return.

It’s important to note that Form 1099-K does not report your crypto gains and losses — it merely summarizes all your crypto transactions. This means that not all the transactions reported on the 1099-K are necessarily taxable, which can make the form extremely confusing, especially for new crypto traders who aren’t expecting to get one.

If you want to estimate your crypto taxes before filing, try our crypto tax calculator or Bitcoin tax calculator.

How do I report my 1099-K for cryptocurrency?

Since 1099 forms are purely informational, you don’t need to include them with your federal income tax return, but you should use any 1099s to report relevant income correctly.

You may have other tax forms related to crypto trading, such as Form 1099-MISC or Form 1099-B. If applicable, you can use these forms in conjunction with Form 1099-K to correctly report your crypto profits and losses.

TaxAct® strives to make crypto tax reporting as straightforward as possible. As you go through the e-filing process with us, you’ll see a section called “Less common income.” Once you check this box and select the type of income you received, you’ll see a section on cryptocurrency:

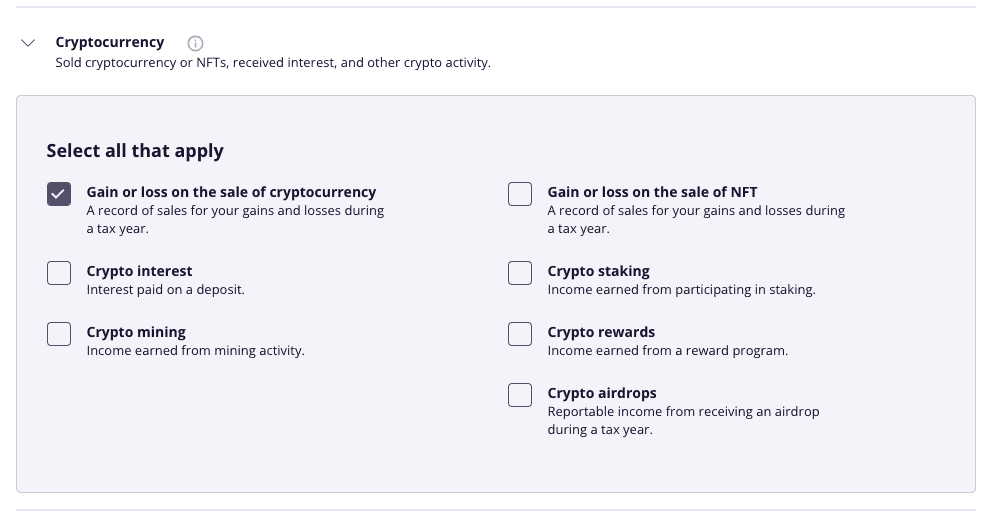

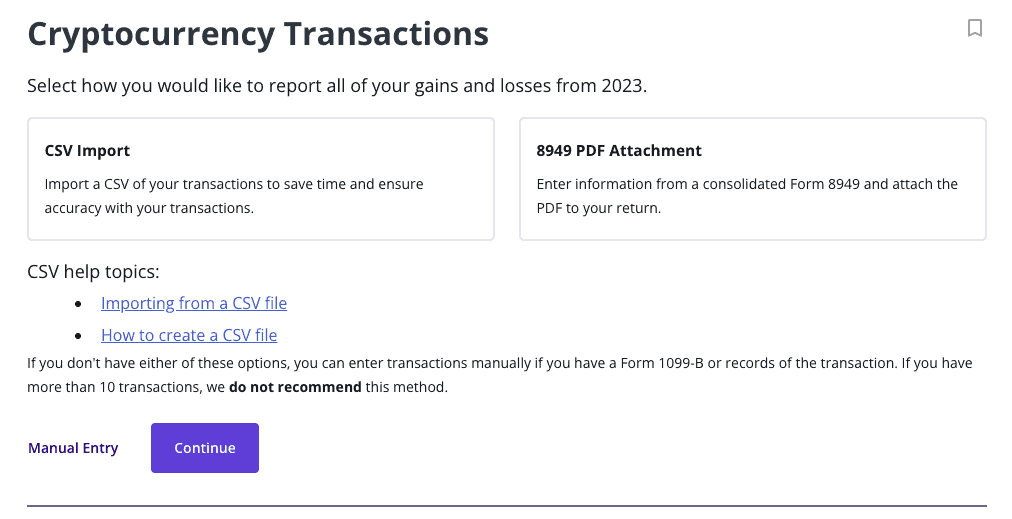

On this screen, you can check all the boxes that apply to your crypto transactions for the current tax year, including gains, losses, crypto interest, mining income, etc. We’ll ask detailed questions about each category to help you correctly report your crypto income. You’ll also be able to import a CSV of your transactions, if you have one, or do so manually:

After you’ve gone through our crypto reporting section, you should be all set.

The bottom line

If you receive an unexpected Form 1099-K from your crypto exchange this year, make sure you know what it’s for and how to use it. Filing with TaxAct makes the process stress-free — our tax software will guide you through it step by step so you can file quickly and confidently.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

All trademarks not owned by TaxAct, Inc. that appear on this website are the property of their respective owners, who are not affiliated with, connected to, or sponsored by or of TaxAct, Inc.