Energy Efficient Home Improvement Tax Credits

File your taxes with confidence.

Your max tax refund is guaranteed.

Updated for tax year 2020

Remembering to turn off the lights on Earth Day may help bring attention to energy usage and our commitments to being responsible consumers, but that’s not where it ends. If you want to make a permanent difference in how much energy you use on a daily basis, it’s time to take a serious look at your home. There are a variety of energy-saving home improvements you can make to help increase energy efficiency and decrease your carbon footprint.

But, if you’re worried about how the cost of these projects may impact your piggybank – there’s good news! Two different home energy credits are available for homeowners to help decrease that dollar amount.

Non-Business Energy Property Credit

Are you looking to update your home’s insulation, windows, doors, or roof? If so, you may qualify for a tax credit for up to 10 percent of the amount you paid or incurred for qualified energy efficiency improvements installed during the year. This also applies to any residential energy property costs.

However, there are a couple of key points to be aware of. The credit is only available for those who did not claim more than $500 worth of home energy credits in earlier years. Any credit amount that was received after 2005 must be subtracted from the “lifetime” $500 credit cap.

Within that credit cap, there are several limits on individual items:

- Windows: $200

- Furnace circulating fan: $50

- Natural gas, propane, furnace, or boiler: $150

- Any single residential energy property cost: $300

Residential Energy Efficient Property Credit

If you make energy-saving improvements to an existing home or one currently being constructed, you may be able to snag up to 30 percent back on your cost of any qualified property. This includes alternative energy equipment, such as solar energy systems, fuel cells, small wind energy systems, or geothermal heat pumps. Be sure to take a look at the manufacturer’s certification to guarantee the product qualifies for the credit.

Additionally, there’s no limit to the amount of credit you can take. If you can’t use the entire credit this tax year because your income taxes are lower than the credit amount, you can carry the unused portion forward to the next year.

How to claim energy tax credits

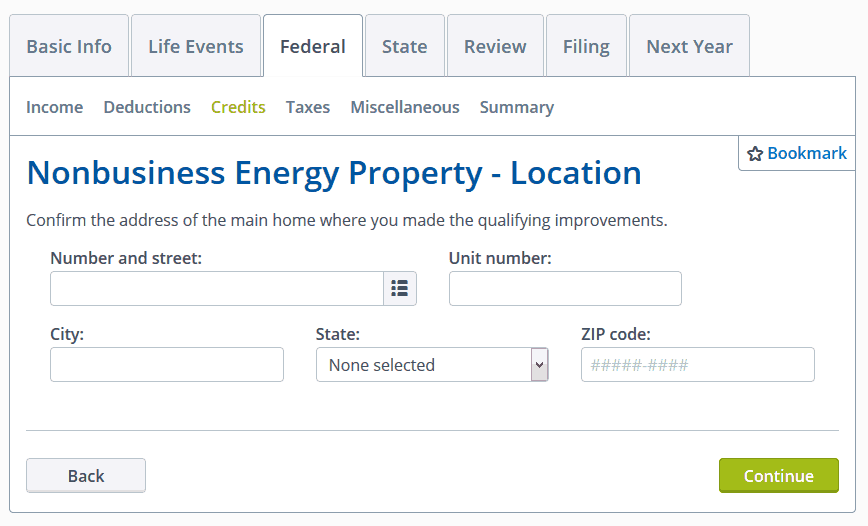

To claim any of these home energy tax credits, you’ll need to complete Form 5696, Residential Energy Credits. Be sure to keep receipts from your purchases in a safe spot until you’re ready to tackle the tax filing stage.

And, to make it easy, enter any cost information you have on qualifying purchases into TaxAct. The program will calculate the credit for you and automatically report the amount on Form 5696. No sweat, no hassle.

Hurry, these credits may expire

Although the energy tax credits have been routinely extended, they may not be around forever. Currently, both are set to expire at the end of 2016.

Extra opportunities to save

In addition to home energy credits, a variety of other tax breaks and deductions are available to homeowners. Several government agencies and utilities offer “green” incentives. Check out the U.S. Department of Energy to see what additional energy-saving home improvement benefits may be available in your state.