Sorry, but nothing matched your search terms.

Please try again with some different keywords.

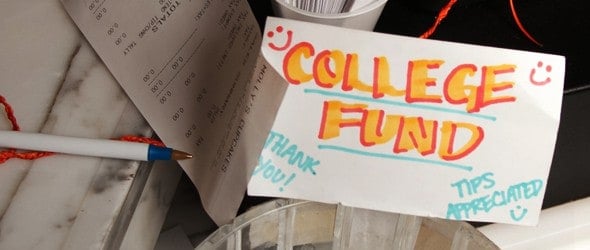

Set Your Own Financial Limits (And Stick to Them)

8 minute read

Sorry, but nothing matched your search terms.

Please try again with some different keywords.