How to Estimate Your Tax Refund or Balance Due

File your self employed taxes with confidence.

Backed by our $100k accuracy guarantee.

This year, don’t let your tax results take you by surprise. Instead of spending time worrying about whether you are withholding enough income tax from your paycheck, take a few minutes to do something about it. Be proactive in your tax planning so you can feel confident you’re covered come tax season.

It’s never too early to start planning, and by doing so you give yourself the opportunity to make a positive impact on your tax outcome. For example, depending on your estimated tax results, you can decide if making deductible contributions or small business investments is best before or after the year ends.

And, if you’re self-employed, you can pay the right amount of estimated tax to avoid falling behind on your taxes or owing a penalty for underpayment of income tax.

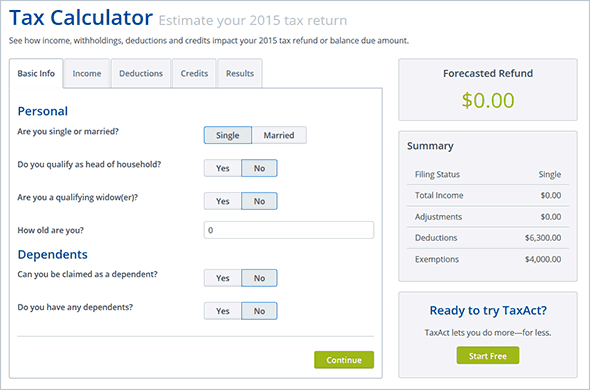

Estimating next year’s tax refund or balance due doesn’t have to be difficult. In fact, TaxAct provides a calculator that asks a variety of basic questions to help you determine what your potential tax refund or balance due could look like. You may be able to go through the calculator in just minutes, depending on your situation.

First, run the numbers with the Tax Calculator.

Answer the questions in each section of the TaxAct Tax Calculator based on your expectations for the entire year. Don’t worry about being exact – just do the best you can. You always have the option to go back and estimate again, especially if your tax situation significantly changes.

In the upper right corner of the screen, you can quickly watch how the information you enter influences your tax outcome as you answer the questions. You can also view your total income, adjustments, deductions and other information in the tax summary.

Try using “what-if” scenarios.

Let’s say you’ve run the Tax Calculator and ended with a lower tax refund or higher tax bill than what you had hoped. You can try different scenarios to see how you may be able to improve your situation.

For example, see what happens if you increase charitable contributions or plug in energy-saving improvements to your home.

If your income is liable to change, consider estimating your taxes with higher and lower numbers to determine how the varying figures affect the amount of tax you might owe.

Estimate again as the year progresses.

Remember the Tax Calculator is a quick tool to help plan your tax year and ensure you’re accounting for the right amount of tax. It’s important to use the calculator whenever your tax situation changes or as you become more confident in your estimated amounts. If your tax situation is more complex, you may need to make adjustments for other factors as well.

The more often you estimate your taxes, the better you can plan ahead and stay in control of your taxes. Tweet this

As tax laws shift throughout the year, TaxAct’s Tax Calculator is updated to reflect those changes. These updates allow you peace of mind when using the results to help determine what potential adjustments need to be made to receive your best possible tax outcome.