How the Affordable Care Act Affects Low Income People

File your taxes with confidence.

Your max tax refund is guaranteed.

Location, location, location; they’re often said to be the three most important factors determining the value of real estate.

Location also matters greatly for low income Americans hoping to get health insurance through the Affordable Care Act (ACA).

The ACA aims to cover 21.3 million low income uninsured Americans through expansion of the federal- and state-sponsored Medicaid program. But when the U.S. Supreme Court ruled on the ACA’s constitutionality last year, it gave states the right to opt out of Medicaid expansion. That means eight million people who could have been covered could be left stranded without coverage.

Medicaid isn’t the only avenue available to low-income Americans seeking to get covered through the ACA. Some low-income households will be able to buy subsidized commercial insurance policies through the new health insurance marketplaces.

Here’s a look at how the ACA will affect low income Americans.

Subsidized Coverage Offered in Marketplaces

For many Americans, the out-of-pocket cost of policies bought through the official insurance marketplaces will be reduced by federal subsidies.

Eligibility and amounts are based on the cost of marketplace premiums and your household size and income. In 2014, the subsidies are available for individuals with annual income between $11,490 and $45,960; for a family of four, they cover households with incomes ranging $23,550 to $94,200.

The definition of income used here is modified adjusted gross income (MAGI), which includes wages, salary, foreign income, interest, dividends and Social Security benefits.

One type of subsidy, the advanced premium tax credits, will be applied upfront as an adjustment to premium costs and paid directly to the insurance company. If you elect to receive a lesser credit or no credit at all, you can claim the refundable credit on your 2014 tax return (due April 2015).

The type of plan you choose also will have a big impact on overall costs.

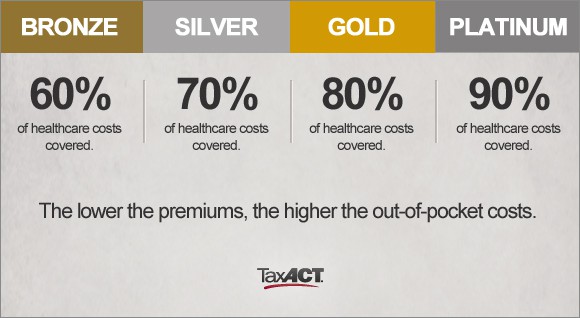

The health insurance marketplaces offer four levels of metal-labeled plans: Bronze (lowest premiums), Silver, Gold and Platinum (highest premiums).

Plans with the higher premiums will have lower out-of-pocket costs. Bronze plans, on average, will cover 60 percent of enrollee costs, with the rest covered by deductibles and coinsurance. Gold and platinum plans will cover 80 and 90 percent of costs, respectively.

If you don’t think you’ll be in a position to cover high out-of-pocket costs in the event of a health emergency, your goal should be to get the most coverage that you can afford.

The HealthcareACT.com subsidy calculator can give you an idea of your premium tax credit eligibility. And the Financial Samurai blog offers a series of helpful charts showing insurance premium costs for various household sizes and incomes for Silver plans.

For example, a family of four with income of $50,000 receiving the premium tax credit would pay an annual premium of $3,365; an individual making $25,000 with the credit would pay $1,729 annually.

Some low-income people will qualify for additional cost-sharing subsidies. The ACA reduces deductibles, copayments, coinsurance and total out-of-pocket spending for people with income below 250 percent of the federal poverty level (FPL).

The reductions will help people who expect a high amount of spending to bump up to a higher-priced metal tier. Click here for details on this extra help feature of the ACA.

Medicaid Expansion

Before the ACA, Medicaid served only children, parents, pregnant women, people with disabilities and seniors; starting in 2014, it’s available to any adult with income below the law’s threshold.

The law also creates a national definition for the income qualifications for Medicaid in states that accept the ACA expansion of the program; prior to the law’s passage, definitions were set by states, and they could vary quite a bit.

Twenty-six states are moving ahead with Medicaid expansion next year. To find out what’s going on in your state, check this status report, which is updated regularly by the Kaiser Family Foundation.

In states that accepted the expansion, Medicaid will cover adults with income up to 133 percent of the FPL. The 2014 definitions won’t be announced until early next year, but this year that translated into $15,282 for an individual.

In states that aren’t expanding Medicaid, many low-income uninsured adults will be uncovered.

However, low-income adults with incomes between 100 and 138 percent of FPL may be eligible for subsidies to help purchase private policies through the health insurance marketplaces.

But people with incomes below that level aren’t eligible for the subsidies. That creates a perverse outcome: in some states, people will be denied access to health insurance because their income is too low.

Enrollment Help

Does all this sound complicated?

That’s because it is – and the problems have been amplified by the technical trouble surrounding the launch of the federal health insurance marketplace Healthcare.gov.

Find the starting point for your state marketplace here or by calling 800-318-2596.

In-person assistance will be available from health centers around the country that have been awarded grants by the U.S. Department of Health and Human Services to hire and train “navigators.”

Some states also will offer assistants and counselors. And states also have the option of allowing insurance agents and brokers to enroll people in the exchanges. Use this link to find assistance near you.

Photo credit: Thomas Hawk via photopin cc