4 Health Insurance Plans Included in the Affordable Care Act

File your taxes with confidence.

Your max tax refund is guaranteed.

What types of health insurance plans are available through the Affordable Care Act?

What kind of insurance plans will you find on the health insurance marketplace?

The simple answer to both questions is: all kinds.

All plans available are required to offer 10 basic coverage areas, which include hospitalization, outpatient care prescription drugs and laboratory testing.

However, the amount of co-pay and deductibles will vary depending on the type of plan.

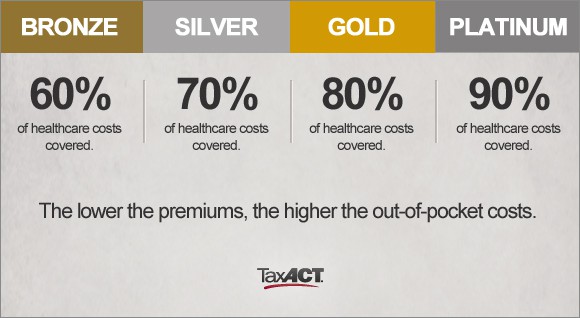

All of the available plans have been grouped into four basic categories: Bronze, Silver, Gold and Platinum.

Here are a few health insurance terms that are helpful to understand.

1. Premiums: The monthly amount of money you pay for your health insurance plan.

2. Out-of-pocket costs: The amount of money you pay when you have medical services performed that are not covered by your health insurance plan.

3. Coinsurance: The percentage of the costs of a covered healthcare service that you are responsible for. An example: if the coinsurance is 20%, and your health plan allows $100 for an office visit and you have paid your deductible, your coinsurance payment will be $20 (i.e., 20% of $100). The insurance plan pays the rest.

4. Copayment: A fixed amount that you pay for a specific, covered, healthcare service. This is usually paid at the time of service. For example, when you go in for a doctor’s visit, you pay $15 at the time of the visit. The amount varies.

5. Deductible: This is the amount of money you have agreed to pay for health services before your insurance company starts paying. For example, if the plan you have has a $1,000 deductible, the insurance plan pays nothing until you have paid $1,000 for services. Once you have paid for $1,000 worth of healthcare services (in one year), the insurance plan starts paying for additional services.

4 health insurance plans included in the Affordable Care Act

Bronze Plans

Bronze plans will provide coverage for the 10 basic coverage areas, but will, on average, only cover 60% of the expenses; the remaining amount will be paid by you.

Silver Plans

The next level of health insurance plans, Silver, will also provide the 10 basic coverage areas, but will only cover 70% of the expenses.

Gold Plans

The Gold plans, of course, still provide the 10 basic coverage areas, but 80% of expenses are covered.

Platinum Plans

The highest plans, Platinum, will cover 90% of medical expenses.

The general rule is that the lower the premiums, the higher the out-of-pocket costs when you actually need care, and vice versa—the higher the premiums, the lower the out-of-pocket costs when you require care.

Gold and Platinum levels will have lower deductibles, co-payments and co-insurance, but will probably have higher monthly premiums. Bronze and Silver plans will probably have lower premiums, but out-of-pocket costs are likely to be higher.

Catastrophic Plans

Another health plan is called a Catastrophic Plan, which is available for people under the age of 30 and some people with low and/or limited incomes.

These plans typically have lower premiums than comprehensive plans, but cover you only in case you need a great deal of care; in other words, if you had a catastrophe such as a major accident or illness.

Under the conditions of a catastrophic plan, the patient is required to pay ALL medical costs up to a specific amount, usually several thousand dollars. The 10 essential areas are covered, but major health problems—for example, if you were severely injured in an automobile accident or required surgery or were diagnosed with a major illness—are not.

Essentially you are gambling that you won’t have a major injury or illness. This is something people should think through seriously.

For example, treatment for a broken leg can costs $7,500 or more. Under a catastrophic plan, your monthly premium is low, but the deductibles and other out-of-pocket costs will be quite high.

Not everyone is eligible for catastrophic plans, but if you are under the age of 30 or have a very low income, it’s an option.

Shop Around

Clearly, the health insurance plans available under the Affordable Care Act are going to provide a wide variety of options.

Although your own finances will play a significant role in your decision, it’s also important to look for the types of healthcare networks and coverage that best apply to your health and situation.

When evaluating a plan, no matter which category, look hard at the doctors, hospitals, and other services available in the network that is covered by the health plan.

Make sure the doctors you use or the doctors you might want to use are available in the network covered by the health plan.

Photo credit: 401(K) 2013 via photopin cc